Maiden useful resource overlaying seven zones anticipated quickly at Kodiak Copper’s MPD copper-gold mission

March 7, 2025 (Investorideas.com Newswire) “As we speak’s outcomes from our regional exploration work as soon as once more spotlight the prospectivity of our MPD mission by including two new targets and upgrading present targets throughout the property”: Kodiak Copper’s CEO Claudia Tornquist on outcomes from the ultimate six holes of the 25-hole 2024 drill program.

Kodiak Copper’s (TSXV:KDK, OTCQB:KDKCF, Frankfurt:5DD1) administration group, and the Discovery Group, have a profitable, envious monitor report of shareholder returns.

Kodiak was established by chairman Chris Taylor of Nice Bear fame. The founder and CEO of Nice Bear Assets presided over its acquisition by Kinross Gold in 2022 for $1.8 billion.

The Discovery Group firm is led by Claudia Tornquist, beforehand a normal supervisor at Rio Tinto working with Rio’s copper operations. She was additionally the previous director of Kennady Diamonds, main the $176M sale of the corporate to Mountain Province Diamonds.

Copper market fundamentals are presently robust, with analysts predicting growing demand going through the headwinds of structural provide deficits.

The corporate plans to launch a useful resource estimate on MPD. Useful resource estimates typically function important catalysts for junior useful resource firm inventory costs.

Kodiak introduced on Jan. 16 that it has began work on a Nationwide Instrument 43-101-compliant useful resource estimate that may embrace seven mineralized zones: Gate/Prime, Man, Dillard, Ketchan, West, Adit, and South/Mid.

Outcomes will probably be delivered all year long, with preliminary outcomes anticipated within the first half of 2025.

Kodiak Copper’s MPD mission has all of the hallmarks of a serious copper/gold porphyry system with the potential, for my part, to change into a world-class mine.

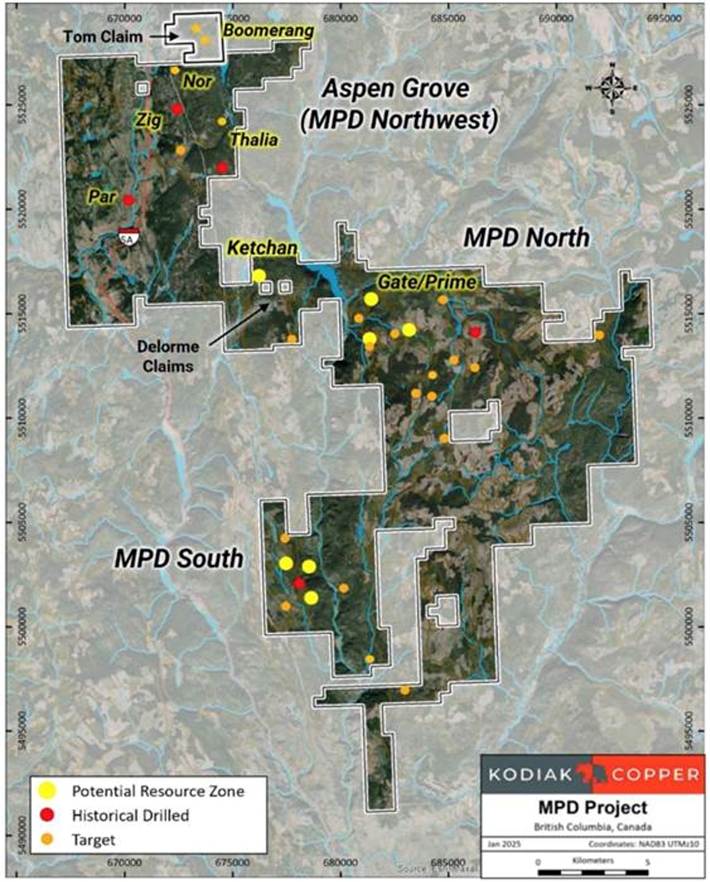

The mission is a 344-square-kilometer land bundle close to a number of working mines within the southern Quesnel Terrane, British Columbia’s major copper-gold producing belt. MPD is between the cities of Merritt and Princeton, with year-round accessibility and wonderful infrastructure close by.

