Reviewing Avantis Rising Markets Fairness UCITS Fund (AVEM)’s Good 6-Month Returns.

In December final yr, I made a submit introducing US ETF firm Avantis establishing a presence within the UCITS markets. You may learn Reviewing Avantis World Fairness and World Small Cap Worth UCITS ETFs (Now Obtainable to Singaporean Traders)

I talked extra about Avantis World Fairness Fund (ticker: AVGC) and Avantis World Small Cap Fund (AVGS) within the article primarily as a result of they had been the one accessible funds.

Shortly after the submit, additionally they launch the Avantis Rising Markets Fairness Fund (AVEM) to the general public.

After reviewing and understanding extra in regards to the fund, I made a decision to reallocate the rising market allocation in Daedalus Earnings Portfolio from iShares EIMI into AVEM. The principle motive is to higher align the portfolio to Daedalus extra systematic lively philosophy. I might haven’t any downside utilizing Dimensional’s Rising Markets Giant Cap Core Fairness Fund however I want to maintain the cash in my Interactive Brokers account to higher compartmentalize the portfolio away from cash for different monetary objectives.

I assumed its good time I talked about it.

The fund began off as their most tiny fund with US$9 million in AUM if my reminiscence don’t fail me too badly. Since then, they’ve grown the AUM to $51 million right this moment. Some readers have requested my channels if there’s a concern about their small AUM measurement.

I’m not positive what’s the concern right here. Maybe they want a sure measurement to stay price environment friendly however I believe their fear is smaller fund, extra vulnerable to shut down. I believe if the fund offers me a 100% premium efficiency over the benchmark index over 15 years and shut down because of the measurement, I might not complain a lot.

I might simply begrudgingly change over to a different fund that helps me specific a scientific lively philosophy for rising markets like Dimensional Rising Giant Cap Core or iShares Edge MSCI EM Worth Issue UCITS ETF USD (EMVL).

Really EMVL might be a fairly good choice.

What’s extra essential to us is:

- We will perceive whether or not the supervisor has a coherent technique.

- Whether or not that technique is sound and align to our personal philosophy.

- Have they proven a historical past of implementing and executing the technique nicely.

- Applied in a low price method.

Just a few of those extra systematic lively funds and ETFs is that.

If the UCITS enterprise doesn’t work out for Avantis, and so they do the identical factor as Vanguard and depart a area, then it isn’t an issue.

It’s a a lot larger downside in the event that they anyhow make investments your cash, constantly change their technique, then determine to shut down the fund. Within the former case, they’ve invested and expose you to the chance and return in a way you understood and agree. Within the later, they principally take your cash to gamble.

Avantis Rising Markets Fairness Efficiency

Anytime I took a have a look at how AVEM did towards EIMI, I used to be fairly shocked.

If we check out how AVEM (mild blue) did towards EIMI (mild purple):

Since final Thursday, AVEM did 20.8% versus 14.9% since inception. Rising markets have usually did nicely.

For those who want to monitor AVEM efficiency, you’ll be able to overview them at Morningstar at this web page. For those who strive Googling Morningstar you would possibly hit pages of various sort of return in numerous currencies.

