Why 100% Money Isn’t All the time Prudent for Revenue Seekers Centered on Lengthy-Time period Sustainability

The wealth impact is an financial idea that describes how folks’s spending conduct adjustments when their perceived wealth adjustments, even when their precise revenue hasn’t modified.

When folks really feel richer, they are inclined to spend extra.

When folks really feel poorer, they are inclined to spend much less.

I used to battle to grasp why housing is such an necessary element to US client spending but when the revered traders inform me there’s a wealth impact in housing, then perhaps let me settle for that.

An increasing number of Individuals personal shares and the autumn in fairness valuations could have begin to fear Individuals sufficient to chorus from spending.

3Fourteen Analysis reveals this chart that reveals that the latest market drawdown has prompted a drawdown in family fairness that’s equal to 23% of US GDP. This ranks because the fourth worst since 1950.

Jenny Van Leeuwen Harrington, Chief Govt Officer of Gilman Hill Asset Administration point out in a latest episode of the Compound and Mates present that one in all her purchasers retire this yr with a reasonably first rate portfolio. The consumer is freaking out when she noticed her portfolio down greater than 10% and received’t dare to journey and purchase stuff.

I study that listening to somebody telling you that you’ve cash to spend, that your portfolio can deal with this sort of capital volatility could be very completely different from your very personal notion of how your portfolio behaves.

An adviser at Providend shared with me how a pair that got here in as purchasers nodded and present that they perceive what the adviser is sharing throughout classes about how we have a look at investing, and what we perceive about market turbulence. We undergo how the precise investing expertise might be like, why we construct the portfolio, the revenue technique in sure methods particularly to deal with a few of these potential issues.

In the long run, the pair of purchasers stored bugging, was shock that their portfolios can have poor efficiency durations, particularly early of their time investing with us, and we couldn’t jog their reminiscence effectively to once we clarify these ideas to them.

We at all times have a notion, an inference or a “hope” that some stuff are too difficult and when the time comes the plan will likely be okay.

This sort of market, when main fairness indexes are down 18% in a really brief span of time, is if you would revisit whether or not your plan is okay for those who determine to retire could also be at first of this yr.

Typically, I felt that some readers will really feel that it’s draggy for me to write down a lot content material about subjects like what are sustainable revenue methods, the secure withdrawal framework, varied side & software of those framework.

I like to think about the breadth of what are the probably final result, and the way effectively the sustainable revenue technique that we thought of will deal with these breadth of outcomes, earlier than we undergo the end result themselves.

Should you haven’t, what you can be fascinated with are EXACTLY the issues I been attempting to discover.

I learn this excellent monetary advisory put up from Alina Fisch, who serves girls at Contessa Capital Advisers LLC about how we will plan in a forward-looking world that appears fairly dystopian.

She shared this brief white paper that’s put out by AllianceBernstein particularly for retirees which are or have been fascinated with retiring that wants revenue.

Its known as Anti-Melancholy Recommendation for Retirees:

- Is money the most secure technique for troubled occasions?

- How does this financial disaster differ from the Nice Melancholy?

- What alternatives may exist regardless of the downturn?

Whoa… this sounds dangerous and it feels prefer it was written for you in case you are retiring at this time.

Besides that it isn’t.

It’s written for these through the 2008 Nice Monetary Disaster.

The Nice Monetary Disaster was… so bleak at a sure level that we have no idea if there will likely be a monetary markets nonetheless. And I suppose there are sufficient people who think about the very best type of motion is to have a portfolio absolutely in money once they retire.

You received’t perceive how dangerous it was till you absolutely skilled it.

This paper is mainly to indicate the folks again then that retiring in a money portfolio is a poor technique.

I discover myself telling a couple of folks in Providend this yr: Danger throughout your income-spending section is completely different from accumulation. It’s now not measured by your threat capability (which relies on a threat profiling questionnaire), and your time horizon (how lengthy of a run approach you’ve got earlier than the purpose you want the cash in your monetary goal).

Danger in income-spending section is outline as whether or not you’ll run-out of cash, and never have a sure pre-agreed stream of revenue for the interval that you simply want. It’s now not nearly whether or not you possibly can take volatility however whether or not you’ll run out of cash.

If that is the way in which we outline it, then we’ll notice all the danger profiling for traders is supposed extra for accumulators and doesn’t work so effectively for income-spenders.

Anyway, I believed if somebody does the analysis, and the illustration seemed nice, I ought to share it.

However first I need to share slightly about what I understood of what AllianceBernstein did.

