Traders Pull $120 Million from Exchanges

Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

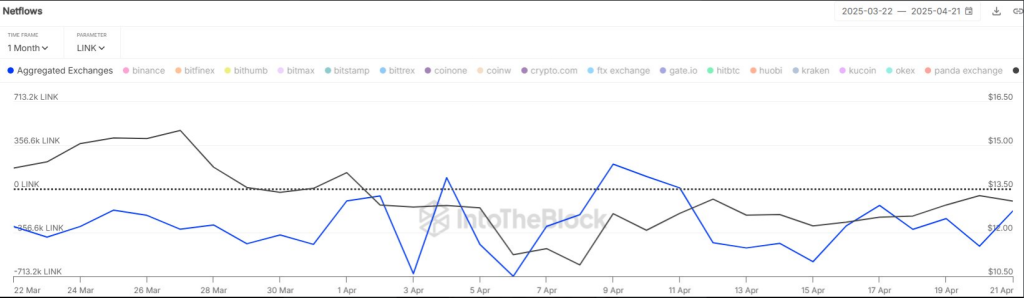

Chainlink (LINK) cryptocurrency has witnessed vital token flows off exchanges only recently. Over $120 million of LINK tokens have been taken off buying and selling platforms inside the final 30 days, stories blockchain evaluation firm IntoTheBlock.

Associated Studying

Traders Take LINK To Chilly Storage

The large outflow signifies a change in investor sentiment. This development normally signifies holders shifting their funds to personal wallets for long-term storage as a substitute of on the point of promote. When change provide declines, costs could enhance if demand stays agency or grows.

Whereas most traders now appear to be shopping for LINK, the market additionally continues to have occasional whale promoting. Such gigantic trades serve to maintain liquidity lively within the Chainlink economic system whereas hanging a steadiness between promoting exercise and withdrawals.

Keep watch over altcoin change flows👀$LINK has seen constant outflows from exchanges over the previous month, hinting at ongoing accumulation. In whole, internet outflows surpass $120 million price of LINK within the final 30 days. pic.twitter.com/XbU4qsGuWd

— IntoTheBlock (@intotheblock) April 22, 2025

Value Pushes Previous Key Threshold

LINK’s worth not too long ago pierced by the $12.50 help degree that has outlined its sample actions earlier this yr. As per CoinMarketCap statistics, Chainlink presently trades at $14.45, 14% increased within the final week, and has a complete market worth of practically $10 billion.

Some specialists assume LINK could hit $26 by December. Such projections, nonetheless, are extremely depending on the efficiency of Bitcoin. Historically, when Bitcoin goes up, different cryptocurrencies comparable to Chainlink comply with go well with. Any weak spot within the total crypto market could decelerate the upward motion of LINK.

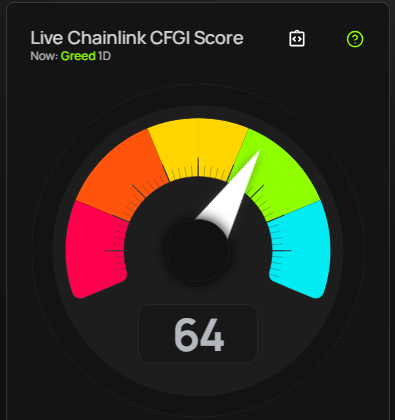

Opposite to the general optimistic perspective, sure technical indicators predict a attainable 28% decline to $10 on Might 24, 2025. Current sentiment gauges mirror ambivalence—technical evaluation signifies a “Impartial” stance whereas the Worry & Greed Index measures 64, reflecting “Greed.”

Partnerships And Integrations Develop

Beneath the hood, Chainlink is steadily increasing its partnership community. On April 21, 2025, the Digital Chamber revealed Chainlink Labs had joined its Govt Committee, putting the challenge nearer to regulatory deliberations and policy-making.

A day later, blockchain platform Monad disclosed that Chainlink instruments can be supportable on its mainnet from day one. This help covers Chainlink information feeds and cross-chain capabilities.

Chainlink can also be collaborating with the massive monetary establishments like Swift, DTCC, and Constancy. These partnerships, along with integrations on bases like Aave and Lido, reveal the challenge is emphasizing core growth over market efficiency.

Associated Studying

Push Into Actual-World Asset Tokenization

Chainlink has recently ventured into tokenized real-world belongings (RWAs). In accordance with March stories, Chainlink collaborated with Abu Dhabi World Market (ADGM) to additional tokenization initiatives.

In the meantime, statistics point out LINK had 16 inexperienced days within the final 30, which is 50% optimistic worth motion days. Value actions have been as excessive as 8.40% throughout the identical interval.

Featured picture from Unsplash, chart from TradingView