Corporations with Very Excessive Money Circulate Outperforms… Till it Would not for the Subsequent Ten Years.

Final week, I wrote an article about why and the way typically we have to take a step again and look deeper into the basic drivers of a scientific fund I invested in, the Avantis World Small Cap Worth UCITS ETF: What does Avantis World Small Cap Worth UCITS ETF’s 23% Money Circulate Yield Means?

My common reader ThinkNotLeft left a remark and surprise how helpful is realizing the price-to-cash circulation and he notice that two ETFs he personal match that standards.

There are lots of methods to worth corporations and your systematic energetic worth technique can use one thing else, and typically it simply got here out the businesses the fund owns can also be low-cost on a price-to-cash circulation foundation.

All in LTAM (ishares MSCI EM Latin Amer ETF) case, the area is simply low-cost!

However ThinkNotLeft’s ideas just isn’t too removed from mine as effectively. How related is that this?

I feel realizing sure nuances may be the distinction between having the conviction to purchase and simply maintain, over disaster and uncertainty, versus… paper hand over what you personal.

I ship two emails out to search out out what others take into consideration this. The primary one is to Avantis, since that is their fund and the second is to Tobias Carlisle, of Worth After Hours, Greenbackd, the ETF ZIG and Acquirer’s A number of. I didn’t get something that I don’t know from each their brief replies.

However yesterday I noticed Tobias Carlisle put out this Tweet:

This price-to-cash circulation stuff might need curiosity him sufficient to do some work haha!

Professor Kenneth French (one half of the Nobel profitable Fama-French) graciously offered everybody with knowledge on his Dartmouth web page.

We now have knowledge about money flows relationship again to 1952 which is about 73 years. If we evaluate a value-weighted portfolio of these with the bottom worth to money circulation (blue) in opposition to these with the very best worth to money circulation (orange), you possibly can see a definite hole in efficiency. If there may be anytime the low worth to money circulation made a comeback, the strains will slender.