A key focus of Kodiak’s 2024 drill program was to determine extra near-surface and high-grade mineralization. Drill outcomes from the Adit Zone to this point have clearly achieved this.

Kodiak Regional Exploration Outcomes Spotlight Additional Targets at MPD Copper-Gold Challenge

The holes considerably lengthen the copper envelope at Adit and when mixed with historic drilling, Kodiak’s new outcomes have outlined a sizeable near-surface, high-grade space of mineralization.

On Feb. 6 Kodiak reported outcomes from soil geochemical, geophysical, prospecting and drilling from the 2024 exploration program. These outcomes have been from the northern and southern elements of the MPD property.

Final 12 months’s exploration program confirmed that the Dillard East and Star goal areas have important copper-gold porphyry mineralization potential with new corroborating outcomes from rock, soil and 3D Induced Polarization (3D-IP) surveys. These goal areas haven’t but been drill-tested by Kodiak.

3D-IP responses at Dillard East and Star are adjoining to, and on the flanks of serious kilometer-scale copper-in-soil anomalies, which additionally host prospecting outcomes with porphyry-related copper and gold mineralization.

Prospecting in 2024 found copper-gold-silver mineralized outcrops in two new areas at MPD (Dry Creek, Northstar), additional highlighting the invention potential throughout the complete MPD property.

The most effective seize pattern from final 12 months’s prospecting program assayed 1.07% Cu, 0.05 g/t Au and seven.0 g/t Ag.

Kodiak’s 2024 regional exploration program included the gathering of two,020 soil samples, 65 rock samples, a 3D-IP survey over 7 sq. kilometers, geological and geotechnical research.

Kodiak accomplished 9,252 meters of drilling in 25 holes in seven goal areas. Outcomes from the ultimate six holes of the 2024 drill program have been reported within the Feb. 6 information launch.

The corporate is incorporating all 2024 exploration outcomes into VRIFY’s predictive AI modeling, thereby updating targets and figuring out new ones for follow-up in 2025.

“As we speak’s outcomes from our regional exploration work as soon as once more spotlight the prospectivity of our MPD mission by including two new targets and upgrading present targets throughout the property,” mentioned Kodiak’s President and CEO Claudia Tornquist. “Whereas the definition of a maiden useful resource estimate for MPD is a crucial focus for Kodiak in 2025, we additionally plan to drill additional targets this 12 months with the purpose to make the following discovery. We’re significantly excited in regards to the exploration potential on the brand new Aspen Grove claims that we acquired in September and can be capable to share an replace concerning that portion of our property quickly.”

