The Feelings Behind Brief-Time period Buying and selling: The Different 5% of Your Cash

In this occasional series, titled The Other 5% of Your Money, we explore these alternative strategies. Our next piece in this series will run in a few months, and it’s about angel investing. If you take part in alternative investments (anything from investing in futures, high-end art, short selling, sports gambling, gold, etc.) and you’re interested in writing a guest post for WCI, either submit an article through our Guest Post Policy page or email [email protected]. Present us how one can make 5% of your cash give you the results you want, even when it’s one thing that goes towards the boring investor’s technique.]

By Dr. A.P., Visitor Author

By Dr. A.P., Visitor AuthorAs 2024 got here to an in depth and the election was determined, my spouse and I had the annual year-end assembly with our accountant, projected our tax burden, and withheld extra earnings from our respective fourth-quarter compensation changes to fulfill that obligation. The rest of the cash was deposited into our brokerage account since our 401(okay) allocations, Roth IRA transfers, and HSA accounts had been all totally subscribed.

My spouse and I are in our fourth and fifth years of follow, respectively, and since we’re comparatively early in our careers and are saving many multiples of our most 401(okay) allocation in a given yr, our brokerage account has roughly 2.5X extra funds than each of our 401(okay) balances mixed. Up till this level, I adopted the suggestions of WCI religiously, and I wish to assume that this has been a significant contributing issue to our monetary progress and general safety. At the moment, we don’t have youngsters, and we save 75% of our take-home pay. Our solely legal responsibility is a 15-year mortgage at a set 2.75% on a $610,000 mortgage that we select to not repay.

In gentle of our low fastened month-to-month bills and ample emergency fund and making an allowance for the ever-changing insurance policies of our present administration, I needed to put aside capital in our brokerage account to commerce outdoors of our regular asset allocations. This was my first try at playing, attempting to reap the benefits of market volatility with a hopeful technique to attain some fast money.

Background

Our 401(okay)s are invested in vanilla Vanguard ETFs, and the identical holds true for the majority of our brokerage account property. That being mentioned, I don’t make adjustments to those asset allocations past the quarterly rebalancing—automated within the 401(okay) and manually finished within the brokerage account by selectively including funds to ETF positions to keep away from taxable gross sales.

My motivation for energetic buying and selling on the aspect was easy: I used to be bored, and I needed to see if my curiosity in private finance and information gained via studying may translate into precise earnings. I’m additionally simply fascinated by passive earnings at baseline. The idea of investing was international to me rising up since my mother and father had low-paying blue-collar jobs, and their complete life financial savings consisted of post-tax earnings after the payments had been paid. They by no means invested within the inventory market, and so they could not construct their web price by way of actual property—we by no means owned a house. It was trustworthy cash, nevertheless it wasn’t good cash.

Physicians work extraordinarily exhausting for his or her cash. When reimbursements fall, we both improve volumes or lower bills to take care of our compensation, and most of us generate little to no income after we’re on trip, finally leading to some type of pay minimize down the road. To me, making a fast buck on the aspect with out seeing sufferers and even doing a aspect gig that requires medical information is the equal of utilizing a cheat code in a online game.

The foreign money for all purchases in my life shouldn’t be {dollars} however hours labored. What number of hours do I’ve to work to purchase a Porsche 911 or a Rolex, for instance? It’s immensely empowering to assume that with a number of clicks of throwing my monetary muscle round in the suitable place on the proper time, I may harvest quite a lot of these hours labored.

Earlier than I really made my first energetic commerce, I set some floor guidelines. I averted choices buying and selling altogether as a result of I merely don’t perceive superior choices methods properly sufficient to make use of them successfully. I averted any type of leverage or leveraged ETFs because of the added decay danger and chance for outsized losses. I additionally selected to solely actively commerce ETFs, not particular person shares, in hopes of driving extra predictable momentum.

To make this worthwhile, I wanted to place myself for beneficial properties that I’d discover sizable, whereas additionally not taking vital danger in a single commerce. I made a decision on setting apart $400,000 to be put to work towards a myriad of concepts.

It ought to be famous that I genuinely take pleasure in studying monetary articles. Between sufferers on process days or at lunch, I learn a good variety of Wall Avenue Journal articles, in addition to extra in-depth evaluation items on In search of Alpha within the evenings. These are my two main subscriptions, and I spend about 2-3 hours a day studying monetary articles of some form. What pursuits me greater than looking for the subsequent NVIDIA or Bitcoin are macroeconomic traits (rate of interest selections on the Fed, Treasury yields, foreign money danger, particular sector outlooks, and many others.) and finally how I can monetize these broader traits as they unfold.

For the previous few months, I saved a logbook of pattern trades and adopted them over time. As soon as I gained sufficient confidence and saved up sufficient capital the place potential losses wouldn’t sacrifice our every day way of life, I began putting actual trades.

