Reflecting on Serial Financial institution Belongings Acquirer First Residents BancShares ($FCNCA)

For some cause, my feed on Twitter ended up with some of us who discuss particularly about banking. That’s perhaps as a result of I used to be looking up if there are good takes on $KRE or the SPDR® S&P® Regional Banking ETF.

And one among them is this text author Victaurs, who writes a letter very give attention to banking.

I might catch Tweets like this…

And these…

I believe there is likely to be some numbers that isn’t simply comprehend if you happen to don’t see the numbers.

So I requested ChatGPT to attempt to simulate for me:

I created a financial institution that has a tangible ebook worth (TBV) of $100, and trades at $130. So the value to tangible ebook worth is 1.3 occasions (P/TBVPS). If the ROTCE is constant and the valuation (P/TBVPS) doesn’t change, what is going to occur in ten years if you happen to improve the ebook worth by 7% and you’re taking the remainder and purchase again the shares?

The Value will go up from $130 to $261 otherwise you principally double your cash in ten years.

That doesn’t all the time really feel like quick rising…

However I believe I might not in a position to relaxation my thoughts except I type of undergo this with a financial institution instance.

So I made a decision to evaluation and mirror on a financial institution to see if I can see it in a lightweight that Victaurs sees. It’s a financial institution that Mr. John Huber wrote in a information letter virtually 1.5 years in the past First Residents BancShares (FCNCA). The inventory was buying and selling at 8 occasions PE again then however its nearer to 12 occasions PE immediately.

Some would think about this as a deeper dive however perhaps some would think about this as a superficial take.

What’s First Residents BancShares? (Ticker: FCNCA)

FCNCA is a financial institution with a 125-year historical past within the Raleigh, NC space in the USA. Their roots will put them as a regional financial institution. However with the latest acquisitions, it places them within the vary of the Fifteenth-Twentieth largest banks by belongings and market cap.

Regional banks get a really dangerous status, if you happen to hear what’s within the information. Banks in itself has a nasty rep (besides in case you are DBS, UOB, OCBC).

FCNCA is fairly low profile on this area and you may’t discover a lot besides from people who find themselves type of severe about banks.

Should you learn a First Residents Bancshares annual report in Feb 2014, when it trades at $224, I ponder if you happen to marvel that in 2025 it can appear like this:

Present share worth sits at $2096.

That’s an annualized return of 21.6% a 12 months. Or unannualized 835% after 11 years.

The chart under tells us FCNCA’s web revenue and earnings per share (EPS) development 12 months on 12 months:

I don’t like this chart as a result of it’s vastly distorted by what occur in 2022/2023 when FCNCA acquired Silicon Valley Financial institution (SVB). Their web revenue jumped as a consequence of accounting for it, and naturally the autumn off.

However apart from 2014, what you’ll discover is that 9 out of the 11 years, FCNCA present constructive revenue development.

I wish to put EPS Progress subsequent to it as a result of your EPS development will be increased by the results of your share buyback. FCNCA began share repurchase in 2018 and you may see the gradual deviation in EPS development.

Share buy is a type of shareholder return and we will roughly approximate it as a buyback yield:

A few of you would favor dividend payout and there are good causes for that. I might undergo the primary cause later.

However I simply need you to consider it this fashion:

- If we all know that the market values an organization primarily based on its stream of revenue

- And its earnings development surprises

- And in case you have a administration that’s dedicated to purchasing again their shares, which suggests return to shareholders

How doubtless is the share worth going to stay down… all else being equal?

You’ll be able to ask what if the corporate decides to fxxk itself up and wouldn’t the inventory be nugatory? The identical will be mentioned about an organization that returns with dividends. In the event that they fxxk themselves up, your dividends will likely be lowered sooner or later, which suggests the share is value much less.

For that $1 that an organization earns, in the event that they return to you, it’s as much as you to spend or redeploy it.

When the corporate buys again its shares, they assume they’re value it relative to different stuff. However can we agree?

If we put that $1 and purchase FCNCA, we’re paying near ebook worth for extra FCNCA, however how a lot would that $1 earn sooner or later?

