Simulating Inflation-adjusted Revenue Spending from a 24-year-old Fund.

I crafted my first spreadsheet that can assist you simulate how your portfolio appears like in case you persistently promote items to offer inflation adjusted earnings final week.

I crafted a second spreadsheet.

You may make a replica by clicking on this hyperlink.

When you perceive the primary spreadsheet you may go forward and have enjoyable with this one.

For many who are new, you may need to learn my earlier publish and likewise a few of my rationalization on this publish.

Why Ought to You be Concerned with This Spreadsheet?

This spreadsheet may enable you to reply some lingering doubts.

- When you surprise how a fund/portfolio will seem like in case you preserve promoting items to get earnings.

- When you all the time assume that in case you promote items, your fund will go to shit very quickly.

- Need to see if Kyith is true that you could get earnings, however the portfolio can develop much more.

- Need to take a look at and see if begin spending $80,000 inflation-adjusted earnings out of a $1 million portfolio will kill the portfolio.

- Perceive vital portfolio earnings ideas.

The Fund We Are Simulating – iShares Core S&P Small-Cap ETF

I’m nonetheless utilizing a small cap ETF however this time I’m utilizing a US-listed ETF.

The iShares Core S&P Small-Cap ETF seeks to trace and replicate the efficiency of the S&P SmallCap 600 Index.

The primary purpose is that the fund is incepted in 22 Could 2000.

Because of this we now have about 24.6 years of precise efficiency to have enjoyable with.

Now, there are limitations. US-listed ETFs often have a dividend distribution (at present 2.2%) however to make it simpler to create the spreadsheet, I solely embrace the NAV. Because of this the return of this ETF is blunted.

Listed below are some info of the fund:

There are about 296 months or 24.6 years. The annualized compounded progress is 8.09% with out the earnings distribution. You would think about the return could be 10% p.a. for nearly 25 years if I didn’t blunt the returns.

This works to your benefit to see whether or not you’ll run out of cash if the returns is a “weaker” 8% p.a.

The inflation throughout this era is 2.5% p.a.

There are Sufficient Adverse Occasions That You Need to Check Potential Adverse Sequence of Return Threat.

You may assume that if the returns over this era is 8-10% p.a. there aren’t any distressful occasions. These of us which can be extra sober can let you know there have been occasions that comes with greater volatility

There’s a main misery for yearly.

Spending an Preliminary $3,000 in Month-to-month Inflation-Adjusted Revenue over 24.6 years.

If we begin in 2000, we are able to see that after spending $728,409 in whole over 24 years, the portfolio was nonetheless alive and finish with $3.3 million. Revenue grew from $3,000 month-to-month to $5,559 month-to-month after 24 years.

The portfolio ended with a present withdrawal price of two% as an alternative of three.6%.

Regardless of the variety of items getting lower by half, the NAV per unit climbed from $17 to $115.

Retiring Simply Earlier than Nice Monetary Disaster

With such a variety of information, this may assist reply your query if you find yourself retiring just a few months earlier than the Nice Monetary Disaster:

If we spend an preliminary of $3,000 from $1 million, you’ll nonetheless have $1.7 mil regardless of the misery. You’ll see your earnings develop and likewise your capital.

Your $1 million fund will get lower to lower than 50% however nonetheless find yourself with 70% extra capital regardless of having an inflation-adjusted earnings.

How A lot Do You Must Spend to Kill The Portfolio?

Begin with a spending of $6,000 a month.

The identical fund, in case you begin barely earlier than GFC, you can be left with $2,000.

The identical portfolio, identical time interval, however as an alternative of portfolio worth ending with $1.7 mil, you find yourself working out of cash.

Similar 8.09% p.a. return.