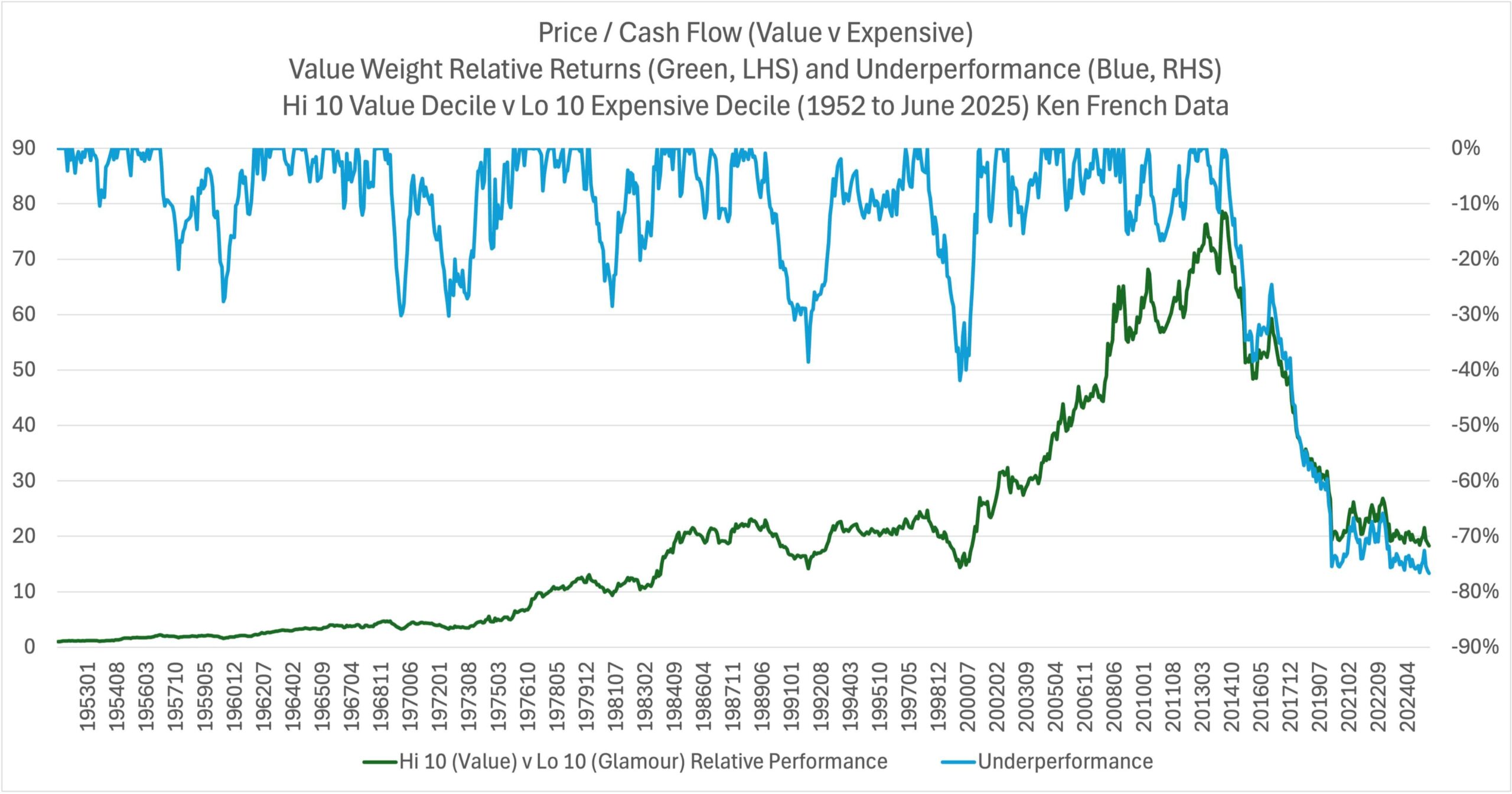

This chart exhibits the unfold between these with the very best money circulation yield minus the bottom money circulation yield (inexperienced line), overlaid with the underperformance.

The very first thing you be taught from the blue line is that there will likely be underperformance sometimes. And the underperformance may be fairly huge.

The inexperienced line exhibits a superb outperformance.

Each factor adjustments in 2014.

Then all the businesses with lowest money circulation yield all of the sudden did so effectively. A lot in order that the underperformance makes individuals suppose that one thing structurally has modified.

Tobias, who pays extra consideration to this than most, doesn’t have a single attribution:

- Free financial coverage?

- Deficits?

- Software program eats the world?

- Mania?

- The singularity?

- Flows?

Folks have tried to attribute however no clear reply. Maybe it’s a mixture of those.

If it’s so tough to determine in hindsight, you surprise if you’ll be able to determine earlier than this.

The final chart plots money flows divided by the market fairness worth. The blue are the low decile and red the excessive decile.

From this, you possibly can see that these with excessive money circulation yield frequently hit 20% yield so the 23% I speak about just isn’t one thing new.

In case it’s not clear, this isn’t simply small caps however US shares normally.

Right here is Kenneth French’s definition of money circulation:

The cashflow utilized in June of 12 months t is complete earnings earlier than extraordinary gadgets, plus fairness’s share of depreciation, plus deferred taxes (if out there) for the final fiscal 12 months finish in t-1. P (really ME) is worth instances shares excellent on the finish of December of t-1.

I attempt to use ChatGPT to interrupt it down for you all:

Elements:

- Earnings earlier than extraordinary gadgets

→ That is much like web revenue from persevering with operations. - Plus depreciation

→ A non-cash expense added again, similar to within the oblique technique of calculating working money circulation. - Plus deferred taxes (if out there)

→ These are non-cash tax bills, typically included within the reconciliation from earnings to OCF.