Extra info right here:

A Die-Arduous White Coat Investor Buys an Particular person Inventory — An M&M Convention

My First Particular person Inventory

Returns

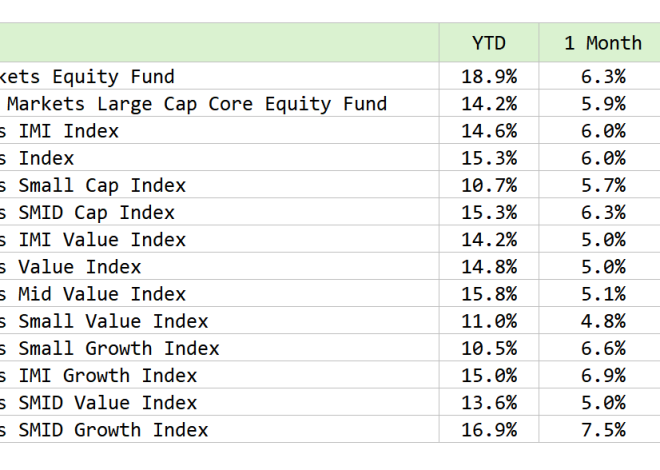

I positioned my first commerce in mid-December and closed out all of the short-term positions by April 2. Over the three.5-month course, I made $77,000 in taxable earnings on that $400,000 in capital. I subsequently withdrew the cash from the brokerage account, put aside 45% for taxes, and spent the remaining. Half of that return got here from buying GLD (the most important bullion-backed gold fund—extremely liquid with tight spreads) early within the yr, aggressively constructing on that place at nearly each dip, after which finally liquidating that complete place at about 1.5% from the fund’s all-time excessive on the time of sale. The underlying play right here was apparent: a de-dollarization wager supported by power US deficit spending endlessly; prospects of excessive inflation; prospects of potential price cuts if a recession pans out (thus making a non-interest/dividend-bearing asset like gold extra acceptable); and, above all, the fixed tariff coverage abuse on equities.

This wager can also be chronically supported by the BRIC nations’ central financial institution buying of gold (initially set in movement by US sanctions on Russia on the onset of the warfare in Ukraine), which is now seemingly compounded by some liquidation of US Treasuries by China, Japan, and different EU nations. I selected to take the gold danger on bullion itself fairly than mining shares which have carried out even higher this yr, since I really feel these shares additionally get offered off in a panic with all different equities and they’re extra susceptible to tariff coverage and civil unrest in mining international locations.

One other quarter of the returns got here from shopping for IBIT (the iShares Bitcoin fund—additionally very liquid) once I anticipated NASDAQ/development shares to outperform on a given day. It was apparent that crypto and tech shares have been extremely correlated via this time course, nearly to the purpose of constructing Bitcoin’s case as a reserve asset laughable, though this correlation could also be unfolding. I all the time liquidated the IBIT commerce on the finish of the identical day attributable to value swings after hours with Bitcoin, which may usually be drastic. I selected an ETF as an alternative of Bitcoin itself so I wouldn’t must cope with pockets storage logistics, passwords, hacks, and fraud on cryptocurrency exchanges.

The value adjustments in even a big ETF like IBIT can simply be 3%-5% in a given day, and with $100,000 invested without delay, I made roughly $4,000 in a number of hours on 5 or 6 separate days. Most of my IBIT purchases had been made when Bitcoin was buying and selling within the excessive $70,000s/low $80,000s, which appeared to be the ground this yr regardless of immense volatility in equities. Past the nightly studying, I in all probability spent half-hour throughout the work day watching costs and putting trades on the Chase app.

Lastly, the final chunk of the returns was produced from VUG (a tech-heavy, growth-focused Vanguard ETF). This fund served as my surrogate for the tech play, which I used to dip my toes within the AI pool with out really committing to particular person corporations and even the AI motion itself. I mainly purchased this fund once I felt it was oversold, when a jobs or inflation report hinted at a potential price minimize, or when Tesla and Palantir hit near their 90-day lows. I purchased and offered this about 5 instances earlier than the Liberation Day tariff bulletins, which had been an absolute massacre for this fund. Once you’re mainly attempting to foretell whether or not a safety goes to extend or lower in worth, your job is to weigh each potential issue that might sway the worth and triage them to reach at your finish prediction. Tech and development valuations had been already stretched and a macroscale tariff announcement could be extra anti-growth than not, so thank goodness I wasn’t on this fund when the market tanked.

There have been many instances once I needed to purchase Tesla or Microstrategy (primarily a leveraged Bitcoin play at this level) after steep selloffs, however I didn’t have the abdomen to lose 10%-25% of my $100,000 regardless of the potential of constructing that in a single day. For that reason, ETFs are typically extra predictable each in pricing and traits, particularly when we’ve a market the place quite a lot of shares transfer in tandem no matter their particular person benefits and the place many retail merchants use appreciable leverage to construct their positions.