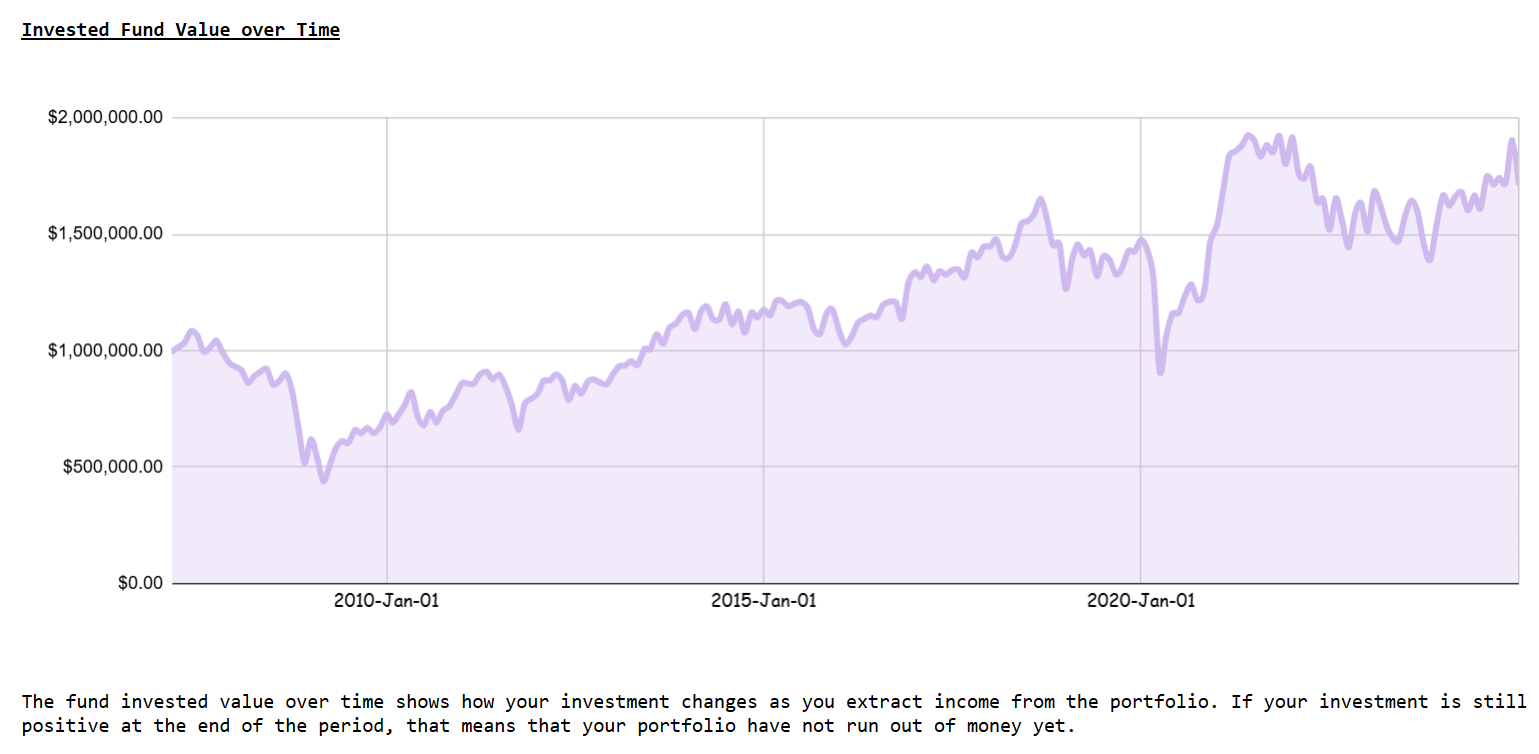

Stare on the invested fund worth over time for this chart versus the earlier one.

Each will get lower to beneath $500,000.

However how come one fund can nonetheless recuperate whereas the opposite one simply went right into a downward spiral.

Returns? I already mentioned no.

It’s how a lot earnings you spend relative to your beginning portfolio worth or your Protected Withdrawal Price.

If you wish to commerce these shares I discussed, you may open an account with Interactive Brokers. Interactive Brokers is the main low-cost and environment friendly dealer I take advantage of and belief to speculate & commerce my holdings in Singapore, the US, London Inventory Trade and Hong Kong Inventory Trade. They mean you can commerce shares, ETFs, choices, futures, foreign exchange, bonds and funds worldwide from a single built-in account.

You possibly can learn extra about my ideas about Interactive Brokers in this Interactive Brokers Deep Dive Sequence, beginning with the right way to create & fund your Interactive Brokers account simply.