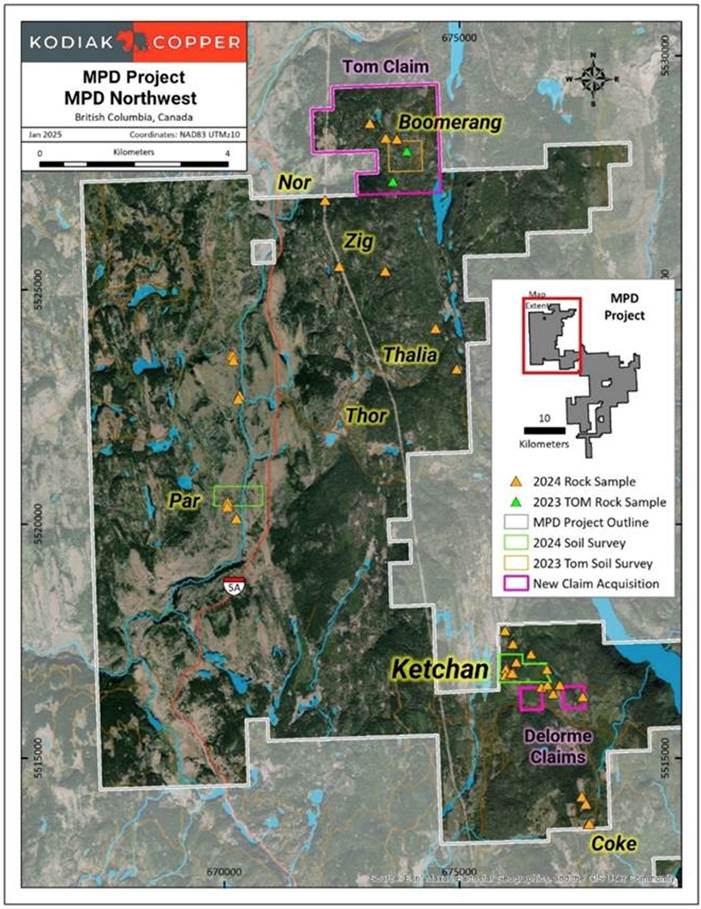

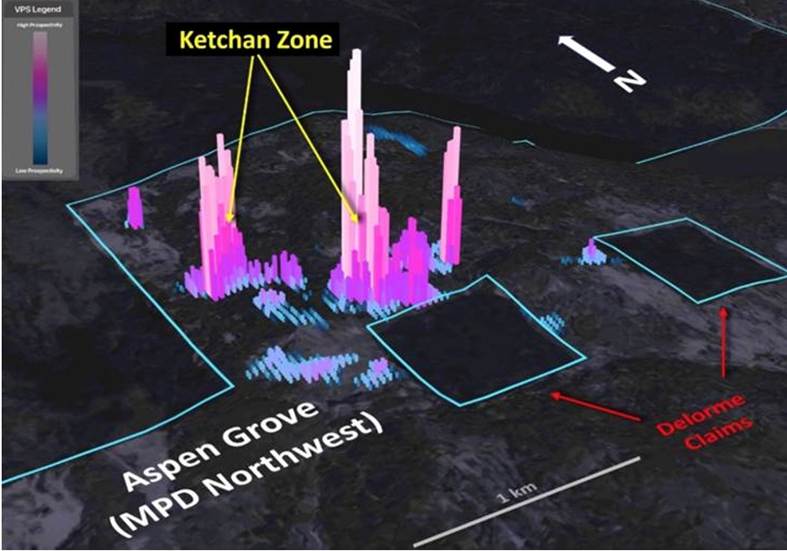

The Aspen Grove claims have been the topic of the subsequent information launch on Feb. 12. Renamed the MPD Northwest claims, the claims host the high-grade, near-surface Ketchan Zone which is able to kind a significant a part of the upcoming MPD mineral useful resource estimate, and a number of different recognized mineral occurrences, offering appreciable exploration upside. Historic knowledge has additionally been analyzed, resulting in the acquisition of latest claims.

As highlighted by Kodiak Copper, MPD Northwest is a big, 118-square-kilometer declare bundle lately added to MPD. It hosts 18 recognized mineral occurrences, together with six with important porphyry-related copper-gold.

