Personal Fairness is Simply Risky and Unsure

Dan Rasmussen over at Verdad Capital has a fairly good article offering a special view on the “no/low volatility” of personal fairness.

When Personal Funds Are Publicly Traded

When you have got personal fairness biased corporations saying that the annualized volatility (customary deviation) is nearer to 10%, then you definitely begin ruffling feathers of individuals within the public fairness area.

10% annualized customary deviation is equal to that of a 60% fairness and 40% mounted revenue, or what we name a Balanced portfolio.

The principle drawback is that

- The personal investments are valued extra occasionally.

- There may be survivorship bias.

- You additionally don’t know the way coherent is the best way they’re valued.

However Dan thought that we are able to use a proxy… to sort of see issues from one other perspective.

Now suppose there are funds that owns these personal investments. If the volatility of the personal investments are actually that low, then the NAV of those funds over time needs to be fairly low proper?

So there are these personal fairness funds which are listed publicly on the London Inventory Change (LSE).

Dan listed the ten of the biggest and most liquid:

- HarbourVest International Personal Fairness (ticker: HVPE) | 2025 Annual Report

- Pantheon Worldwide (PIN) | Web site

- NB Personal Fairness Companions (NBPE) | 2024 Report

- HgCapital Belief (HGT) | Q1 Report

- Oakley Capital Investments (OCI) | 2024 Annual Report

- Companions Group Personal Fairness (PEY) | 2024 Annual Report

- CT Personal Fairness Belief (CTPE) | Web site

- Patria Personal Fairness Belief (PPET) | 2024 Annual Report

- Apax International Alpha (APAX) | 2024 Annual Report

- ICG Enterprise Belief (ICGT) | 2025 Annual Report

I’ve hyperlink you to among the important paperwork with the intention to preview them. (Possibly a few of you’ll thank me for sharing this with you haha.)

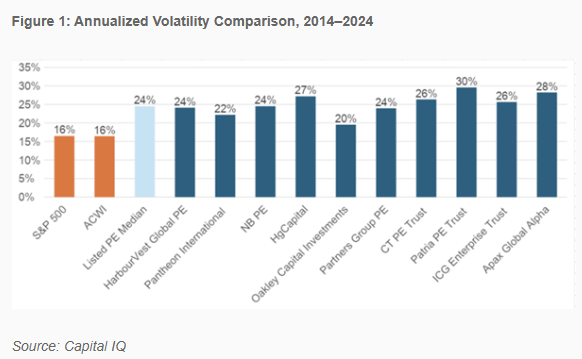

If we look at the volatility of the NAV, we get a really totally different conclusion.

Conventional reporting by the PE funds has their NAV common at 14% volatility, or about 0.9 instances the market common of 16%.

The annualized volatility of the PE funds’ inventory value is nearer to 24% or 1.5 instances of the market.

The chart beneath reveals the annualized volatility of the funds:

The annualized customary deviation for the US small cap worth is nearer to twenty-eight% for the previous 98 years.

The title for these corporations may be low-margin, leveraged micro-caps.

Some individuals detest investing in small caps. They imagine that small caps gained’t do nicely examine to massive cap. However how come they may be desirous about investing in a basket of micro-caps.

The Low cost to NAV Makes Individuals Query the Valuation

Dan additionally tabulated the market cap-weighted low cost to NAV for the listed PE Funds:

The funds, as a market-cap weighted mixture, at the moment trades at 70 cents to a greenback.

Usually, you’ll have a look at that and be very to speculate as a result of when you purchase the fund at 70 cents and so they liquidate the fund right this moment, assuming they will promote all of the underlying, you get again 1 greenback.

However… what if the stuff can not promote at 1 greenback?

What does that inform us in regards to the valuation in regards to the funds?

That is additionally an more and more related query as U.S. congresswoman Elise Stefanik is now probing whether or not school endowments needs to be allowed to make use of NAVs slightly than, say, current secondary market transactions as the only real supply of valuation for personal property.

Market observers attribute this alteration to rising rates of interest shifting investor preferences towards extra liquid property, coupled with rising considerations over the perceived opacity within the underlying property of portfolios. This shift in investor sentiment has led to higher scrutiny and warning round illiquid and opaque property like PE funds. In consequence, traders demand a better liquidity premium, which means a better low cost to NAV, to compensate for the elevated danger and lowered liquidity. This elevated required return enhances the widening low cost, pushing down the market costs of PE fund shares relative to their reported NAVs.

I believe the principle factor they’re attempting to focus on isn’t that you shouldn’t put money into these funds. For all we all know, a lot of them are public portfolio managers which have small cap corporations on their portfolio.

What they wish to carry to your consideration is that rare and suspect valuation doesn’t imply that there aren’t actual volatility.

It’s what it’s.

In case you don’t prefer to put money into small nascent corporations, however prefer to put money into massive Magazine 7, you actually obtained to ask your self why is there such a disconnect in your funding philosophy.

If you wish to commerce these shares I discussed, you possibly can open an account with Interactive Brokers. Interactive Brokers is the main low-cost and environment friendly dealer I take advantage of and belief to speculate & commerce my holdings in Singapore, america, London Inventory Change and Hong Kong Inventory Change. They mean you can commerce shares, ETFs, choices, futures, foreign exchange, bonds and funds worldwide from a single built-in account.

You may learn extra about my ideas about Interactive Brokers in this Interactive Brokers Deep Dive Collection, beginning with find out how to create & fund your Interactive Brokers account simply.