You Will not Dare to Put money into This Fund With 70% of Your Web Wealth

I first discover Saga Companions in the course of the frantic funding interval popping out of Covid-19 (man that was so far-off now…)

Sagar Companions is a Registered Funding Adviser (RIA) that manages an extremely concentrated fund that began in 2016/17. Joe Frankenfield created the fund, managed underneath an SMA construction. The fund fees 1.5% p.a. on the belongings underneath administration and no efficiency price.

Joe philosophy is to take a position long-only, in corporations with sturdy aggressive benefit, top quality administration with a proprietor mentality and are attractively priced.

The time horizon that it is best to have needs to be fairly lengthy. And you’ll quickly see why.

Joe will replace on efficiency ceaselessly and we will discover their previous letters on their web site. You and I can find out about a deeper, maybe totally different views concerning the corporations they invested in.

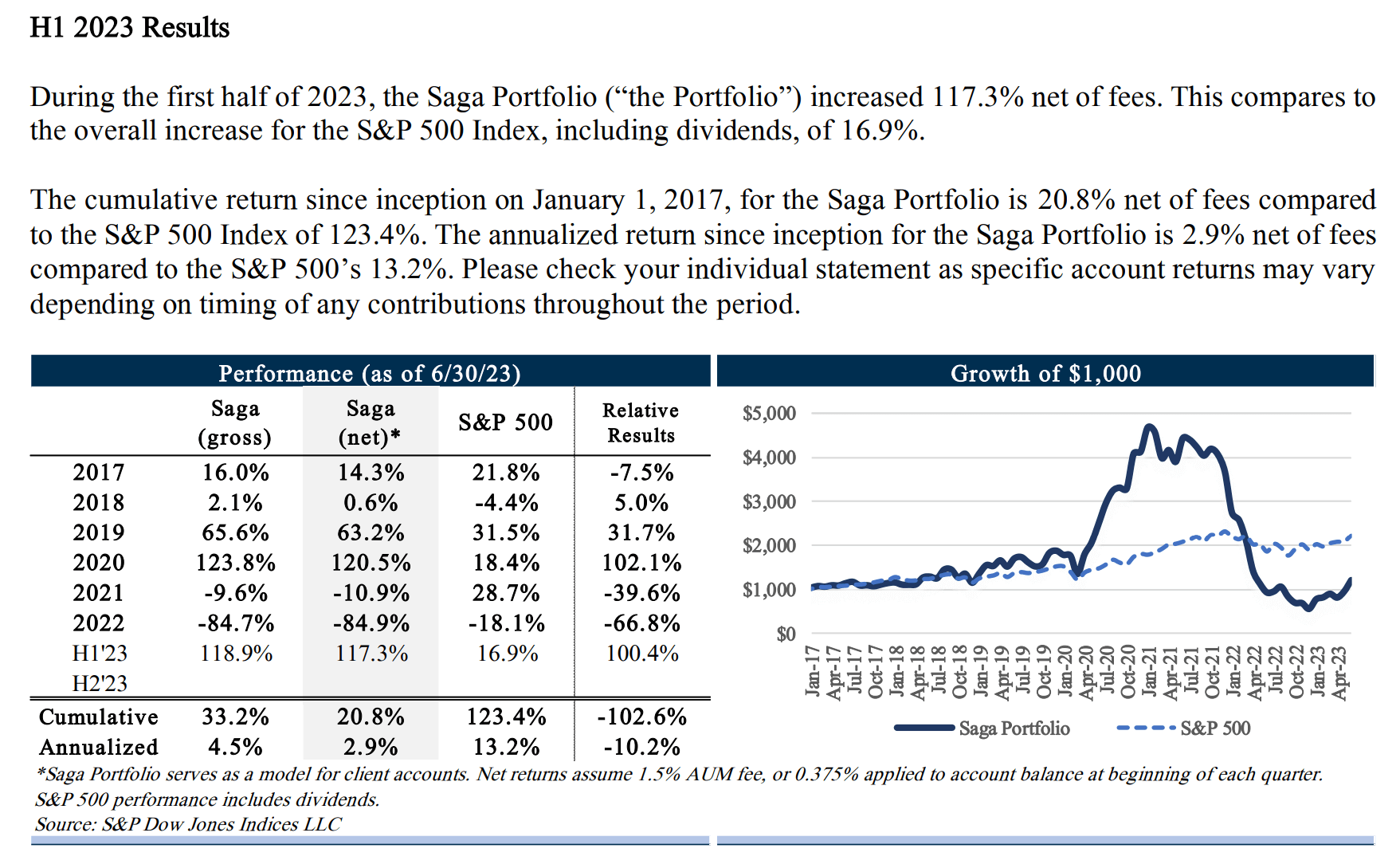

That is their consequence after 1 yr:

The fund spend money on the smaller, mid-sized corporations so the appropriate benchmark may be the Russell 2000 index, which is a mix of the 2000 smallest corporations within the US. However it is usually proper to evaluate your efficiency if you’re taking up extra threat, and whether or not you may beat the S&P 500.

One yr later, or after investing for 2 years, you can begin seeing the fund vastly outperforming the Russell 2000 but additionally the S&P 500.

Throughout this era, Saga revealed they’ve invested in:

- The Commerce Desk (TTD) | Commentary letter

- Platform Specialty Merchandise (PAH)

- Linamar Company (LIMAF)

- Underneath Armor (UA)

- LGI Houses (LGIH)

- Fb (FB)

- Trupanion (TRUP) | Commentary letter

Very concentrated and in small caps. They usually had been in a few of these names that benefited drastically from Covid lengthy earlier than Covid.