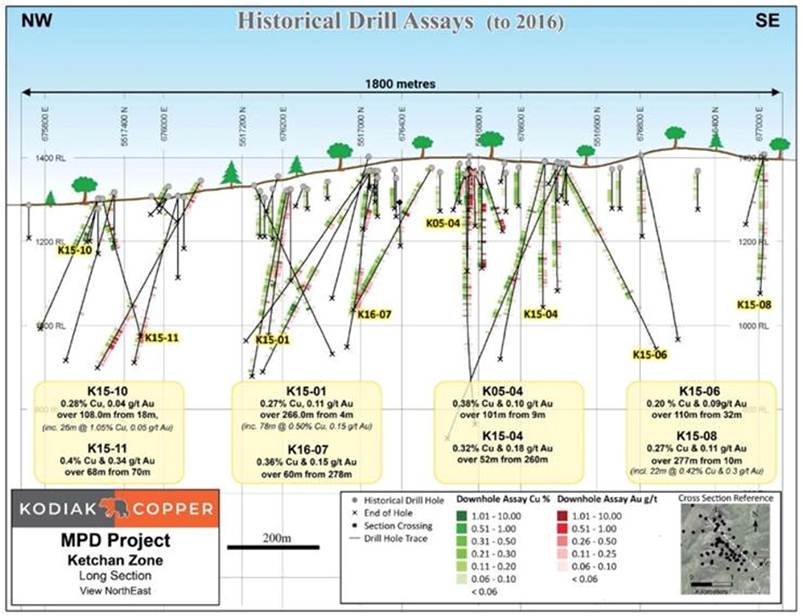

The big-scale Ketchan Zone provides important drill-proven, near-surface, high-grade copper-gold stock to MPD. It has been drilled over 1,800 by 500 meters – roughly thrice the world of Kodiak’s Gate Zone discovery – and stays open in most instructions.

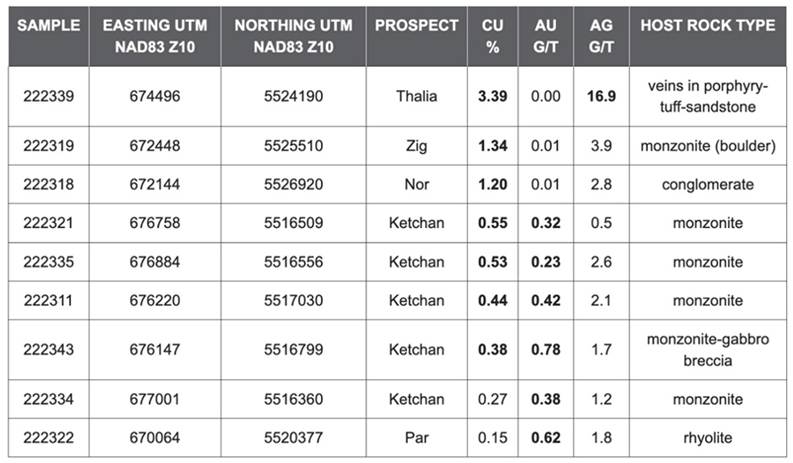

Bedrock seize samples collected in 2024 affirm high-grade mineralization at Ketchan. The most effective two samples assayed 0.55 % Cu, 0.32 g/t Au and 0.5 g/t Ag, and 0.38 % Cu, 0.78 g/t Au and 1.7 g/t Ag, respectively.

Information assessment, choose core re-logging, sampling and geological modeling has confirmed that Ketchan will probably be a fabric a part of the upcoming MPD mineral useful resource estimate.

The Ketchan Zone is situated solely 4.5 kilometers from the high-grade Gate Zone. This proximity and potential synergies with Gate, plus a number of close by targets, prioritizes this space.

Modeling with VRIFY’s Synthetic Intelligence (AI) software program has recognized new potential areas at MPD Northwest, together with potential extensions to the Ketchan Zone.

Regional exploration has confirmed substantial mineralization by way of early-stage prospecting, mapping and soil geochemistry at choose websites alongside the northerly pattern of mineral showings central to MPD Northwest.

An extra three claims have been added to the MPD Northwest declare block. These safe strategic tenure within the Ketchan space interpreted to doubtlessly host extensions to that zone (the Delorme claims) and high-grade showings within the north (the Tom declare).

“We’re delighted with the outcomes from our preliminary exploration work and the historic knowledge assessment on the MPD Northwest claims, which very a lot validate our determination to amass these claims final autumn,” mentioned Tornquist. “The drilling carried out by earlier operators on the Ketchan Zone has outlined a mineralized zone of serious scale and with good grades. Not solely are we assured that the Ketchan Zone will change into a fabric a part of our useful resource estimate, we additionally consider there may be ample room to increase it in a number of instructions. We’re equally excited in regards to the targets and prospectivity of the broader MPD Northwest declare bundle, which hosts drill-proven copper and gold mineralization in addition to untested targets with the potential for brand spanking new discoveries. As we’re plan our 2025 exploration program, MPD Northwest is actually a precedence.”

