“In a Few Years, This Will Be Only a Fraction”

Key Takeaways:

- Bitcoin hits a historic all-time excessive (ATH) of $122,604, pushed by institutional demand and ETF inflows.

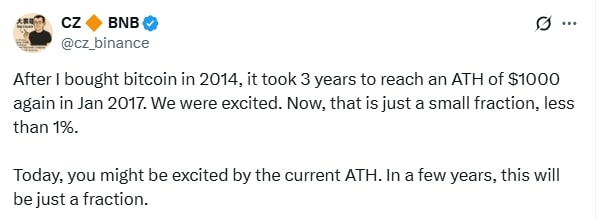

- Former Binance CEO CZ warns the present ATH might quickly look minor, recalling BTC’s rise from $1,000 in 2017.

- Spot Bitcoin ETFs and rising international adoption have pushed BTC’s worth up over 215% since early 2024.

Bitcoin’s worth surge has reignited bullish sentiment throughout the crypto world. On July 14, 2025, Bitcoin broke by $122,000, hitting an all-time excessive that few may have imagined only a few years in the past. However whereas retail merchants have a good time, Binance founder Changpeng “CZ” Zhao provides a sobering reminder: right now’s ATH might be tomorrow’s footnote.

Learn Extra: CZ Warns Bitcoin Sellers: “Remorse at $77K Is Actual” — Why Lengthy-Time period Charts Matter

Bitcoin Surpasses $122K: A New Period of ATHs

Bitcoin soared previous the $120,000 mark and climbed as excessive as $122,604 on Monday, based on TradingView knowledge. The shift represented a 3.5 % rise inside 24 hours supported by the booming volumes with a blow of institutional curiosity.

Historic Development and Milestone Metrics

The current ascent has positioned the BTC because the fifth-largest asset on the planet market cap solely after Apple, Microsoft, NVIDIA, and gold. Its market cap now exceeds $2.43 trillion, pushing it previous Amazon.

Day by day quantity additionally elevated considerably, rising 94.2% from the day prior to this to greater than $44 billion on exchanges like Binance, KCEX and CoinW.

This newest escape follows a development noticed for the reason that SEC gave its stamp of approval to identify Bitcoin ETFs in early 2024. In that point, bitcoin has surged greater than 215%, and confirming the notion that conventional finance is embracing crypto.

CZ Displays: “This Is Simply the Starting”

Amid the joy, former Binance CEO CZ reminded his 8.6 million followers on X (previously Twitter) to maintain the large image in thoughts. Recalling his private historical past with Bitcoin, CZ wrote:

“After I purchased Bitcoin in 2014, it took 3 years to succeed in an ATH of $1,000 once more in Jan 2017. We have been excited. Now, that’s only a small fraction, lower than 1%. In the present day, you may be excited by the present ATH. In a number of years, this might be only a fraction.”

CZ’s submit frames right now’s highs not a lot as an all-time excessive, however as one other plateau that ALCM has risen to. His perception within the long-term prospects of BTC has remained intact even following his rise to the ranks of the CEO of the Binance on the finish of the 12 months 2024 when it confronted sure conflicts with the rules.

Those that have lived to see BTC develop out of obscurity right into a worldwide monetary participant will learn the message with an amazing feeling of connection to it. Based on CZ, the joy round $122K might quickly pale compared to future valuations.

Institutional Demand and Spot ETFs Gas the Rally

The current run-up within the worth of Bitcoin shouldn’t be merely “hypothesis.” A big a part of the momentum is pushed by the growing acceptance of Bitcoin as an institutional-grade asset.

Giant funds and asset managers have added funds constantly for the reason that first wave of U.S. spot Bitcoin ETFs acquired the go-ahead from the SEC in January 2024. These ETFs provide publicity to BTC to classical traders who’ve eschewed the crypto asset, partly on danger, and partly on regulatory unease.

This has opened up BTC to retirement portfolios, endowments, and pension funds, all of whom have traditionally shied away from the crypto scene. And as a brand new class of long-term holder has grown, total volatility has waned, serving to Bitcoin appeal to its first {dollars} from mainstream portfolios.

The proportion of BTC held by long-term holders presently stands at an all-time excessive of 69% — a growth that coincides with CZ’s sentiments as that humungous determine proves that valuations at spot charges are nonetheless early in Bitcoin’s international monetization journey.

Learn Extra: Bitcoin Hits New ATH; Right here’s What It Means for BTCBull and Why It May Be the Potential Crypto Presale Now

Market Sentiment and Considerations of a Pullback

Analysts are warning that the rally has generated extreme enthusiasm.

The Crypto Worry and Greed Index is at present at 74, exhibiting robust “Greed.” Readings like this have usually been adopted by modest corrections, as it’s within the nature of overly keen markets to overshoot earlier than reining themselves again in.

Nonetheless, long-term believers, within the mildew of CZ, stay unfazed. To them, BTC’s restricted provide, decentralized construction, and growing recognition all through the world means momentary volatility doesn’t matter. As CZ’s submit suggests, the worth may pull again, however the total trajectory is up.

Bitcoin’s Place Amongst World Belongings

The remainder of Bitcoin’s worth efficiency makes it a totally totally different ball sport. It has since debounced as a macro asset, likened to gold, and a hedge in opposition to money devaluation and inflation.

Since 2024, a number of central banks in international locations reminiscent of Nigeria, Turkey, Argentina, have even began experimenting with BTC and stablecoins as options to their ailing native currencies. These massive image shifts nonetheless present fertile floor for Bitcoin over the long term.

Moreover, sovereign adoption is doubtlessly on the horizon as nicely. With El Salvador and the Central African Republic having already launched into testing Bitcoin as authorized tender, there may be growing hypothesis {that a} G20 nation will add BTC as a reserve asset earlier than 2030.