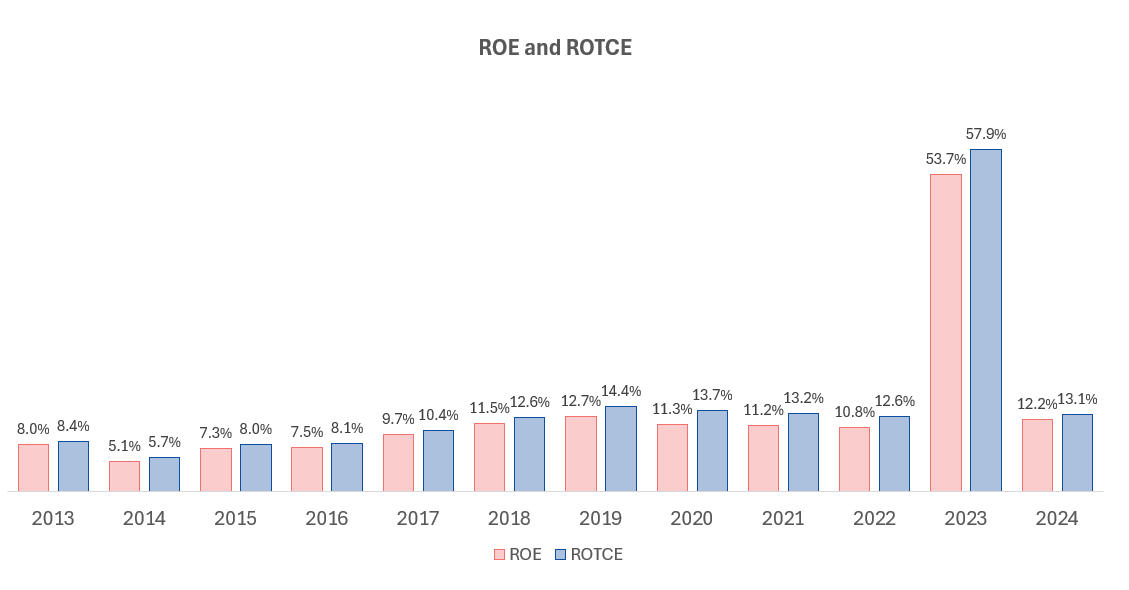

Why ROTCE and ROE Tells Us A Lot of Lengthy Time period Returns

Return on Fairness (ROE) and Return on Tangible Fairness (ROTCE) tells us the return of that $1.

Victuars focus a lot on ROTCE primarily as a result of it tells us which financial institution earns extra relative to the ebook worth. Tangible fairness is taking whole fairness minus goodwill, intangibles and most popular shares as a result of banks regularly have non-performing loans (as a system) and so they must promote belongings to shore up the stability sheet. You can’t promote goodwill and intangibles.

It is smart to evaluation ROE and ROTCE collectively.

Right here is FCNCA’s numbers:

FCNCA made just a few acquisitions over the previous 11 years however little or no goodwill and intangibles had been added. The ROE and ROTCE is added.

FCNCA ROTCE was across the 8% area. Then with acquisition and scale, it grew to become 10%. Then 12-14% area.

Now because of this if FCNCA had been to commerce at 1 occasions tangible ebook worth, your $1 earned from FCNCA that they use to purchase again their inventory is put into:

- A enterprise that’s rising in scale.

- Scaling up in effectivity.

- Incomes a constant 12-14% a 12 months.

- Which have this sort of ROTCE for some time already.

Now the place are you going to purchase a enterprise like that?

I believe this purchase again at 12-14% ROE/ROTCE and the corporate in a position to keep this ROTCE for very long time is the magic and differentiation to paying out a dividend.

It’s like there’s a identified potential golden goose however you assume there may be higher issues on the market than this golden goose. So that you relatively spend your time to search out one other.

I believe what Victaurs is harping on is that.. you can not discover so many things (there are lots of small banks within the US) that’s

- so homogeneous,

- that often trades round ebook worth

- every has completely different effectivity

- has a protracted profile of ROE/ROTCE to evaluation

Identical to REITs, if you happen to construct up your competency, you may be capable to thrive right here.

We are able to’t simply say have a look at ROE or ROTCE if we can not even purchase at ebook worth.

Many may need heard you can purchase banks at near 1 occasions ebook worth. Sometimes banks can commerce increased than ebook worth. When disaster or recession comes alongside, they must promote their belongings at discounted costs and that is the place their ebook worth will get lower and the corporate bottoms out under ebook worth.

So the 1 occasions ebook worth is the pivot level between whether or not issues have gotten frothy.

However Victaurs doubtless would have extra nuance to this.

Right here is FCNCA’s Value to Tangible Ebook Worth:

I’m calculating most of this with a worth at finish Feb of the 12 months after. So whether it is 2013, the value is taken in Feb 2024, on the conclusion of the monetary 12 months. You’ll be able to view it as “I sat on my sofa studying the annual report of 2013, on Feb 2014, and have a look at the inventory worth immediately”.

FCNCA usually trades above ebook worth, however given this, and the ROTCE, how do we all know the “yield” we’re paying for?