The Revenue Expertise AllianceBernstein Simulated

They need to discover out by utilizing historic knowledge to mannequin the experiences of people that retired in each interval ranging from 1926 and reply 2 key questions:

- Would folks retiring in earlier durations have run out of cash?

- Which asset allocation would have been the very best technique to fund retirement?

With the info from 1926 until the time of the paper (I think 2009), they can think about if we cut up Kyith into 53 Kyith and ship these 53 Kyith down every 30-year durations between 1926 to 2009.

They need to examine two asset allocations:

- 100% money technique

- 60% shares 40% bonds

Every Kyith will take out 5% per yr and see if it final 30 years. Now I’ve to confess, based mostly on what I learn, I believe is extra like Kyith will spend an equal of $50,000 on the primary yr from a $1 million portfolio, and proceed to spend a flat $50,000 a yr after that for the remainder of 30 years.

It’s because I can’t think about how spending 5% of the prevailing portfolio worth will make both portfolio run out as a result of it’s simply mathematically not potential. E.g. if my portfolio is left with solely $20,000 and 5% is simply $1000 yearly. Little or no revenue however my portfolio just isn’t zero technically.

There are NO inflation changes.

Afterward, as a substitute of a flat 5% of the preliminary yr, they determine to see how the allocation will fare if we modify for inflation.

Now let’s see the illustrations.

No Contest – A 60/40 Portfolio Traditionally Has Been the Finest Method

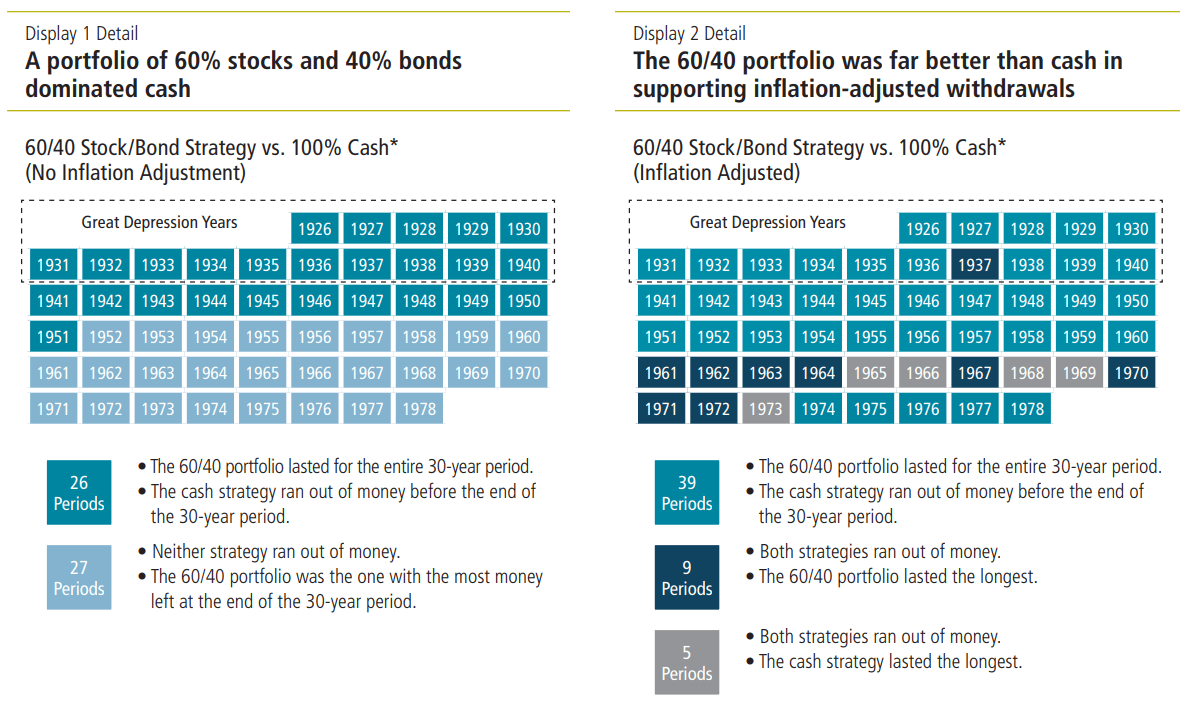

Love the matrix however I believe I want to elucidate. The matrix cut up the efficiency of the money technique and the 60/40 based mostly on whether or not

- They final your entire 30-years.

- Ran out of cash sooner or later.

