Your VC Fund’s Efficiency Returns can be a Single Draw from a Broad Vary of Attainable Returns.

he final article that I wrote about non-public investments was the analysis executed by Dimensional, introduced in certainly one of their Superior Convention.

The conclusion from the info piece then is:

- For those who handle to spend money on one of the best non-public listed funds, the returns will be higher than comparable listed returns.

- In case your luck is common, the returns are typically not too totally different from the typical returns of a diversified portfolio of listed shares.

- For those who decide a poor fund, you would possibly find yourself with poorer returns than listed shares.

- Measure in opposition to the proper benchmark, you would possibly understand that there are much less outperformance. A part of the returns of the non-public funds additionally come from conventional sources of extra dangers.

A few months in the past, I got here throughout this analysis from Carta on Enterprise Capital (VC) Funding and this analysis offers insights into VC returns.

This would possibly curiosity these buyers who might have entry, contemplating it, and marvel concerning the actuality of their returns. This could undoubtedly construct on to Dimensional Analysis.

Carta when by way of a good variety of enterprise funds. It is very important understand they aren’t referring to all non-public investments, which can embody buyout funds, non-public actual property, and personal infrastructure funds.

Their information will present the investments in these funds from 2017 to 2024.

If you hear folks discuss a “classic 12 months” in non-public investing—like in enterprise capital or non-public fairness—they’re referring to the 12 months a fund begins investing its cash. Consider it just like the beginning 12 months of that funding fund. Similar to a wine classic refers back to the 12 months the grapes had been harvested, a non-public funding classic 12 months tells you when the cash was dedicated and the fund started shopping for stakes in firms.

Why does this matter? As a result of the financial circumstances and market setting in a selected 12 months can strongly have an effect on how nicely that group of investments performs. A fund that began in a booming 12 months might need overpaid for firms, whereas one which began throughout a downturn might have picked up nice firms for much less. So, buyers typically examine the efficiency of funds based mostly on their classic years to see how they did relative to friends who began on the identical time and beneath related circumstances. It’s a strategy to benchmark and perceive efficiency in context.

Completely different Measurements of Non-public Funding Returns

It may additionally be good to familiarize your self with the totally different metrics they use to measure returns. There isn’t a “finest” strategy to measure returns. Every will inform you one thing that you just want to know and will have their very own downsides.

Carta introduced them within the report.

And NPV = web current worth of the fund’s future money distribution (set to 0 to numerically clear up for IRR)

IRR is one thing that buyers in public markets may be most accustomed to. It measures the “annualized yield” of your resolution to place in a stream of irregular cash, take out a stream of irregular cash, to be able to examine your return to say the financial institution curiosity, CPF OA rate of interest and so on.

It components in time worth of cash, compounding, but additionally the load of the cash invested and brought out.

TVPI is straightforward in that it measures the cash paid out to the investor and the residual worth left within the investments, divided by the cash you place in.

TVPI is like your easy returns.

If the quantity is above 1, and the upper it’s, it exhibits that you just become profitable!

Nevertheless it doesn’t allow you to examine to the consequences of inflation, or different investments that nicely.

DPI lets you know the way a lot distribution, examine to the cash that you just put in have you ever acquired.

Okay now to the efficiency information.

Variety of LPs are Falling so Fund Elevating Turns into extra Difficult.

Goodness you possibly can see the funding drop off for these LP that funds $100M to $250M. I feel the smallest LP does present indicators of accelerating however typically these with cash are chopping funding.

Your IRR Returns is One Draw of Returns from a Vary of Returns.

This desk exhibits the Internet IRR (after charges) based mostly on Classic 12 months.

The very first thing that ought to scream at you is how large the returns. For those who deal with the 2017 classic, the longest classic, the returns after 7 years vary from 4.9% to 26.0%! And it’s the identical for the remainder.

It’s doable that you’ve invested in a single 12 months (classic 2023) and have a 26% IRR, however extra possible these vintages will be unfavorable for the primary few years.

Now you bought to ask your self how you’re feeling if returns will be 1.3% to 27%…

Carta then frames the return differently.

They take a look at the median IRR return of every classic over 28 quarters (28 x 3 = 84 months or 7 years):

In case your luck lands you on a median VC fund, you understand it takes some time for the VC funds to show optimistic. These vintages in 2021 to 2023 are nonetheless unfavorable.

