Some Brief Notes & Factors on Potential Deregulation and Affect to the Markets.

One of many potential optimistic angles buyers see when Trump gained the Presidential election final 12 months was some kind of a de-regulation. The market interpret that de-regulation is mostly good for the market.

Final month, I put out a abstract observe of the dialog between Steve Eisman and the parents at Portales Companions. How Sturdy are the US Banks and Personal Fairness Going into the Subsequent Recession?

The observe make clear how a few of these de-regulation will play out.

I’m nonetheless undecided if any of those are priced in or whether or not this can ultimately be optimistic for equities, particularly the group that individuals suppose that it’ll profit. I suppose if there are uncertainties, there’s threat premium and due to this fact the potential reward is there.

Typically:

- The primary de-regulation will assist extra mergers and acquisitions will get authorized. Because of this in case you are an organization that seems enticing to others, you would possibly get purchased out. You probably have extra of this, it typically ends in some attributable small-cap, mid-cap premiums being realized. (means higher small cap or mid cap efficiency attributable to this).

- The second kind of de-regulation entails financial institution de-regulation. There have been many stringent regulatory guidelines put in place for the banks within the aftermath of the World Monetary Disaster. Some (seemingly the banks) argue they have been overly stringent. The banks are in higher form as we speak in that if a recession hits, they’ve sufficient capital such that they don’t should fire-sale the belongings on their steadiness sheet which usually kills them. There are particular advantages for this:

- Underneath the Dodd-Frank Act, banks with over US$100 million in belongings face heightened regulatory scrutiny. There’s a likelihood the edge is raised to $250 million or eradicated. This is able to unencumber many regional banks from expensive stress testing and capital planning necessities, permitting extra capital to move to lending and progress initiatives.

- Underneath the Volcker Rule, banks are restricted from proprietary buying and selling and sure investments in hedge funds/personal fairness. The de-regulation could alleviate this or for smaller banks which can be underneath $10 or $50 billion from compliance. It will give the banks extra flexibility.

- Underneath Basel III, there are capital conservation buffers resembling liquidity protection ratios to be maintained. Deregulation could optimize this higher based mostly on financial institution measurement. This is able to lead to some financial institution segments to have bigger lending capability, and would enhance their ROE

We have now already seen some proof of a extra relaxed, lenient regulatory atmosphere.

- Wells Fargo was positioned underneath an asset cap by the Federal Reserve in February 2018 as a punishment for widespread shopper abuses, notably stemming from the faux accounts scandal. Their belongings have been capped at $1.95 trillion. This implies they can’t develop their steadiness sheet till Wells Fargo fastened its governance, threat administration and compliance programs. As of June 3, 2025, the Fed formally lifted the asset cap after figuring out Wells had met its obligations underneath the 2018 consent order. Hyperlink

- The $35 billion merger between Capital One and Uncover, introduced Feb 2024, lastly closed on Could 18, 2025 after Fed and OCC approval.

- In April 2025, Columbia Banking System (mother or father of Umpqua Financial institution) introduced a $2 billion all-stock merger with Pacific Premier Bancorp to create a Western U.S. regional financial institution powerhouse with roughly $70 billion in belongings. The deal, anticipated to shut within the second half of 2025, considerably expands Columbia’s presence in Southern California and accelerates its progress technique by a few decade. The merger combines complementary strengths—Columbia’s treasury and wealth companies with Pacific Premier’s area of interest in HOA banking and custodial belief companies—and is projected to ship mid-teens earnings accretion and $127 million in annual value synergies. The transaction displays a broader wave of regional financial institution consolidation amid a extra deregulatory regulatory atmosphere.

I believe given how problem they’re making an attempt to convey down the curiosity yields within the US in order that they’ll refinance present matured US Treasury at decrease charges, it’s seemingly these to be pushed by. However I believe extra so, much less regulation overheads could scale back prices and enhance enterprise profitability. This would possibly drive the EPS group of the non-mega caps.

Listed below are perhaps another notes that you simply would possibly want to examine.

Trump administration prepares to ease massive financial institution guidelines | 31 Could 2025

- Scott Bessent: Decreasing capital necessities is a “prime precedence” for federal banking companies. And he mentioned he’s anticipating motion on the difficulty “over the summer season.”

