Falling Egg Costs and the Begin of a Huge Bear?

The most recent weekly podcast from Renaissance Macro Analysis to me has some good takeaways.

- Their resident head of financial analysis Neil Dutta has a superb commentary about what he see available in the market.

- The pinnacle of technical analysis Jeff deGraaf clarify why the current 10% correction is extra sentiment pushed then one thing that may result in a technical bear market.

- Jeff then explains roughly increased possible method of figuring out a cyclical prime.

That is my private notes.

You may discover them fascinating.

Neil: Egg Costs down 30%! There Must be Extra Charge Cuts then Much less This 12 months

In case you aren’t conscious, there was a lethal outbreak of chook flu within the US. To cease the unfold, farms need to cull their flocks to forestall illness unfold.

The workforce mentioned that costs of eggs are 30% decrease. The stunning factor to me was that it will have an effect on 1/10 of the upcoming month-to-month headline CPI inflation.

RenMac additionally observe corn, diesel costs coming down, rental costs as effectively.

At this second, making any adjustments and attracting consideration is the furthest factor on the FED’s thoughts.

Financial system is presently cooling. Authorities spending will come down. Development results are extra dominant than inflation results.

Market is pricing in a primary price reduce in June. The consensus variety of cuts are two in a 12 months. The market is pricing in 2-3 cuts based mostly on weighted possibilities. Markets are pricing in 66% in all probability of the reduce in Might and the opposite to chop within the upcoming assembly. Neal thinks we’ll see extra price cuts. By ready till June to chop, the Fed is saying they’ll tolerate extra weak point within the economic system.

- Labor markets proceed to chill.

- The variety of work weeks may be very low.

- Whole earnings development is moderating.

- Numerous cyclical areas of the economic system, significantly building is getting worse.

- Final 12 months actual consumption development was 3% (very robust) however actual earnings development was 1.5%. Web-net, there was a discount of financial savings price (consumption web of earnings has to return from someplace). With weakening crypto, tradefi, property markets, most contributors is not going to be decreasing their financial savings charges.

All it will put us in an atmosphere the place unemployment will tick increased.

Going into the interval the place houses are being offered (spring), the house builders are getting extra nervous.

Based mostly on what he’s reviewing, Neil doesn’t assume that the economic system goes to get going until the Fed cuts rates of interest. Some non-linear shock to the economic system will simply spike up the unemployment price.

These weaker numbers will put the Federal Reserve behind the curve by June.

The US Federal Financial institution of San Francisco slabbed collectively a scrape about what persons are listening to concerning the information and it typically strains up fairly effectively with different sentiment indicators. This index peaked in November 2024. Neal thinks most count on with Trump, you’re going to get tax cuts, de-regulations and tariffs however extra in that order. Apparently, they didn’t get it in that order.

The danger is that this sentiment will in the end weigh on client spending.

Indicators of a Begin of a Cyclical Bear?

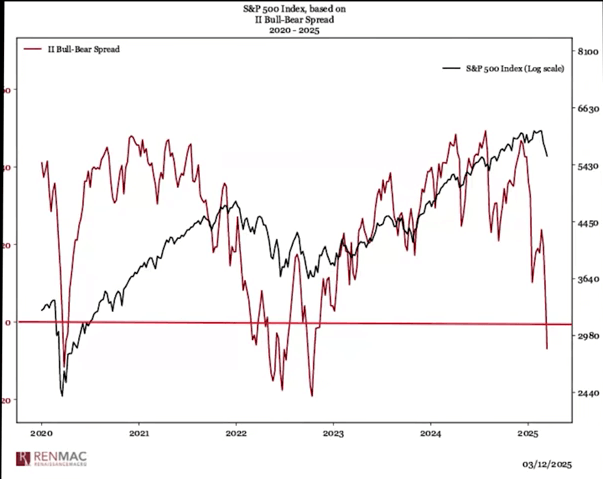

The investor intelligence is a survey service created in 1963. The survey is design to seek out out if a subscriber is bullish, bearish, overly bullish, overly bearish. At the moment, bears outnumber bulls. This doesn’t occur typically and solely occurs 6% of the time.

This tends to be bullish.

The implicit assumption right here is that folks have digested the information, in all probability acted upon the information, and right here we’re. If this isn’t an enormous bear market, it often make sense to deal with this as a shopping for alternative.

Jeff would often advise their purchasers to “assume extra optimistically” as an alternative of “assume extra pessimistically” in comparable conditions as a result of this survey exhibits the shift in sentiments presently. Recall that we got here into the 12 months the place most are giving increased finish of the 12 months targets and we have now a superb fairness run and now we have now a 180 levels shift.

Jeff goes on to elucidate why he doesn’t see an enormous bear market on the horizon.

RenMac is fairly information targeted however they not simply have a look at the info independently. They view the info within the context of a relationship with different crucial information. For instance, one of many relationship is between fairness efficiency and credit score (I appear to listen to this one so much!). If an enormous bear is across the nook a 5% decline in fairness ought to include a X% decline in credit score. On this regard, the ten% decline in fairness we presently observe is much, far, far lower than what RenMac is anticipating in credit score decline. In different phrases, the credit score market just isn’t confirming the fairness drawdown. We are able to conclude what we see proper now could be extra sentiment pushed than coverage pushed.

The naysayers will dispute that often the credit score will deteriorate finally however from what they observe, RenMac disagrees with this. Normally credit score, at worst, is coincidental and hopefully credit score tends to guide fairness decline. Normally, the folks working in credit score solely care about getting paid again. The credit score folks are usually the pessimistic folks versus the fairness folks.

The financials are additionally not confirming an enormous bear market presently. The financials are presently weak however they don’t seem to be as weak given the general decline we observe within the markets.

The best momentum is generated throughout the early part of a bull market making breath thrusts one of the simplest ways to verify cyclical occasions. What are a number of the finest methods to verify a brand new cyclical decline?

It’s true that the best momentum is generated early in a bull market. That’s the reason breadth trusts [how many stocks are advancing versus declining] is an effective option to verify a cycle advance.

The current inventory market motion in Hong Kong and China are examples of that.

One of many greatest errors on this enterprise is that if an indicator works on the backside or on the prime, folks default the indicator will work in different conditions. If one thing works on the backside, folks assume the precise reverse will work on the prime.

RenMac’s datawork tells them that a number of indicators are asymmetrical. They labored effectively on the backside, they gained’t work in the identical or precisely reverse vogue on the prime.

RenMac have a look at issues as a sequencing of occasions.

An overbought state of affairs wouldn’t characterize a brand new cyclical decline. What we’re on the lookout for is that deterioration, the shortage of momentum inflicting the markets to really feel like it’s “at a standstill”. RenMac’s Market Cycle Clock helps them to juxtapose inflation and development, then they may have a look at whether or not breadth diverges. Then they have a look at what is occurring to the components (worth, profitability, creddit) and betas. Discovering tops are more durable than discovering bottoms. Jeff thinks that discovering bottoms are a lot simpler.

If you wish to commerce these shares I discussed, you’ll be able to open an account with Interactive Brokers. Interactive Brokers is the main low-cost and environment friendly dealer I take advantage of and belief to speculate & commerce my holdings in Singapore, america, London Inventory Trade and Hong Kong Inventory Trade. They assist you to commerce shares, ETFs, choices, futures, foreign exchange, bonds and funds worldwide from a single built-in account.

You possibly can learn extra about my ideas about Interactive Brokers in this Interactive Brokers Deep Dive Sequence, beginning with the way to create & fund your Interactive Brokers account simply.