Physician asks: “Do you assume I have the funds for to spend for the remainder of my life?”

“Yong Cheng, do you assume I have the funds for to spend for the remainder of my life?”

This query got here from a consumer of mine—a 70-year-old semi-retired physician who has properties price greater than $10 million and constructed a profitable medical apply over a long time of laborious work. On paper, she has greater than sufficient, but she worries every day about whether or not she will be able to afford to spend

My colleague Yong Cheng be part of the corporate and have become a consumer adviser two years earlier than I joined. For the previous 8 years, he spent sufficient time listening to the needs of the folks that got here by our door.

In the previous few years, Chin Yu and him will handle the extra financially endowed and sophisticated household conditions.

Between all of us, we grew to deepen our understanding that spending is greater than the numbers.

On this article, Yong Cheng collate and share why a few of his shoppers struggled to spend the wealth that they earned.

I obtained suggestions whether or not it’s logical for somebody to retire with $1,000 month-to-month in my final article. Nicely, this one is on the other spectrum. Virtually all of them are planning to retire with extra.

Why do they discover it so troublesome to spend?

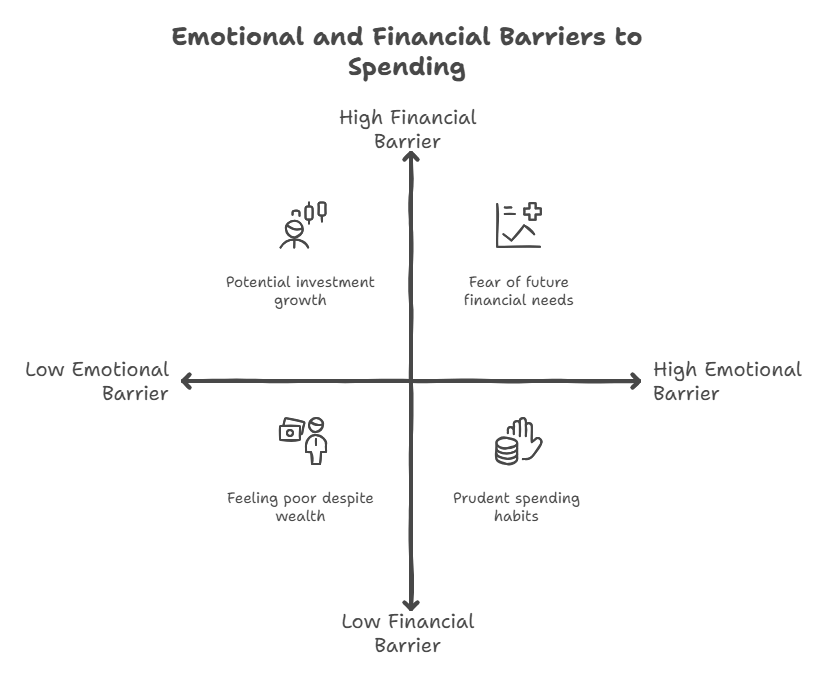

Obtained extra money or don’t have extra money, you could find the identical folks elevating what Yong Cheng has heard of over time:

- “If I promote these funding properties now and spend the cash on myself and my household, they might be price a lot extra sooner or later,” a seasoned property investor consumer as soon as instructed me.

- “Regardless that you’ve got been exhibiting me that my funding portfolio is rising, I at all times really feel poor after I have a look at my financial institution stability.”

- “What if we have to assist our kids or face large medical bills?“

- “As a result of I used to be prudent with my cash, that’s how I could be rich immediately.”

I believe it’s fairly apt Yong Cheng present 3 strategies that will help you spend with extra confidence. Not directions as a result of we acknowledge that past the technical numbers, spending cash is an emotional factor to virtually everybody.

And also you may want extra time to work by it.

If you wish to commerce these shares I discussed, you’ll be able to open an account with Interactive Brokers. Interactive Brokers is the main low-cost and environment friendly dealer I exploit and belief to take a position & commerce my holdings in Singapore, america, London Inventory Change and Hong Kong Inventory Change. They help you commerce shares, ETFs, choices, futures, foreign exchange, bonds and funds worldwide from a single built-in account.

You’ll be able to learn extra about my ideas about Interactive Brokers in this Interactive Brokers Deep Dive Collection, beginning with create & fund your Interactive Brokers account simply.