Interpretation:

This formulation is successfully:

Working Money Circulate ≈ Web Earnings + Depreciation + Deferred Taxes

It excludes:

- Adjustments in working capital

- Non-operating gadgets like capital expenditures or financing flows

Which makes it:

- A partial measure of working money circulation, not full-blown free money circulation

- Extra consultant of money generated from operations than simply uncooked earnings

That is nearer to EBITDA than something.

So for about 10 years, corporations with low earnings, low money flows, earlier than even capital expenditure spending are outperforming these with money flows to spend.

What Are You Holding within the Finish

On one hand a profitable technique may be one which has given traders the perfect return within the final 5 years.

Many would inform me “isn’t progress or returns what we’re on the lookout for on the finish in any case Kyith?”

That’s true.

However what occurs when what you purchase into doesn’t work?

Or extra realistically, it doesn’t work instantly? for two years?

Most will simply promote out and transfer to the subsequent shiny issues.

And it’ll take some time for them to appreciate.. how come nothing lasts ceaselessly?

The reality may be that nothing at all times works. The constant relative underperformance within the second chart ought to inform us that typically progress lose to worth and typically reverse.

That’s the nature.

It’s when individuals assume there’s something that at all times works.

I discover that we discuss an excessive amount of about this huge cap versus small cap, high quality vs worth, worth vs progress an excessive amount of.. that we are likely to neglect what we’re shopping for.

And I feel it’s comforting to know that if you happen to maintain on to a basket of shares that are likely to generate money flows which are excessive, relative to their worth, you’re holding on to one thing that’s not excessively costly.

I see so many individuals diss this diss that. Say this doesn’t work or that.

Then once I ask them why aren’t they placing extra money into the technique they selected (which isn’t the one they diss), they are saying it’s too “frothy” or “costly”.

You need to see my eyes roll as I see these messages.

The formulation that we’re taught to worth an organization is the discounted money circulation mannequin above. We low cost the money circulation that an organization can earn sooner or later at this time again with a reduction hurdle price (r).

The money circulation (CF) can develop at a sure progress price (g). Your inventory can grows at a quick tempo, or progress price may be detrimental as effectively.

It reminds us that.. basically what we’re paying for at this time is the mixture money circulation sooner or later.

How would you are feeling if you happen to personal a bunch of corporations whose money flows with out progress is definitely very low, relative to what you’re paying at this time?

Not good.

It’s disingenuous for you to not take into account the larger progress Kyith.

Sure you’re proper.

However it is usually a lot harder to estimate correct sufficient the diploma of progress of a person firm. The saving grace is that in case you are buying a portfolio of shares with excessive progress, issues may work out.

However you bought to ask your self what triggered the nice progress previously ten years and would these components nonetheless be current for the subsequent twenty years you want?

That’s so that you can discover out.

I don’t have an correct reply. I think you gained’t have as effectively. Your reply is only a good guess. And also you consider sufficient in it to stake your retirement funds into it.

The normal worth investing method is to position extra emphasis on the money circulation at this time.

The expansion is simply the icing on the cake. If it occurs then its good.

However you wish to just be sure you don’t overpay for the money circulation at this time. You wish to be sure that even when the expansion doesn’t occur, the money circulation is so ridiculous that the market will notice its worth.

For those who understood these fundamentals, reflecting upon this with a few of their systematic-active methods would permit them to construct the conviction to carry on even when it’s not working (I’m saying that this is applicable normally, not simply worth associated methods)

On the finish, apart from the proof of premiums proven by Mr. Carlisle with Professor French’s knowledge right here, your understanding of what drives returns are fairly necessary.

If you wish to commerce these shares I discussed, you possibly can open an account with Interactive Brokers. Interactive Brokers is the main low-cost and environment friendly dealer I exploit and belief to take a position & commerce my holdings in Singapore, the US, London Inventory Change and Hong Kong Inventory Change. They will let you commerce shares, ETFs, choices, futures, foreign exchange, bonds and funds worldwide from a single built-in account.

You possibly can learn extra about my ideas about Interactive Brokers in this Interactive Brokers Deep Dive Sequence, beginning with the right way to create & fund your Interactive Brokers account simply.