We are able to calculate the Efficient Yield which is ROTCE divide by Value-to-Tangible-Ebook worth:

An efficient yield of 9.8% means that you’re incomes 9.8% though the financial institution is incomes 13%.

And you bought to consider whether or not 9.8% is cheap sufficient. In a approach, if we’re serious about investing in FCNCA, it feels… there has by no means been a less expensive time, apart from 2022 then immediately.

What’s the Value Earnings Ratio?

Since we occur to be on the subject of valuation, right here is the historic PE:

Once more, the value relies on the Finish Feb for the next 12 months.

Goal talking, the PE primarily based on historic is nearer to 12 occasions at present. That quantity adjustments relying on the excellent variety of shares, and the way you anticipate the earnings.

Mr. Huber mentioned that the common PE is round 13 occasions within the final 20 years. If we throw out Covid, the common is nearer to fifteen occasions. FCNCA isn’t precisely low cost (not when he first wrote in Jan 2024, when the PE is 8 occasions).

However you bought to think about what you might be shopping for for the value.

Tangible Ebook Worth Per Share Progress Tells Us If Worth is Accumulating or Destroyed.

For a enterprise that’s easier, that usually trades to the proper or left of ebook worth, its ebook worth will inform us quite a bit. Should you pay out all you earn as dividends, then your ebook worth doesn’t develop. What you keep in your stability sheet will find yourself rising the ebook worth. And you need to use that to make acquisitions. However extra time, a worth destroying acquisition will ultimately impacted ebook worth.

But when a agency can construct up ebook worth over time:

- It’s incomes and conserving cash.

- It could be making good use of that cash.

If we pair that with a mirrored image of ROTCE or ROE, it might probably tell us if it makes extra sense to maintain cash with this financial institution or to deploy ourselves.

However ebook worth gained’t inform dilution as the corporate can concern lots of shares to others. Identical to REITs, the place Dividend per unit tells greater than dividend revenue, reflecting on tangible ebook worth per share tells us extra:

The chart above exhibits the tangible ebook worth per share development (pardon the title misnaming) through the years. Should you personal one share of FCNCA in 2013, you don’t see a lot dividends.

However you see the ebook worth of your share develop by this a lot 12 months after 12 months. The above is 19.4% p.a. over 11 years.

Mr. Huber says FCNCA have compounded their ebook worth at 13% p.a. over the previous 30 years.

So if you happen to pay for a PE of 12 occasions, or 8-9% Efficient Yield, and so they by no means paid it out to you, however compound your ebook worth per share at 13-20% per 12 months, would you be completely satisfied about it?

I believe many could be even completely satisfied that the hurdle is simply 10%.

How Impactful are Market Curiosity Charges to FCNCA’s Enterprise?

A few of us is likely to be questioning… How huge is the impression of brief time period or long run charges?

I put FCNCA’s web curiosity margins in opposition to the US 1-year and 5-year yield as a way to have an thought of the impression. The web curiosity margins fluctuate however what impacts issues is greater than curiosity alone.

It’s also attention-grabbing that with the quantity of acquisitions, this itself stay as constant.

Nevertheless it must be mentioned that:

- When rate of interest rises, the banks earn more cash.

- When rate of interest falls, the banks earn much less cash.

Which is a bizarre factor why everyone seems to be harping for the Fed to chop charges as many occasions as a result of it can profit the regional banks. I assume it’s the quantity of unrealized losses of the belongings held on their stability sheet. However I ponder if that could be a bit myopic.

If the Fed lowers the rates of interest on the brief finish:

- However lengthy finish stays however no recession: NIM appears higher and demand for loans will increase. Mortgage development is bigger.

- However lengthy finish comes down as a consequence of demand: NIM stays the identical.

- Recession and: Demand for loans fall.

I believe state of affairs 3 is feasible.

However is there a risk the place NIM goes down and demand improves? I’m not certain about that. However hypothetically if FCNCA’s mortgage ebook is $137B, their NIM can go down from 3.5% to three.1%, a lack of 0.4%. That roughly translate to about 548 million in curiosity revenue. In the event that they develop their mortgage ebook by 7%, the rise in curiosity in come is 297 million. Their mortgage ebook might want to develop by 14% to make up for that loss in curiosity revenue. Within the early years of 2014, they’ve a mortgage development goal of 6.5% p.a. if you happen to have a look at the figures, each charges are doable given what they’ll do.

It’s also prudent to imagine that EPS will be decrease.

Maybe Progress Loans is Extra Vital Than Curiosity Charges.

What will likely be extra necessary is rising the loans. Since loans are fairly homogeneous, you both lend extra or consolidate one other financial institution to develop it, with out giving up an excessive amount of of your personal fairness.

