Delegator, Validator, or DIYer? | White Coat Investor

By Dr. Jim Dahle, WCI Founder

By Dr. Jim Dahle, WCI FounderOne of the vital issues to find out about private finance and investing is to determine whether or not you’re a delegator, a validator, or a DIYer. I am making an attempt to develop a device to assist white coat traders decide this. That is my first try. This one is an easy quiz. Take it, reply the questions pretty, and rating it, and I believe it provides you with a fairly good concept of what you might be. In case you have no concept what a delegator, validator, or DIYer is, simply take the quiz after which learn the remainder of the publish afterward.

The Quiz

A. Which of the next statements do you agree with most?

- I don’t get pleasure from studying about private finance and investing in any respect, and I would favor to not spend any of my time doing it.

- I do not like studying about private finance and investing. However I do know I have to do it, and I’m keen to do some. These things is sort of boring, and I’ve far more attention-grabbing hobbies.

- Private finance and investing is certainly one of my hobbies. Perhaps even my favourite pastime.

B. Which of the next statements do you agree with most?

- I have no idea rather a lot about private finance and investing.

- I do know greater than most individuals about private finance and investing.

- I am essentially the most educated individual about private finance and investing that I do know in my “common life.”

C. How a lot do you are worried about your monetary selections?

- I by no means take into consideration cash in any respect.

- I fear rather a lot about my cash.

- I fear a bit of about cash and would love to fret much less.

- I take into consideration cash rather a lot, however I by no means fear about it.

D. I’ve written monetary targets.

- No.

- Sure, however they want some work.

- Sure, I’ve had these for a very long time. Duh.

E. I’ve a written monetary plan to assist me obtain every of my targets.

- No.

- Sure, nevertheless it wants some work.

- Sure, all of them.

F. I’m assured that I’m on observe to attain all of my targets.

- By no means.

- I believe so, however I might like to have another person look issues over and share their opinion.

- Very.

G. How do you’re feeling about paying monetary advisory charges?

- I pay somebody to scrub my home and mow my garden, so why not? I might be keen to pay as much as $15,000 a yr for good recommendation and repair.

- I might be keen to pay a whole lot or perhaps a few thousand {dollars} from time to time for knowledgeable opinion.

- Are you kidding me? What a ripoff! Do you could have any concept what these charges might compound to over 30 years?

H. What did your funding conduct appear like within the final bear market?

- When was the final bear market?

- I panicked and went to money with some or all of my portfolio.

- I did not panic, however I wasn’t actually certain what to do and will have used some assist.

- I stayed the course, continued to speculate, and rebalanced my portfolio as mandatory.

I. How snug do you’re feeling placing in purchase and promote orders for investments on-line?

- By no means snug.

- I believe I might get there.

- Very snug.

J. How lots of the following do you could have or have you ever had in place: a will, belief, incapacity insurance coverage, time period life insurance coverage, private legal responsibility insurance coverage, 529, HSA, Backdoor Roth IRA, solo 401(okay)?

- 0-3.

- 4-6.

- 7+.

Okay. How do you’re feeling a couple of Backdoor Roth IRA?

- What’s that?

- That sounds actually difficult.

- I guess I can try this, however I might wish to run it by a professional the primary time to verify I am doing it proper.

- No downside.

L How do you’re feeling about performing a retirement account rollover by yourself?

- I do not even know the place to start out.

- I believe I might in all probability screw that up.

- I guess I might determine that out.

- It will not be the primary time, and at the least my charges will in all probability be decrease and my funding choices can be higher.

M. If a monetary advisor handed you a well-written, personalised monetary plan for the subsequent 5 years of your life, what would you do with it?

- Put it in my submitting cupboard.

- Comply with it to the T.

- Decide it aside, query every thing in it, and run it by my pals on the web to see what they consider it.

Rating the Quiz

When you’ve answered each query, it is time to rating the quiz. The minimal rating is 13. The utmost rating is 43. Nonetheless, this isn’t the MCAT. The very best rating is just not “the very best” rating. You are not searching for the very best rating. You are searching for essentially the most correct rating. Want to return and take the quiz once more? Most likely. Go forward, I am going to wait.

OK, bought your rating now? Here is what it means.

13-18: You might be undoubtedly a delegator, and cash spent on a “full-service” monetary advisor is a superb deal for you.

19-23: You are in all probability a delegator, however you possibly can turn out to be a validator over time if you’re . However even then, you’ll seemingly want frequent check-ins with an advisor.

24-32: You might be, at the least at present, a validator, and it’s worthwhile to rent a monetary advisor specializing in validators.

33-35: You’re a validator with some DIY tendencies. If you would like, an advisor specializing in validators could possibly prepare you to turn out to be a DIY investor over time.

