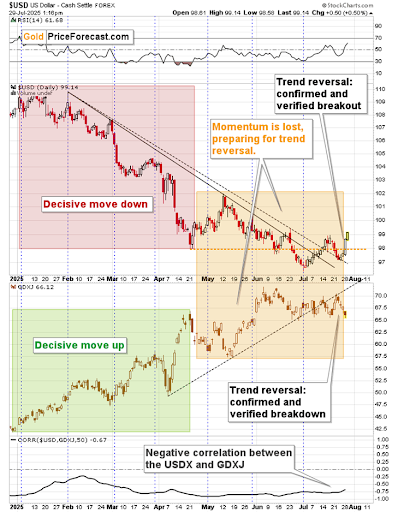

Month-to-month Highs in USD, Month-to-month Lows in GDXJ…

July 29, 2025 (Investorideas.com Newswire) As per the title —

we’re seeing extra and

extra confirmations

that the pattern has modified.

USD and GDXJ Return to April Extremes

The

foreign exchange market

clearly helps it. The USD Index simply moved above 99, and it is the

first time this month that it is taking place.

Conversely, even earlier than at the moment’s session — throughout yesterday’s

buying and selling — the GDXJ moved to new month-to-month lows in intraday

phrases, after which closed the day on the contemporary new month-to-month low in tune

with

my earlier feedback.

That was additionally a day by day shut clearly under the flag sample. Not like

the mid-July breakdown, this one is evident as GDXJ closed properly under

the decrease border of the sample, not simply barely so.

It was additionally a detailed under the April intraday excessive. That is bearish,

however it is going to be much more bearish after we see a day by day shut under the

highest shut of April. To simplify, a detailed under $65 within the GDXJ

will function the ultimate warning — in case you missed the entry to

quick this sector beforehand, this is likely to be your final probability earlier than

the decline accelerates.

In truth, in case you look yet another time on the earlier USD Index chart,

you may see one thing particular concerning the worth strikes that ended on the

present worth ranges.

Specifically, the April slide within the USDX and the April rally within the GDXJ

each ended kind of the place each devices are buying and selling proper

now. The strikes in each instructions will be comparable, with the strikes to

the draw back having an opportunity of being much more unstable (concern is a

stronger emotion than greed).

Which means as soon as USDX’s rally accelerates and GDXJ lastly

breaks under the April excessive, the transfer decrease might be fairly sharp.

In truth, it would not shock me to see a fairly fast slide to the

$50 space — to the April backside.

I understand that this may not appear practical on condition that GDXJ did

barely something within the latest weeks, however I guarantee you that that is

greater than doable. In truth, intervals of low volatility are usually

adopted by intervals of excessive volatility and vice versa. It seems like

a pointy transfer goes to happen quickly. And given the confirmed

breakout within the USDX and confirmed breakdown within the GDXJ, it is usually

fairly clear wherein route the markets will transfer.

Proper now, we’re on the verge of these strikes —

additionally in gold. We will

see one thing comparable in different markets, too.

Platinum

already moved again under its June excessive, nevertheless it’s taking a break

earlier than declining extra. Once more — it is on a verge of the large transfer

decrease.

SILJ Quantity Spikes Echo 2021 High

Silver worth broke

under its higher rising help line, nevertheless it hasn’t damaged under the

decrease one but. As soon as this stage and June excessive are damaged, the door to

a lot decrease silver costs shall be broad open.

And as you noticed in April — silver can decline very quick.

To make clear, silver stays my favourite

long-term funding, nonetheless, it would not change the truth that I believe that it is going

to say no when the USD Index rallies, particularly if the inventory

market declines as properly.

The ultimate chart for at the moment is the one that includes SILJ — the

silver junior mining shares ETF.

The factor that I need to emphasize right here is the rise in quantity

that we noticed very lately. That is the second quantity spike in a

comparatively quick interval. We noticed one thing comparable previously, and

it occurred proper on the 2021 prime.

SILJ did NOT break into new highs, it merely encountered very sturdy

resistance. The sudden enhance in quantity represents the sudden

enhance in curiosity on this ETF — that is what tends to

accompany tops, and the analogy to 2021 proves it.

Thanks for studying my at the moment’s evaluation – I recognize that you simply

took the time to dig deeper and that you simply learn your complete piece. If

you’d prefer to get extra (and further particulars not obtainable to 99%

buyers), I invite you to remain up to date with our free analyses -

join our free gold publication now.

Thanks.

Przemyslaw Ok. Radomski, CFA

Extra Information:

Disclaimer/Disclosure: Investorideas.com is a digital writer of third celebration sourced information, articles and fairness analysis in addition to creates unique content material, together with video, interviews and articles. Authentic content material created by investorideas is protected by copyright legal guidelines apart from syndication rights. Our web site doesn’t make suggestions for purchases or sale of shares, providers or merchandise. Nothing on our websites must be construed as a suggestion or solicitation to purchase or promote merchandise or securities. All investing includes danger and doable losses. This web site is at the moment compensated for information publication and distribution, social media and advertising, content material creation and extra. Disclosure is posted for every compensated information launch, content material revealed /created if required however in any other case the information was not compensated for and was revealed for the only curiosity of our readers and followers. Contact administration and IR of every firm instantly concerning particular questions.

Extra disclaimer information: https://www.investorideas.com/About/Disclaimer.asp Be taught extra about publishing your information launch and our different information providers on the Investorideas.com newswire https://www.investorideas.com/Information-Add/

International buyers should adhere to rules of every nation. Please learn Investorideas.com privateness coverage: https://www.investorideas.com/About/Private_Policy.asp