- The capital rule into consideration would alter what is named the supplementary leverage ratio — an extra safeguard that requires banks to keep up a minimal stage of capital based mostly on the entire measurement of their belongings. Bessent: “Pushing to have this supplementary leverage ratio both diminished or eliminated, and it’ll enable banks to purchase extra Treasuries,”

Considerably decreasing regulatory burdens is the some of the sensible and impactful means the brand new admin can obtain its targets of each sparking disinflationary progress and decreasing the deficit. | Bob Elliot | 14 Jan 2025

Reforming Leverage Ratios Is Critically Obligatory | Dr Zhang Guowei | 27 Could 2025

The Trump administration tried to de-regulate throughout Trump’s first time period however was largely unsuccessful however this time spherical, Scott Bessent views this as extra vital as a result of decreasing the supplementary leverage ratio (SLR) will enable the banks to freely commerce Treasuries extra, and this enables the banks to purchase extra Treasuries.

If international entities will not be demanding as a lot USD and in flip treasuries, then somebody wants to soak up extra of them. If banks are in a position to, then this may be a approach to convey the Treasury yield down in order that they’ll refinance simpler.

Listed below are some knowledge charts which can be associated, primarily from Apollo:

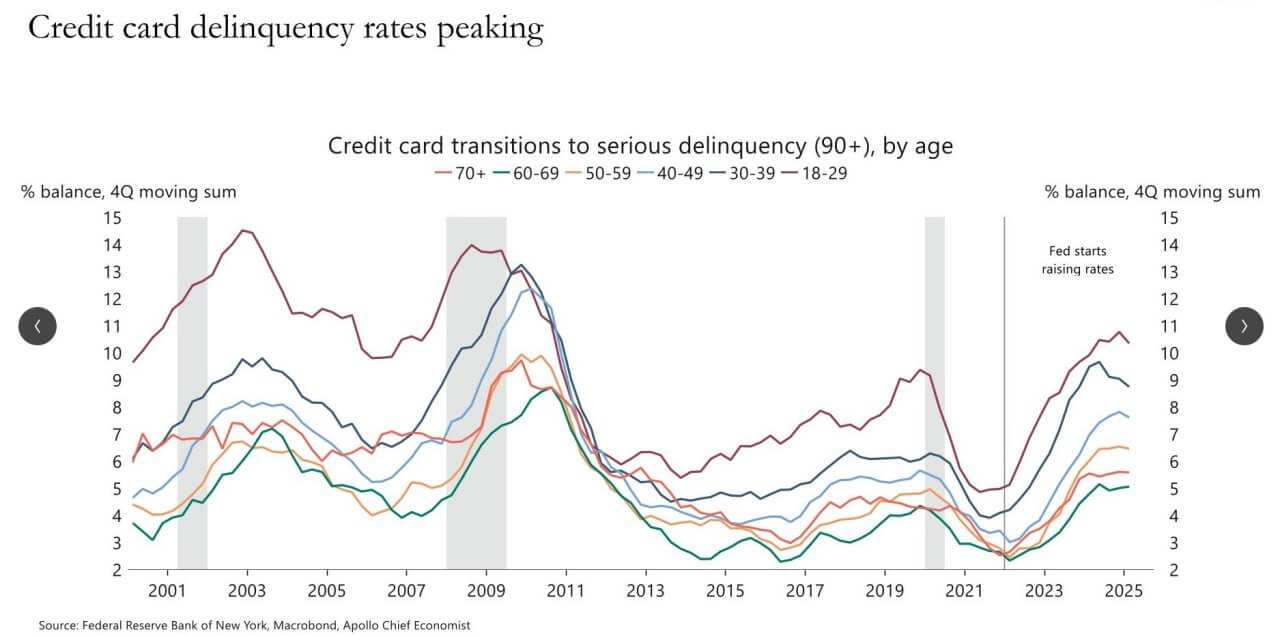

Credit score Card delinquency appears to be like to be peaking, which is an efficient signal.

Residential mortgage delinquency appears to be like low nonetheless.

The mortgage delinquency charge for industrial actual property appears to be like low nonetheless. The delinquency on the prime 100 largest banks appears to be like to be peaking, not so for the remainder of the banks.

If you wish to commerce these shares I discussed, you may open an account with Interactive Brokers. Interactive Brokers is the main low-cost and environment friendly dealer I exploit and belief to speculate & commerce my holdings in Singapore, the USA, London Inventory Alternate and Hong Kong Inventory Alternate. They can help you commerce shares, ETFs, choices, futures, foreign exchange, bonds and funds worldwide from a single built-in account.

You may learn extra about my ideas about Interactive Brokers in this Interactive Brokers Deep Dive Collection, beginning with find out how to create & fund your Interactive Brokers account simply.