36-43: You’re a DIYer. Cease preventing it. Get a plan in place, get these previous couple of objects in your listing taken care of, hearth your advisor, and observe your plan to investing success.

When you scored within the 28-40 vary, it’s best to think about taking our Fireplace Your Monetary Advisor on-line course. It comes with a one-week, money-back assure.

When you scored under 36 and don’t at present have an advisor that you understand is supplying you with good recommendation at a good worth, it’s best to search for a brand new one from our advisable listing. In case your rating was within the 24-35 vary, you could have a more difficult job forward of you. You have to to pick an advisor skilled in and keen to work with a validator-type consumer. Considered one of your first questions needs to be one thing like, “I believe I am a validator-type consumer. How do you’re feeling about working with folks like me, and the way is your agency set as much as serve folks like me?” If the reply is, “What’s a validator?” or, “We’re actually set as much as serve delegators primarily,” it’s worthwhile to transfer on. If the reply is, “We’ve got dozens or a whole lot of validators who’ve used our agency. Some turned DIYers and fired us, and a few realized they had been actually delegators. However there are lots who now simply test in with us yearly or two for a good hourly or flat price. We’ve got a price construction that works properly for many validators.” That is when you understand you have discovered the appropriate agency.

Extra data right here:

Ought to the White Coat Investor Change into a Monetary Advisor (and Cost AUM Charges)?

What Is a Delegator?

A delegator is a consumer who desires and wishes to make use of a monetary advisor. Whereas they want to verify they’re truly getting good recommendation and paying a good worth (not the best factor for a real delegator), they’ll typically be happiest and richest by growing a long-term relationship with a high-quality advisor. They don’t get pleasure from messing with their cash, haven’t got a lot expertise with managing cash, and fear rather a lot about doing the unsuitable factor. They don’t thoughts spending cash to purchase again their very own time. Roughly 30% of white coat traders match into this class.

What Is a Validator?

A validator is a consumer who desires a decrease stage of service from a monetary advisor in change for a decrease stage of charges. Whereas investing is not their pastime, they’re keen to work laborious to learn to do monetary duties, like a Backdoor Roth IRA, a retirement plan rollover, or rebalancing a portfolio. They do not learn monetary books for enjoyable, however they’re keen to learn a handful of them. They like the thought of checking in with an advisor from time to time to verify they’re on observe and ask a couple of questions. Roughly 50% of white coat traders match into this class.

What Is a Do-It-Yourselfer (DIYer)?

A DIYer is a hobbyist. They love these things. They don’t seem to be solely subscribed to this weblog, however they really learn a lot of the WCI emails despatched to them. They often touch upon them or ahead them to pals. They take part in on-line private finance and investing communities just like the WCI Discussion board, the WCI Financially Empowered Girls (FEW), the WCI Fb Group, or the WCI Subreddit. They may think about themselves “a Boglehead.”

They may personal a couple of rental properties, they usually may need even managed the properties themselves for a couple of years earlier than hiring it out. Whereas they could or might not put money into personal investments, they’ve an knowledgeable opinion about them. They’d think about attending a cash convention, they usually would possibly even apply to talk at it. They get pleasure from studying monetary books. If they’ve a monetary query, they’re extra prone to ask it on-line than to search out an advisor. In the event that they did ask the query to an advisor, they’d nonetheless run it by their on-line pals to see what they give thought to the reply. They really feel assured of their capacity to search out correct solutions to their questions in locations like IRS publications. They’re very “fee-sensitive.” They could be a DIYer in lots of different areas of their life, comparable to garden care, housekeeping, automotive upkeep, journey planning, tax preparation, and extra. Roughly 20% of white coat traders match into this class.

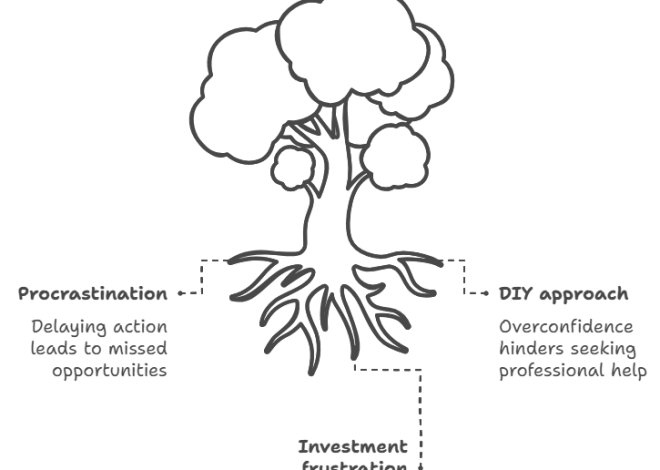

What do you assume? Are you a delegator, validator, or DIYer? Why do you assume that is vital to find out early in your investing profession? What occurs if you’re one factor however attempt to act like one other?