Their outcomes one yr later occurs to be proper on the depths of Covid. Since they’re concentrated, small caps and lengthy solely, the beneficial properties they’d evaporated. The benchmark comparability modified from Russell 2000 to S&P 600. Regardless of shedding 28% they nonetheless did higher than the S&P 600 however not higher than the S&P 500 for the yr.

One yr later, the fund achieved its finest efficiency thus far, doing 120% whereas the S&P 500 did 18%. The annualized return over 4 years is 41% p.a.

That got here crashing down one yr later as a result of a variety of the small caps that benefited from the Covid pulled ahead couldn’t maintain the costs. The fund dropped 9% for the yr, however in 1 quarter dropped 42%!

Saga’s lower than 10 concentrated portfolio accommodates the names resembling Carvana and Redfin, which had been closely offered down.

They might finish that yr down 84%.

All through this era, they didn’t make huge adjustments to their portfolio. They nonetheless held Carvana, the corporate that individuals thought its destined to not survive as a result of they suppose the thesis continues to be there. They offered GoodRX, which they admitted was a mistake. By now, they’ve underneath carry out the S&P 500 (2.9% p.a. vs 13.2% p.a.).

They did 200% in 2023 and doubtless one other 40% within the first half of 2024. Whereas they’re nonetheless underperforming the S&P 500, they managed to make up floor.

That is the newest replace in the long run second half 2024:

They did 115% in 2024. Over the previous eight years, they managed to compound the early consumer’s wealth, those that nonetheless caught with them at 17% p.a. after charges.

You may see the month by month efficiency, taken from their factsheets over right here. This lets you see the volatility of the fund.

That is their present portfolio. Simply six corporations. Apart from Clever many held lengthy.

Reflections

I skilled a special feeling trying on the efficiency of the fund after I subscribe to get the updates of the fund since 2020. I may have unsubscribed as a result of I don’t do particular person inventory investing a lot anymore however I discover a variety of worth listening to Joe’s ideas about investing and in addition his firm perspective.

I’ve a really… unvested however distinctive emotion once I learn the poor efficiency of 2021 and 2022.

I ponder how the brand new buyers are feeling after they see their capital go down like 90%.

I ponder how the early buyers within the fund, who loved nice returns felt after they see

- all their unrealized beneficial properties worn out,

- after which stepping into losses

i’m fairly positive the supervisor can be fielding calls why you’d stick to corporations like Carvana, GoodRX, Redfin and Roku.

Additionally it is attention-grabbing should you assessment the fund immediately.

Our advisers reviewed the present portfolios of their shoppers and prospects and they’d see many funds. One query we received the advisers and associates to ask is: Did the fund beat their benchmark index?

Effectively we sit right here and take a look at it immediately and it DID beat any of the benchmark.

You ask anybody if a fund did 21% p.a. or 420% in 8.5 years, internet of charges, and they’d say that is nice efficiency.

However are there belongings you gained’t be capable to inform simply by reviewing JUST historic efficiency?

Many would take an opportunity with these managers, throwing warning to the wind, dismissing if they will sit with such a fund.

As a result of if this fund works out, they will attain their monetary aim.

Totally different teams of Saga Companions buyers would expertise totally different feelings.

If you’d like such efficiency:

- You can’t simply closet index and attempt to beat the index yearly. You bought to be keen to underperform the index.

- You would wish to have an funding philosophy to information you about what sort of corporations you’d make investments and the way you’d handle them.

- You need to focus.

- You want to have the ability to discover methods to dig into your self and see should you can dig out sufficient conviction concerning the few shares you spend money on, whereas managing rationality that doubtlessly you may be flawed.

I intentionally laid out the returns yr by yr, so as to soak them in however I feel studying the previous updates may promote what I wish to promote you.

The emotional a part of investing may be very underrated.

Think about should you sunk in 70% of your internet wealth as a 55-year-old, trusting this supervisor as a result of you understand him properly sufficient, and then you definately see this string of month-to-month return:

- -4.6%

- 4.2%

- -3.1%

- -9.6%

- -25.2%

- -6%

- -18.1%

- -33.0%

- -20.9%

- -17.6%

- 3.0%

Are you able to keep within the sport? (The fund has no lock-up)

In case you are interested by investing immediately, would you’ve got the mindset that this was “particular circumstances” and gained’t occur to you?

I feel generally the rationale buyers get themselves into sure conditions just isn’t due to the fund supervisor or the exterior folks however what sort of conversations you’ve got with your self.

It could even be attention-grabbing to marvel if you’re extra diversified, would such poor sequence of efficiency don’t hit you? That have to be what many keep in mind proper now.

For those who diversify adequately, your investments gained’t present this sort of detrimental surprises that you simply gained’t expect.

You may suppose for your self how true that can be.

Let me know should you would sink 70-80% of your internet wealth as a 55-year previous into this fund.

If you wish to commerce these shares I discussed, you possibly can open an account with Interactive Brokers. Interactive Brokers is the main low-cost and environment friendly dealer I exploit and belief to take a position & commerce my holdings in Singapore, america, London Inventory Alternate and Hong Kong Inventory Alternate. They assist you to commerce shares, ETFs, choices, futures, foreign exchange, bonds and funds worldwide from a single built-in account.

You may learn extra about my ideas about Interactive Brokers in this Interactive Brokers Deep Dive Sequence, beginning with learn how to create & fund your Interactive Brokers account simply.

![What Is Actual Property Syndication? [101 Guide]](https://fccrypto.site/wp-content/uploads/2025/07/Understanding-Real-Estate-Syndications-FB-660x470.png)