Michael Saylor Drops $500M On Bitcoin—What’s His Subsequent Transfer?

Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

MicroStrategy has simply added one other 4,980 Bitcoin to its stash, spending about $531 million at a median of $106,801 per coin. That brings the corporate’s complete haul to 597,325 BTC.

Associated Studying

At right this moment’s market worth, these holdings are value over $64 billion, in contrast with the roughly $42.4 billion MicroStrategy (now Technique) has put in, charges included.

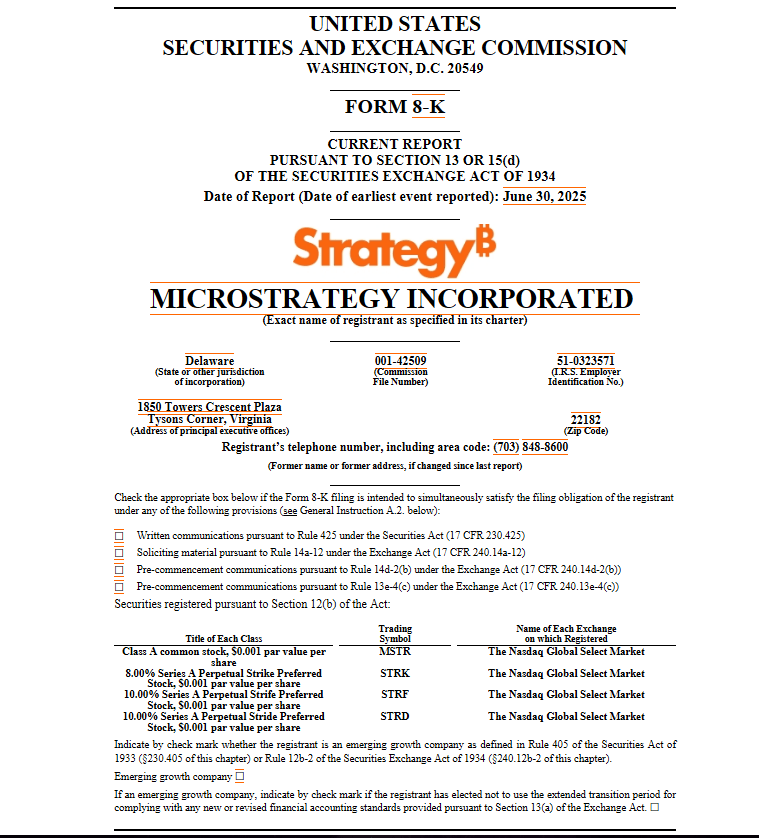

In line with the June 30 submitting with the US Securities and Alternate Fee, Technique – led by billionaire Michael Saylor – is sitting on practically $21.6 billion in unrealized features.

Strategic Bitcoin Push

Technique purchased its newest batch in the course of the week ending June 29. The agency has already snapped up 88,062 BTC value practically $10 billion up to now this 12 months. Again in 2024, the corporate picked up 140,538 BTC at a price of $13 billion.

Firm information exhibits a Bitcoin yield of virtually 20% 12 months‑to‑date, with 7.8% gained within the second quarter alone. That edges Technique nearer to its objective of a 25% yield by the top of 2025.

Technique has acquired 4,980 BTC for ~$531.9 million at ~$106,801 per bitcoin and has achieved BTC Yield of 19.7% YTD 2025. As of 6/29/2025, we hodl 597,325 $BTC acquired for ~$42.40 billion at ~$70,982 per bitcoin. $MSTR $STRK $STRF $STRD https://t.co/xvWnSkfukS

— Michael Saylor (@saylor) June 30, 2025

Company Treasury Development

Technique now controls nearly 3% of all of the Bitcoin ever mined out of the 21 million cap. That dominance has impressed 134 publicly traded companies to observe swimsuit, including Bitcoin to their company treasuries.

Current adopters embody Twenty One, US President Donald Trump’s media agency Trump Media, and GameStop. In Japan, Metaplanet added 1,005 BTC this week to convey its complete to 13,350 BTC.

Over in Europe, The Blockchain Group purchased 60 BTC, lifting its holdings to 1,788 BTC valued at round €161.3 million.

🟠 The Blockchain Group has acquired 60 BTC for ~€5.5 million at ~€91,879 per bitcoin and has achieved BTC Yield of 1,270.7% YTD, 69.3% QTD. As of 6/30/2025, $ALTBG holds 1,788 $BTC for ~€161.3 million at ~€90,213 per bitcoin⚡️@_ALTBG Europe’s First Bitcoin Treasury Firm… https://t.co/BmcqZzvfoz

— Alexandre Laizet ⚡️ (@AlexandreLaizet) June 30, 2025

New Buying and selling Merchandise Arrive

Cryptocurrency exchanges are racing to satisfy all this demand. On June 28, Gemini rolled out a tokenized model of Technique inventory for traders within the EU. That marks the change’s first tokenized fairness providing in that area.

Shares of Technique have climbed practically 5% over the previous month, buying and selling round $391, based on Google Finance information.

Associated Studying

Value Resistance Looms

Bitcoin itself has been holding close to $108,000. It rose as a lot as 3% over the weekend to hit $108,798.

Some merchants, like MN Capital founder Michael van de Poppe, count on a short pullback earlier than BTC tries to breach $109,000. That stage sits on the four-hour chart as a transparent resistance level.

Knowledge from CoinGlass exhibits practically $50 million in liquidity stacked at $109,500. If Bitcoin can clear the $110,000–$112,300 zone, it might set off a brief squeeze that pushes costs into recent report territory.

Featured picture from Unsplash, chart from TradingView