Crypto Market Recap: Technique Eyes US$1 Billion Capital Elevate, Uber Considers Stablecoin Utilization

This is a fast recap of the crypto panorama for Friday (June 6) as of 9:00 p.m. UTC.

Get the newest insights on Bitcoin, Ethereum and altcoins, together with a round-up of key cryptocurrency market information.

Bitcoin and Ethereum worth replace

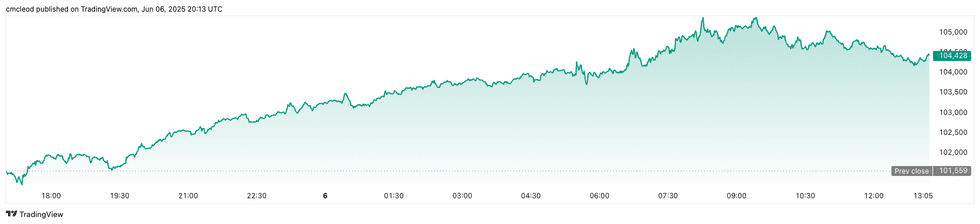

Bitcoin (BTC) was priced at US$104,245 as markets closed for the week, up 2 p.c in 24 hours. The day’s vary for the cryptocurrency introduced a low of US$104,006 and a excessive of US$105,201.

Bitcoin worth efficiency, June 6, 2025.

Chart through TradingView.

After dipping under US$101,000 throughout the dispute between US President Donald Trump and Elon Musk, Bitcoin recovered to round US$105,000 early within the buying and selling day, influenced by a powerful US labor report.

Regardless of the rebound, analysts are cautious because of technical indicators like a weakening relative energy index, suggesting potential draw back. A doable charge minimize from the US Federal Reserve on June 18 may push Bitcoin to US$112,000, however the outlook is unsure. Order e book knowledge signifies a liquidity lure, and restricted brief curiosity factors to a fragile restoration.

Extra promoting stress and investor mistrust are contributing to shaky market sentiment.

Ethereum (ETH) completed the buying and selling day at US$2,490.63, a 2 p.c lower over the previous 24 hours. The cryptocurrency reached an intraday low of US$2,482.52 and noticed a day by day excessive of US$2,519.25.

Altcoin worth replace

- Solana (SOL) closed at US$149.26, buying and selling flat over 24 hours. SOL skilled a low of US$148.86 and reached a excessive of US$151.79 on Friday.

- XRP is buying and selling at US$2.17, reflecting a 1.6 p.c enhance over 24 hours. The cryptocurrency reached a day by day low of US$2.16 and a excessive of US$2.18.

- Sui (SUI) peaked at US$3.18, exhibiting a riseof 5.7 p.c over the previous 24 hours. Its lowest valuation on Friday was US$3.16, and its highest was US$3.19.

- Cardano (ADA) is buying and selling at US$0.663, up 2.8 p.c over the previous 24 hours. Its lowest worth of the day was US$0.6604, and it reached a excessive of US$0.6693.

At this time’s crypto information to know

Uber considers stablecoins for value discount

On stage on the San Francisco-based Bloomberg Tech Summit on Thursday (June 5), Uber Applied sciences (NYSE:UBER) CEO Dara Khosrowshahi stated the corporate is “positively going to have a look” at utilizing stablecoins to assist scale back the price of transferring cash world wide.

“We’re nonetheless within the examine part, I’d say, however stablecoin is likely one of the, for me, extra attention-grabbing instantiations of crypto that has a sensible profit apart from crypto as a retailer of worth,” he stated. “Clearly, you possibly can have your opinions on Bitcoin, nevertheless it’s a confirmed commodity, and you understand, individuals have completely different opinions on the place it’s going,” he added.

UK set to raise ban on retail entry to crypto ETNs

The UK’s Monetary Conduct Authority (FCA) has introduced plans to raise its ban on retail traders shopping for crypto exchange-traded notes (ETNs), a significant shift from its earlier risk-averse stance.

