Apprehensive about Your UCITS ETFs Denominated in USD? Maybe the Funds Must be Denominated in Yen!

I’ll get questions looking for my views about how do I have a look at the problem with investing in UCITS ETFs since most of them are denominated in USD.

I believe this query comes up much more as gold costs soar as in comparison with property denominated in fiat currencies. The troubles on the USD is just not unfounded. The nation is at the moment operating a big fiscal deficit that many thinks it’s sustainable.

But, they assume that the USD is just too overvalued and needs to be cheaper. With all this, there’s a actual worry that in case you spend money on a set of funds denominated in USD, this may have an effect on your wealth constructing or retirement considerably.

As an alternative of sharing my views, like previously, I occur to have a fund which is denominated in several currencies.

The Dimensional International Core Fairness will be seen as a fund advisers use to assemble the core anchor place of their portfolio.

When you’ve got money in SGD, GBP, USD, EUR or JPY, you may spend money on the International Core Fairness denominated in several currencies.

This fund has 7,774 securities unfold all through the world. All of them maintain the identical securities, invested in the identical area, in the identical sectors, operating the identical technique. They’re simply denominated in a different way.

When you’ve got $1 million within the totally different currencies, and also you spend money on them since Aug 2017, right here is your efficiency:

$1 million EUR will develop to $2.1 million EUR. Or $2.6 million JPY.

You won’t have the ability to evaluation the efficiency clearly, so here’s a desk of the efficiency 12 months by 12 months:

Maybe as a substitute of investing in a SGD Denominated International Core Fairness, we should always have invested in a JPY Denominated International Core Fairness as a result of the efficiency is the most effective!

Some won’t like me speaking about a big cap mix fund that’s tilted in direction of much less Mega, extra worth and worthwhile. However I actually assume the International Core is far nearer to an MSCI World index than a number of the European, Pacific Basin, International Focused Worth that’s underneath Dimensional’s secure of funds.

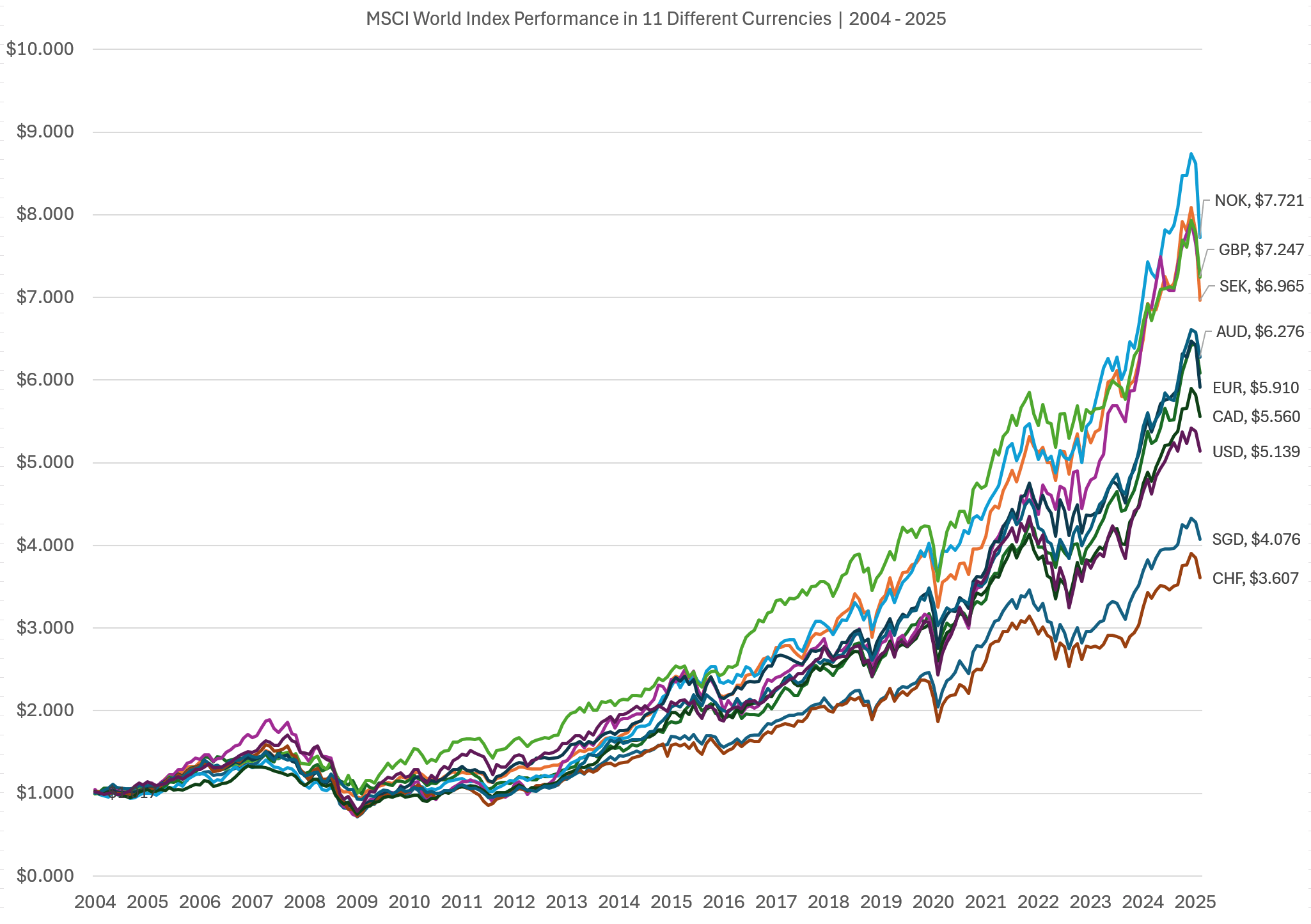

When you don’t like… I occur to have the MSCI World efficiency in 11 totally different currencies for the previous 20 years:

Whoa $1 million GBP invested within the MSCI World denominated in GBP turns into $7.2 million 21 years later.

Maybe as a substitute of denominating in JPY we should always denominate in GBP.

So what does this all imply? Identical underlying securities however so totally different in efficiency!

This time, I don’t wish to discuss a lot throughout Good Friday.

I allow you to make your individual conclusions and learnings from this. You may remark in Telegram or depart a remark beneath.

If you wish to commerce these shares I discussed, you may open an account with Interactive Brokers. Interactive Brokers is the main low-cost and environment friendly dealer I exploit and belief to speculate & commerce my holdings in Singapore, the USA, London Inventory Change and Hong Kong Inventory Change. They can help you commerce shares, ETFs, choices, futures, foreign exchange, bonds and funds worldwide from a single built-in account.

You may learn extra about my ideas about Interactive Brokers in this Interactive Brokers Deep Dive Collection, beginning with how you can create & fund your Interactive Brokers account simply.