I’ve not dive into every of the mortgage development however I hazard to guess FCNCA grew lots of loans through acquisitions:

And that is the place I discover what the native SG banks are attempting to do however the banks they acquired has extra regulatory points.

It’s not that it’s straightforward within the US. It’s tough which is why there’s a wave of deregulation.

In a single week we’ve got this:

- America First CU To Purchase $1.35B Meadows Financial institution In Business’s Second-Greatest Financial institution Purchase | 26 Jul

- East Texas Monetary Company, Kilgore, pronounces plans to accumulate Texas Nationwide Bancorporation, Inc. | 24 Jul

- Pinnacle Monetary Companions, Synovus announce $8.6bn merger | 25 Jul

- Michigan, Georgia banks suggest to purchase in-state friends | 24 Jul

I may nonetheless go on however that may take up an excessive amount of time. I attempt to simulate what is going to occur if the web curiosity margin stays at 3.2%, the financial institution have a ROTCE of 13% and a mortgage development of 6.5% p.a.:

Web Earnings grows at ~10.4% CAGR, not simply 6.5%, as a result of:

- Fairness compounds through retained earnings

- The return on rising fairness (13%) drives exponential web revenue development

Mortgage Ebook and Web Curiosity Earnings (NII) develop at 6.5%.

Web Earnings grows sooner than mortgage ebook, as a consequence of fairness compounding.

Should you embrace share buyback and browse the EPS, it is likely to be extra absurd.

With Scale and Prudence, FCNCA will be Extra Environment friendly.

The effectivity ratio takes the non-interest expense, divide by the sum of non-interest revenue and web curiosity revenue.

It principally exhibits how a lot you spend on issues much less associated to lending. In a enterprise that could be very give attention to lending, it permits you to see your value management.

But in addition in case you have enhance your economies of scale.

FCNCA exhibits that they’ve built-in the acquisitions nicely, and have lower down on the non-interest bills in order that their effectivity enhance over time.

ChatGPT offers the next vary:

| Effectivity Ratio | Interpretation |

|---|---|

| ~40–50% | Very environment friendly (usually massive or tech-savvy banks) |

| ~50–60% | Common effectivity |

| >60% | Inefficient, might have value management or income enchancment |

This sort of exhibits us the struggles of smaller banks versus the bigger banks.

Nevertheless it additionally exhibits us the place they’ll enhance and develop their final bottomline. They will nonetheless get to lower than 0.50 effectivity.

Simply How Leveraged is FCNCA?

With a lot acquisitions made, you be questioning how they do it and whether or not they’re deliver on lots of leverage. A “debt” which is deposits are what is going to match present loans. What they’ve to accumulate is what they retained.

FCNCA might be of their most leverage place… which is 6.7%.

For probably the most half they’ve sizable money holdings, which is fairly good if you happen to can purchase one thing that would ultimately enhance so that you just get 13% ROTCE.

Their Sequence of Acquisition and Mergers

FCNCA is just not a small entity anymore and a part of the rationale they grew a lot was by consolidation.

Here’s a glimpse of that over these years:

- 2014: Merger with First Monetary

- 2014: Merger with First Residents Bancorporation

- 2015: Buy from FDIC sure belongings of Capitol Metropolis Financial institution & Belief (CCBT)

- 2016: Buy from FDIC sure belongings of First CornerStone Financial institution of King of Prussia

- 2016: Buy from FDIC sure belongings of North Milwaukee State Financial institution of Milwaukee

- 2016: Merger with Cordia Bancorp

- 2017: Buy from FDIC sure belongings of Warranty Financial institution of Milwaukee

- 2017: Buy from FDIC sure belongings of Harvest Neighborhood Financial institution of Pennsville

- 2017: Merger with HomeBancorp

- 2018: Merger with Palmetto Heritage Bancshares

- 2018: Merger with Biscayne Bancshares

- 2018: Merger with Capital Commerce Bancorp

- 2019: Merger with First South Bancorp

- 2019: Merger with Entegra Monetary Corp

- 2020: Merger with Neighborhood Monetary Holding

- 2020: Merger with CIT Group

- 2023: Merger with Silicon Valley Bridge Financial institution

There are lots of small $10 million to $30 million mergers however none as huge because the CIT Group and Silicon Valley Financial institution measurement.

A whole lot of these are belongings of failed banks from the FDIC for pennies on a greenback.

The Silicon Valley Financial institution Acquisition (SVB) was such a Good Deal.