In an interview with Crux Investor, Chris Taylor highlighted the potential for a market re-rating primarily based on the upcoming useful resource estimate, stating:

“That’ll provide you with an concept of what the mission economics might be primarily based on these comparables and then you definitely construct on it with the persevering with exploration program as properly. That is what we may ship to shareholders this 12 months – a re-rating primarily based on the quantity of copper we see within the floor proper now, and an appreciation for the truth that there are extra zones that we will be drilling and there is important extensions on the zones that we are going to have assets on initially.”

One other vital side of the MPD story is its potential upside.

Whereas the corporate has recognized a number of zones, it stays committing to continued exploration to additional develop the mission, each by way of zone enlargement and the testing of latest targets. Says Taylor:

“We’ve all these extra targets on the mission that we proceed to check whereas we’re doing the useful resource work. It is a type of issues that makes our trade very attention-grabbing – I’ve lived by way of it many occasions – is we nonetheless have that discovery potential as properly. We have carried out it prior to now and it might occur once more sooner or later.”

Map of mission areas and exploration targets mentioned within the Feb. 12 launch – MPD mission, southern BC. The Tom and Delorme claims have been added to the mission.

Ketchan Zone northwest-southeast lengthy part with historic drill outcomes to 2016. Choose historic intervals present important shallow mineralization alongside 1.8 kilometers of strike size.

2024 prospecting outcomes highlights MPD Northwest

2024 exploration exercise on the MPD Northwest claims. 2024 soil survey grids are outlined in inexperienced, 2023-2024 prospecting samples as triangles and newly acquired strategic claims are outlined in magenta.

Screenshot of VRIFY AI 3D geo-targeting mannequin at Ketchan Zone, MPD Northwest claims trying northeast. Picture highlights VRIFY areas of curiosity central to recognized mineralization at Ketchan, and adjoining areas for follow-up in 2025. Peaks and warmth map colours present the AI rating for Cu-Au mineralization. Delorme claims are actually additionally owned by Kodiak.

Conclusion

With bullish fundamentals, now could be pretty much as good a time as ever to be an organization exploring for copper, particularly in a protected, secure jurisdiction with low-cost energy like British Columbia.

However investing in junior mining corporations is not for the faint of coronary heart, nor the “get wealthy fast” crowd. It takes time, ability and perseverance to determine an organization, do your due diligence, after which have the religion and endurance to stick with it by way of the often-bumpy experience from discovery to buy-out.

The kicker is that the juniors don’t have any income stream to finance their exploration actions; they usually depend on outdoors sources for funding. Kodiak Copper is in within the technique of checking that field.

Kodiak has simply gone to the market to completely fund its 2025 exploration program, asserting a $5 million non-brokered personal placement on Feb. 25. The providing at $0.70 per Charity Move-through Unit is anticipated to shut on or about March 18.

Discovery Group Chairman Chris Taylor says Kodiak Copper “may ship to shareholders a re-rating primarily based on the quantity of copper we see within the floor proper now, and an appreciation for the truth that there are extra zones that we will be drilling and there is important extensions on the zones that we are going to have assets on initially.”

Whereas the corporate has recognized a number of zones, it stays dedicated to continued exploration to additional develop the mission, each by way of zone enlargement and the testing of latest targets. Says Taylor:

“We’ve all these extra targets on the mission that we proceed to check whereas we’re doing the useful resource work. It is a type of issues that makes our trade very attention-grabbing – I’ve lived by way of it many occasions – is we nonetheless have that discovery potential as properly. We have carried out it prior to now and it might occur once more sooner or later.”