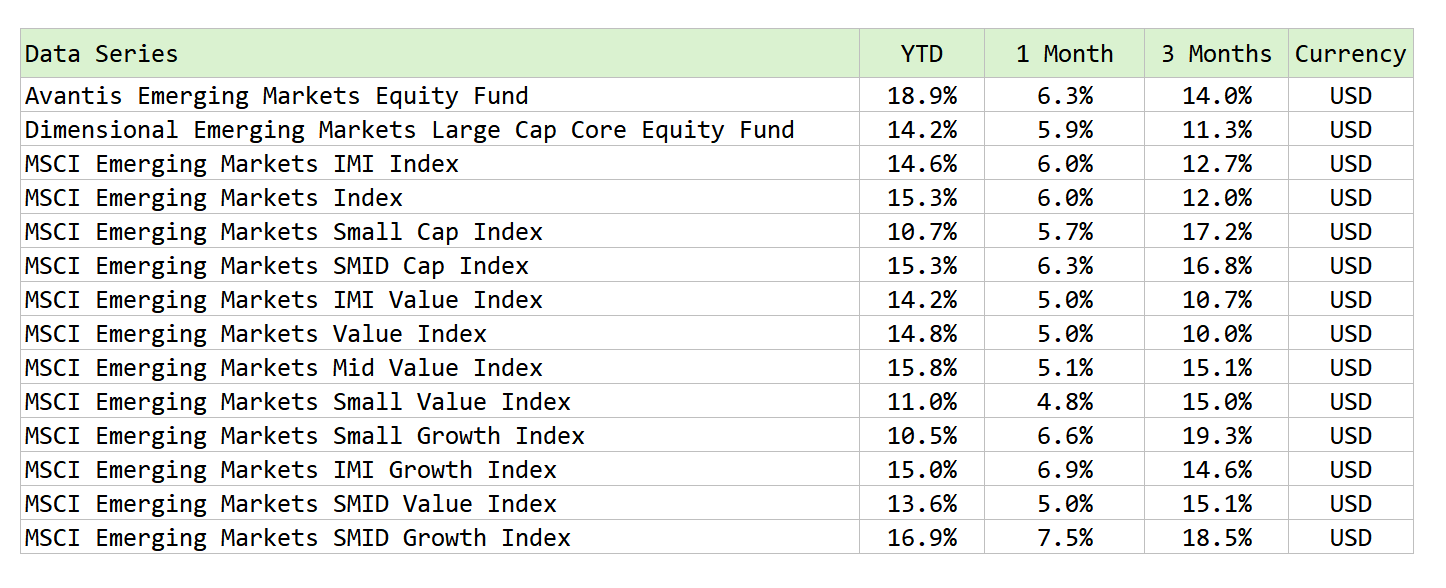

I put AVEM’s efficiency until finish of June over right here with the index return of assorted Rising Market indexes:

IMI stands for Investable Market Index, which implies the index consists of large-cap, mid-cap and small-cap shares. SMID stands for Small and Mid Cap so it excludes massive cap shares. I’ve up to date the desk to incorporate each EMVL (the iShares) and another index.

Earlier than we begin, notice that this can be a very quick six-months. In all probability not the timeframe to see if this can be a good fund or unhealthy fund.

What I’m making an attempt to do is to determine the place the efficiency is attributed to.

Usually:

- Mid-size firms had been doing higher than bigger firms that are doing higher than the smaller firms.

- However smaller firms had been doing significantly better than bigger firms within the final three months.

- Growthy firms had been doing higher than cheaper firms.

- Within the final 3 months, the growthy bigger firms had been doing higher than the bigger worth firms.

- Within the final 3 months, the growthy small firms had been doing higher than the small worth firms.

- Within the first 3 months, it’s possible worth did higher.

Avantis runs a scientific technique primarily based across the analysis of what constantly will get you firms that offers excessive anticipated returns.

And that finally ends up with firms which can be:

- Pretty worthwhile firms however very low cost.

- Extremely worthwhile firms which can be truthful in value and even cheaper.

- Smaller firms that match #1 and #2

For those who want to perceive extra about Avantis’ systematic technique, you’ll be able to learn my first article on them.

AVEM benchmark towards the MSCI Rising Markets IMI index, which implies not like Dimensional’s technique they like to cowl some smaller firms as nicely. The fund is fairly diversified over 1,498 firms. The Dimensional Giant Cap Core covers 1,502 firms regardless of its massive cap focus. The MSCI Rising Market has 1,203 firms whereas IMI has 3,099 firms.

Your returns will finally be primarily based on the securities holdings in your fund, which is in the end primarily based on the technique. Whether it is an indexing technique, then its primarily based on the index weighing. If it’s a systematic lively technique like Dimensional’s, EMVL or AVEM, then it’s primarily based across the systematic securities choice within the technique.

AVEM increased weightage to the profitability issue (which tends to point out up in development firms) and larger variety of small, mid measurement firms could have improved their efficiency relative to Dimensional’s. Regardless of worth doing higher within the first 3 months, and development doing higher within the final 3 months, AVEM did nicely in each half of the half-year. It’s outstanding that AVEM managed to seize the return within the systematic method.

If we spend money on AVEM, we most likely have to notice that we most likely get extra mid-cap measurement firms which can be extra worthwhile and corporations which can be truthful in worth. This technique will suck if massive cap rising markets did very nicely for a very long time or worth firms do worth nicely for a very long time.

I’m pleasantly shocked by how Avantis have executed with AVEM to date. Let’s see if I should swallow these phrases on the finish of the yr.

For many who are fascinated by investing in AVEM or EMVL, these are UCITS ETFs which can be listed on the London Inventory Trade. You may spend money on them via a dealer similar to Interactive Brokers. These ETFs are domicile in Eire and extra tax environment friendly. The extra essential level is that at present Eire have zero property tax for overseas non-resident. ETFs domicile within the US would have 18-40% property tax. After all dividend withholding tax (if there are dividends distributed) is 15% relative to 30% for the US domiciled ones.

If you wish to commerce these shares I discussed, you’ll be able to open an account with Interactive Brokers. Interactive Brokers is the main low-cost and environment friendly dealer I take advantage of and belief to speculate & commerce my holdings in Singapore, america, London Inventory Trade and Hong Kong Inventory Trade. They help you commerce shares, ETFs, choices, futures, foreign exchange, bonds and funds worldwide from a single built-in account.

You may learn extra about my ideas about Interactive Brokers in this Interactive Brokers Deep Dive Collection, beginning with the way to create & fund your Interactive Brokers account simply.