SVB, as soon as a distinguished lender to tech startups and enterprise capital companies, collapsed in March 2023 as a consequence of a basic financial institution run. The financial institution had parked a big portion of its deposits in long-term authorities bonds and mortgage-backed securities throughout a low-interest-rate atmosphere. As rates of interest rose quickly in 2022–2023, the market worth of these bonds plummeted. When SVB introduced it wanted to lift capital to shore up its stability sheet, it triggered panic amongst its tech-heavy depositor base, who quickly withdrew funds. Inside 48 hours, the financial institution was taken over by regulators, marking the second-largest financial institution failure in U.S. historical past.

The collapse of SVB despatched shockwaves by the regional banking sector, sparking considerations over liquidity, uninsured deposits, and poor rate of interest danger administration at different banks. The SPDR S&P Regional Banking ETF (KRE), which tracks a diversified group of regional banks, plummeted within the aftermath. From early March to mid-Might 2023, KRE misplaced over 30% of its worth, reflecting widespread investor concern of contagion and regulatory tightening. Different regional banks like Signature Financial institution and First Republic additionally failed or required rescue, intensifying the sector’s stress.

In March 2023, SVB was valued at $16 billion.

The next diagram exhibits SVB’s stability sheet earlier than the collapse and what FCNCA acquired:

They acquired $72 billon in SVB loans at a $16.5 billion low cost paying solely $55.5 billion which is 23% much less. These are very high-quality, short-duration loans, largely maturing in lower than a 1 12 months. That is principally making an attempt to sweeten the deal so this deal can reduce impression to the depositors and monetary markets. The FDIC agreed to soak up a big portion of future losses on the mortgage portfolio for 5-8 years. This protected FCNCA from draw back danger.

As pat of the deal, the FDIC additionally moved money equivalents of deposits value as much as $56B (as a result of loans occur as a consequence of deposits) as liabilities a part of the deal.

FCNCA paid zero money upfront. Okay, technically they paid $500 million for that mortgage ebook.

It is because the deal is structured as a “buy and assumption” transaction. It is a type of deal the FDIC likes to construction for failed banks rapidly to attenuate disruption to depositors and monetary markets.

Why this deal is nice is as a result of:

- Should you perceive some components above if FCNCA has a 12-14% ROTCE, 3.2% NIM, what this deal principally does is double their mortgage ebook.

- They will enhance their effectivity ratio.

- The FDIC insurance coverage protects them from draw back for this SVB portion.

- They get necessary tech shoppers and relationships.

- They get charge revenue.

- And present shareholders didn’t get diluted!

SVB has been a financial institution that for many years earn stable ROE and had a really beneficial relationship with Silicon Valley startups and expertise firms. Mr. Huber spoke to some SVB prospects and likewise those who left in a panic final March.

The frequent remark is that the large banks don’t supply the identical high quality of service that SVB offers. The massive banks don’t know the tech house nicely.

It type of exhibits how various things are within the lending house, and why regional banks have distinctive benefits that may not be so simply changed.

Conclusion

John Huber’s authentic thesis at US$1,500 for FCNCA was 3 engines:

- Modest earnings development.

- Sizable share buybacks.

- Buying and selling at a extra cheap PE of 12-14 occasions versus 7-8 occasions when he first wrote it.

I believe 3 is off the desk and in case you are , it can depend upon the way you perceive #1 and #2.

What Mr. Huber likes is that:

- If rates of interest stays excessive, the corporate has mountains of money.

- The administration by no means thinks about maximizing the following 12 months’s earnings however undertake a long run mindset.

- And to allow them to put the money to work by acquisition.

FCNCA is managed by the Holding Household and that is now the third era of administration. They personal 13% of FCNCA, which is a stake value greater than $3 billion).

I believe this has been a superb train of digesting and reflecting upon what Victaurs appears to be saying. It additionally helps me acquire a greater framing of banks usually. By sitting alone and going by issues, it will assist my sample recognition in banks higher. This text may also be the article I come again to if I forgot about this stuff through the years.

I hope you acquire some worth out of this as a lot as I’ve.

Disclaimer: The writer holds FCNCA in Crystalys. It’s not a considerable sum of cash by all measurement.

If you wish to commerce these shares I discussed, you’ll be able to open an account with Interactive Brokers. Interactive Brokers is the main low-cost and environment friendly dealer I take advantage of and belief to speculate & commerce my holdings in Singapore, the USA, London Inventory Alternate and Hong Kong Inventory Alternate. They permit you to commerce shares, ETFs, choices, futures, foreign exchange, bonds and funds worldwide from a single built-in account.

You’ll be able to learn extra about my ideas about Interactive Brokers in this Interactive Brokers Deep Dive Sequence, beginning with how you can create & fund your Interactive Brokers account simply.