All of the 53 Kyith who’re on the 60/40 technique have that flat $50k yearly revenue for the 30-years. Because of this regardless of the shit that occur from 1926 to 2009 (excessive inflation, going off the Gold normal, Nice Melancholy, oil shock, struggle and battle), all of the Kyith retirement survives.

In distinction, 51% of the Kyiths on 100% money has an revenue that final 30 years.

This illustrations present which Kyith’s revenue stream survive and which one doesn’t. The yr reveals the beginning yr {that a} particular Kyith begin spending from and try and spend for 30-years.

You’ll notice that within the final 27 durations, each methods final for 30 years and it was the primary 26 durations the place the money technique ran out of cash.

That is bloody attention-grabbing when introduced this fashion since you would have thought a 100% money technique as a substitute of 1 with equities would work higher in these difficult Nineteen Thirties durations.

After taking a look at a lot secure withdrawal charges, I’ll know why. In case your revenue stream is adjusted to inflation, and through these interval there’s very excessive deflation, your inflation-adjusted revenue went down however not within the case for those who simply spend a flat $50,000 yearly. However this doesn’t clarify all the pieces.

The principle motive is the returns of a 60/40 finally ends up greater regardless of the difficult circumstances.

If We Contemplate Inflation Adjustment in Our Revenue Simulation

If we think about adjusting the revenue by inflation, then we’ll begin seeing among the 60/40 technique to run out of cash prematurely. 64% of these 26% that ran out of cash lasted longer than a 100% money technique.

The 100% money technique ran out of cash in 100% of the simulation.

You possibly can see that are the difficult years the place each methods ran out of cash pre-maturely.

I’d at all times inform folks if you wish to solely take a look at the difficult durations, take a look at in case your technique survives the 30-year interval beginning in 1937, 1966 and 1968. In the event that they survive these three durations… your technique is fairly strong.

The methods that’s most difficult are these durations beginning in 1961 to 1973.

Why?

Persistently excessive inflation.

You’ll discover the retiree retiring on the top of the Nice Melancholy did okay in a 60/40 portfolio spending 5%.

What made the Secure Withdrawal Price nearer to 3-4% isn’t a recession or market drawdown however persistent excessive inflation that you should modify your spending upwards.

Now for those who perceive this, you’ll know a couple of issues:

- If you wish to take threat by not factoring in a drawdown like a Nice Melancholy 15-year bear, then you can begin with the next revenue.

- In case you are okay to lose buying energy throughout excessive inflation interval and cap your revenue, you can begin with the next revenue.

How About Towards 100% Fastened Revenue?

A set revenue technique has greater returns than money:

The 100% bond technique improves the end result for among the durations the place you spend an inflation adjusted revenue however not by lots.

It is usually attention-grabbing that in these durations that Kyith ran out of cash, generally the bond technique final the longest, generally its the 60/40.

It goes to indicate that when view over a spectrum of many alternative market durations, some methods won’t do as effectively.

Ending Phrases

I’ve a couple of methods to explain the secure withdrawal price framework relating to revenue planning and that is one which I seldom brings out however I would as effectively did:

We’re basically attempting to plan not based mostly on the typical final result, earlier than we begin, and get a shock 1/4, midway or 3/4 into it however to think about that we might be each very fortunate and unfortunate. If we have now a good suggestion how unfortunate we might be, then we will determine if we need to begin our planning being very conservative or we need to reside with the danger.

Most on this world would plan with common outcomes and of their minds, the unfortunate scenario occurs “solely to essentially the most unfortunate folks”. Or they are often versatile with their spending if must.

i can reside with it for those who want to be versatile however once more what is difficult to get is the notion about how a lot you should modify or the character of your revenue stream.

I can clarify until the cow comes house however for those who don’t actively hear, have a distinct notion in your thoughts, then you’ll nonetheless be shock or fearful when issues that I’ve mentioned may doubtlessly occur earlier than really occur.

However I just like the Alliance Bernstein paper. The illustration is good.

Simply don’t suppose a 100% money technique would at all times work effectively even if you’d like a flat revenue for 30-years.

If you wish to commerce these shares I discussed, you possibly can open an account with Interactive Brokers. Interactive Brokers is the main low-cost and environment friendly dealer I take advantage of and belief to speculate & commerce my holdings in Singapore, the US, London Inventory Change and Hong Kong Inventory Change. They let you commerce shares, ETFs, choices, futures, foreign exchange, bonds and funds worldwide from a single built-in account.

You possibly can learn extra about my ideas about Interactive Brokers in this Interactive Brokers Deep Dive Collection, beginning with how you can create & fund your Interactive Brokers account simply.