Initially barred because of issues over volatility and investor safety, the FCA now says customers ought to have the fitting to decide on whether or not these high-risk belongings match their portfolios. David Geale, the FCA’s digital belongings chief, stated the transfer is a part of a broader push to “rebalance” the regulator’s strategy to monetary threat. The proposal, which might permit ETNs to be bought on FCA-registered funding exchanges, will now enter a public session part.

This regulatory pivot follows the UK’s introduction of draft legal guidelines in April geared toward integrating crypto into the formal monetary system. The FCA emphasised that its separate ban on crypto derivatives for retail merchants will stay in place.

Switzerland adopts crypto data change invoice

The federal government of Switzerland has adopted a invoice to allow the automated change of knowledge (AEOI) on crypto with 74 companion nations, together with the UK, all EU member states and most G20 nations.

The measure excludes the US, Saudi Arabia and China. The invoice is at the moment beneath dialogue in parliament and, if authorized, the AEOI framework for crypto belongings will take impact on Jan. 1, 2026.

Switzerland will solely interact in AEOI with companion states that additionally need data change with Switzerland.

Technique to lift practically US$1 billion to purchase extra Bitcoin

Technique (NASDAQ:MSTR), the corporate identified for its aggressive Bitcoin acquisition technique, is launching an almost US$1 billion capital elevate via its new 10 p.c Collection A STRD most popular inventory. The providing contains over 11 million shares and guarantees a excessive mounted yield, making it engaging to yield-hungry traders in a low-rate surroundings.

Not like different Technique choices like STRK (convertible) and STRF (senior standing), STRD presents the best payout at 10 p.c, however comes with extra threat because of its non-cumulative dividend and junior standing. Dividends are solely issued when declared, and the shares can’t be referred to as beneath regular market circumstances.

Proceeds will go towards “common company functions,” which notably embody increasing its Bitcoin holdings.

Metaplanet plans US$5.3 billion warrant providing to scale Bitcoin treasury

Tokyo-based Metaplanet (OTCQX:MTPLF,TSE:3350) is taking its Bitcoin dedication to the subsequent stage with a large US$5.3 billion inventory warrant issuance, the biggest of its form in Japan.

The corporate is providing 555 million shares via inventory acquisition rights, utilizing a novel moving-strike pricing mannequin that adjusts with market worth — a primary within the Japanese market.

This 555 Million Plan follows an earlier US$600 million elevate and is a part of Metaplanet’s objective to carry over 210,000 BTC by 2027, roughly 1 p.c of whole Bitcoin provide.

The overwhelming majority of the proceeds — round 96 p.c — will go towards direct Bitcoin purchases, whereas a small fraction will help debt administration and by-product methods like promoting places.

Maple Finance expands syrupUSD to Solana

Lending platform Maple Finance introduced on Thursday that it has expanded person entry by deploying its syrupUSD yield-bearing stablecoin to Solana-based platforms Kamino and Orca.

Beforehand, it had solely been accessible on the Ethereum blockchain.

Based on the announcement, Solana integration is launching with US$30 million in liquidity, which can set up “a deep and secure basis for lending, buying and selling, and collateral provisioning.”

This new system was made doable through the use of Chainlink’s Cross-Chain Interoperability Protocol (CCIP), which began working on the Solana essential community on Could 19. CCIP lets completely different blockchain programs, particularly these utilizing Ethereum Digital Machine and Solana Digital Machine know-how, share data.

The flexibility to switch knowledge between these distinct blockchain environments is predicted to considerably increase environment friendly and inexpensive progress inside the digital ecosystem.

Do not forget to observe us @INN_Technology for real-time information updates!

Securities Disclosure: I, Giann Liguid, maintain no direct funding curiosity in any firm talked about on this article.

Securities Disclosure: I, Meagen Seatter, maintain no direct funding curiosity in any firm talked about on this article.

From Your Web site Articles

Associated Articles Across the Internet