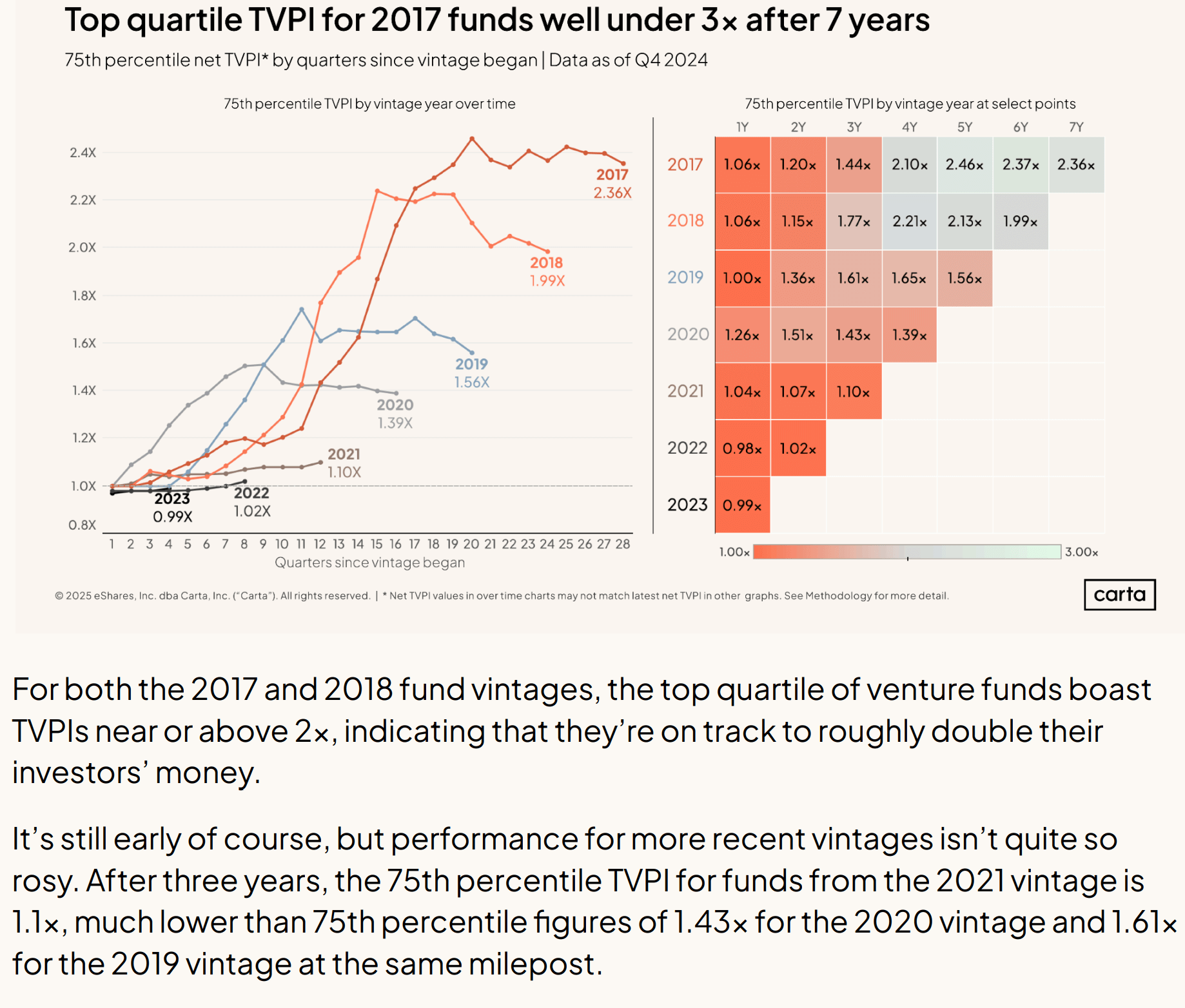

How Did the Prime VC Funds Fare?

What about these within the prime 75% or prime quartile:

They’re higher. These of classic 2021 within the prime quartile would have damaged even.

What about these prime 10%:

Whoa, they are going to be optimistic from the primary quarter!

I feel it emphasize the purpose that the nice returns in non-public investments are typically concentrated within the prime funds. For those who wrestle to get into it, then your return expertise may not be too totally different from public investments.

What additionally, you will discover concerning the SHAPE of these returns over time. All of them go up rattling excessive earlier than moderating. I’d not learn an excessive amount of into it as a result of I think which may be the results of 2020-2021 interval the place a number of returns of threat property did extraordinarily nicely till they didn’t accomplish that nicely.

Efficiency by TVPI is Broad

The median fund did an 11% IRR and the median fund on this case did 1.7x in 7-8 years. However people who did very nicely has returns fairly removed from the seventy fifth percentile.

If TVPI is a kind of easy returns that individuals can perceive, i’m wondering if their buyers could be glad that their funds did 1.25x. I acquired a sense they won’t.

VC Funds Will be Actually Illiquid

It’s no coincidence that every time I hear a podcast of somebody speaking about their non-public investments, they are going to point out casually “I don’t know when I’ll see my cash…”.

Which is true as a result of a part of the potential premium of those funding is the trade of your liquidity.

DPI will present how a lot cash you bought again from the funds after they understand the positive aspects from promoting off the underlying. Funds which can be lower than 5 years have little or no distribution.

Apart from the 2017 classic, even the ninetieth percentile of funds have solely distributed 0.46x of their dedicated capital.

This slide above exhibits the variety of funds that distribute greater than the capital the LPs have put in. This can be a small quantity. If you’re on the lookout for quick returns, you would possibly need to take into account extra completely.

1 in 5 fund elevating rounds prior to now 3 years had been down rounds.

Lastly, each fund elevating spherical is a chance to understand the worth of your organization.

If 20% of the fund elevating are down rounds, it implies that your funding returns finally ends up decrease at this second.

What does this imply?

I feel the 4 concluding factors that I introduced over from the Dimensional Analysis article are nonetheless legitimate kind of.

Whereas there are funds that generate nice returns, you would possibly have to be learn that you could be get returns that aren’t so good.

VC funds just isn’t magical such that you just gained’t lose cash.

If you wish to commerce these shares I discussed, you possibly can open an account with Interactive Brokers. Interactive Brokers is the main low-cost and environment friendly dealer I exploit and belief to take a position & commerce my holdings in Singapore, america, London Inventory Change and Hong Kong Inventory Change. They permit you to commerce shares, ETFs, choices, futures, foreign exchange, bonds and funds worldwide from a single built-in account.

You’ll be able to learn extra about my ideas about Interactive Brokers in this Interactive Brokers Deep Dive Sequence, beginning with the best way to create & fund your Interactive Brokers account simply.