Feelings

I began on this path as a result of after discovering success in my follow, I felt that, with ample schooling and analysis, I may additionally generate income within the inventory market and be a savvy retail dealer. I’m certain many professionals can relate to arriving at this checkpoint, the place you interpret success in your day job as a Midas contact for all different ventures. In hindsight, some trades appear so apparent, and also you beat your self up over triggers not pulled. However buying and selling on the aspect whereas working does have its advantages. With entry to massive quantities of capital, I can pursue increased returns with out leverage. I may afford to easily wait out trades which have soured if the underlying safety is one I’d maintain long-term—or double down on that very same commerce if the basics of my speculation are nonetheless intact. Many of the conclusions I outlined above when justifying my trades seemingly would not be that troublesome to make by different attentive WCI readers.

One other main cause why I needed to strive short-term buying and selling is as a result of I discover inventory market hypothesis exhilarating, just because it‘s such a pure and unapologetic method of being profitable. Better of all, you don’t must deal or depend on different individuals to perform the purpose. I’m additionally actually captivated with quick gratification and utilizing beneficial properties to instantly higher your life not directly. I utterly perceive the worth of getting wealthy on paper slowly over a few years, avoiding taxable beneficial properties, and positioning your self for the step up in foundation whenever you kick the bucket—the overwhelming majority of our portfolio is devoted to this mission. Nevertheless, unrealized beneficial properties are simply that—unrealized—and that is evident whenever you don’t understand how uncovered your beneficial properties are to losses till the subsequent downturn.

Tobey Maguire—the one Spider-Man for my part, a prodigious poker participant, and the assumed participant X in Molly Bloom’s e book (and the film Molly’s Recreation)—famously mentioned, “Cash received is healthier than cash earned.” I couldn’t agree extra. There’s nothing groundbreaking about your administrator telling you you can make 10% more cash by seeing 2-3 extra sufferers in a day. I made $77,000 in three months in an in any other case down market with out seeing a single affected person, taking up any procedural legal responsibility, or answering a single activity message. I’m a practical particular person, so I attribute the beneficial properties to what I believe is usually talent (an accurate spot interpretation of the present market panorama) and a few luck.

This isn’t a publish that’s meant to advertise day buying and selling, however all of us have mental curiosities. Embarking on them with technique and guardrails is healthier than a casual method.

I’ve quite a lot of mates my age who’ve invested $50,000-$100,000 in a number of actual property syndication offers and/or rental properties, or older mates close to retirement who largely make investments for dividends and/or bond curiosity. I acknowledge that these methods might very properly be superior in the long term. However these individuals by no means appear enthusiastic about their investments, and most of them already make sufficient cash to maintain their life with out having to attend for these methods to bear fruit. Briefly, you by no means really feel such as you’ve received something, and I felt the very same method till these previous few months.

WCI is undoubtedly proper: good investing ought to be boring. However over time, for the traders who need to be extra engaged, it could actually additionally change into sterile.

Extra info right here:

When Is It OK to Carry Debt (and The way to Really feel Fulfilled by It)?

Takeaway

I do know my current beneficial properties usually are not a life-changing amount of cash for most individuals who learn this weblog, and so I depart you with this. Sooner or later, you could be tempted to have interaction in short-term buying and selling if braveness will get one of the best of you. If and when that occurs, method short-term buying and selling as an instructional experiment as an alternative of as an aggressive technique to complement your earnings. If you end up dropping an excessive amount of of your principal, take an extended break or cease altogether, as a result of the second you are feeling determined, in want, and pressured to recoup your principal, that is the second you speed up losses.

If you will quick time period and/or day commerce, set floor guidelines you might be comfy with, do your analysis, observe the markets every day for an extended whereas earlier than making a single commerce, be systematic in your technique so you may try to copy worthwhile trades however perceive that correlations can abruptly change into undone, don’t be distracted mentally by buying and selling whereas caring for sufferers, and by no means commerce securities you don’t perceive. Most significantly, don’t play with cash you’ll really need for a critical life expense. If you’ll find one thing extra helpful, noble, and/or fulfilling to do along with your money, do this different factor as a result of buying and selling will all the time be ready whenever you get again.

I personally discover that taking my income as an alternative of reinvesting beneficial properties, setting apart the taxes, and spending the cash nearly instantly allowed me to understand one thing tangible with my returns. It additionally made digesting short-term losses on different trades far more palatable. I plan on persevering with to short-term commerce with a minority allocation of money purely as a interest, and I’ll in all probability cease once I’ve both misplaced a palpable amount of cash or made sufficient the place I can give up working towards altogether.

As for my current winnings, we purchased a tasteful leather-based sofa and travertine espresso desk for our front room, my spouse booked a visit to Tuscany along with her girlfriend, I added a Jaeger-LeCoultre Reverso to my assortment, and we changed our 22-year-old HVAC. Dr Jim Dahle all the time says that he can’t predict market traits as a result of his crystal ball is cloudier than yours. I’ve discovered that if I wipe mine down with heat, soapy water and a clear microfiber fabric, I can sometimes make one thing out within the clouds.

It’s both that or a hallucination; time will inform.

What do you consider short-term promoting or day buying and selling? Is that one thing you’ve got tried? How did it work out?