Kodiak Copper

TSXV:KDK, OTCQB:KDKCF, Frankfurt:5DD1

Cdn$0.43 2025.03.04

Shares Excellent 75.9m

Market cap Cdn$33.0m

KDK web site

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free publication

Authorized Discover / Disclaimer

Forward of the Herd publication, aheadoftheherd.com, hereafter generally known as AOTH.

Please learn the complete Disclaimer fastidiously earlier than you employ this web site or learn the publication. If you don’t conform to all of the AOTH/Richard Mills Disclaimer, don’t entry/learn this web site/publication/article, or any of its pages. By studying/utilizing this AOTH/Richard Mills web site/publication/article, and whether or not you truly learn this Disclaimer, you might be deemed to have accepted it.

Any AOTH/Richard Mills doc shouldn’t be, and shouldn’t be, construed as a proposal to promote or the solicitation of a proposal to buy or subscribe for any funding.

AOTH/Richard Mills has primarily based this doc on info obtained from sources he believes to be dependable, however which has not been independently verified.

AOTH/Richard Mills makes no assure, illustration or guarantee and accepts no duty or legal responsibility as to its accuracy or completeness.

Expressions of opinion are these of AOTH/Richard Mills solely and are topic to vary with out discover.

AOTH/Richard Mills assumes no guarantee, legal responsibility or assure for the present relevance, correctness or completeness of any info offered inside this Report and won’t be held answerable for the consequence of reliance upon any opinion or assertion contained herein or any omission.

Moreover, AOTH/Richard Mills assumes no legal responsibility for any direct or oblique loss or injury for misplaced revenue, which you will incur because of the use and existence of the knowledge offered inside this AOTH/Richard Mills Report.

You agree that by studying AOTH/Richard Mills articles, you might be performing at your OWN RISK. In no occasion ought to AOTH/Richard Mills answerable for any direct or oblique buying and selling losses attributable to any info contained in AOTH/Richard Mills articles. Data in AOTH/Richard Mills articles shouldn’t be a proposal to promote or a solicitation of a proposal to purchase any safety. AOTH/Richard Mills shouldn’t be suggesting the transacting of any monetary devices.

Our publications should not a suggestion to purchase or promote a safety – no info posted on this web site is to be thought-about funding recommendation or a suggestion to do something involving finance or cash except for performing your personal due diligence and consulting together with your private registered dealer/monetary advisor. AOTH/Richard Mills recommends that earlier than investing in any securities, you seek the advice of with an expert monetary planner or advisor, and that it is best to conduct an entire and unbiased investigation earlier than investing in any safety after prudent consideration of all pertinent dangers. Forward of the Herd shouldn’t be a registered dealer, supplier, analyst, or advisor. We maintain no funding licenses and should not promote, provide to promote, or provide to purchase any safety.

Extra Information:

Disclaimer/Disclosure: Investorideas.com is a digital writer of third get together sourced information, articles and fairness analysis in addition to creates unique content material, together with video, interviews and articles. Unique content material created by investorideas is protected by copyright legal guidelines aside from syndication rights. Our web site doesn’t make suggestions for purchases or sale of shares, companies or merchandise. Nothing on our websites must be construed as a proposal or solicitation to purchase or promote merchandise or securities. All investing includes danger and attainable losses. This web site is presently compensated for information publication and distribution, social media and advertising, content material creation and extra. Disclosure is posted for every compensated information launch, content material printed /created if required however in any other case the information was not compensated for and was printed for the only curiosity of our readers and followers. Contact administration and IR of every firm instantly concerning particular questions.

Extra disclaimer information: https://www.investorideas.com/About/Disclaimer.asp Be taught extra about publishing your information launch and our different information companies on the Investorideas.com newswire https://www.investorideas.com/Information-Add/

World traders should adhere to laws of every nation. Please learn Investorideas.com privateness coverage: https://www.investorideas.com/About/Private_Policy.asp