One thing is Brewing in Singapore Small Caps….

This Boustead that nobody desires is up 55%. There are information that they is likely to be considering of REITing the properties.

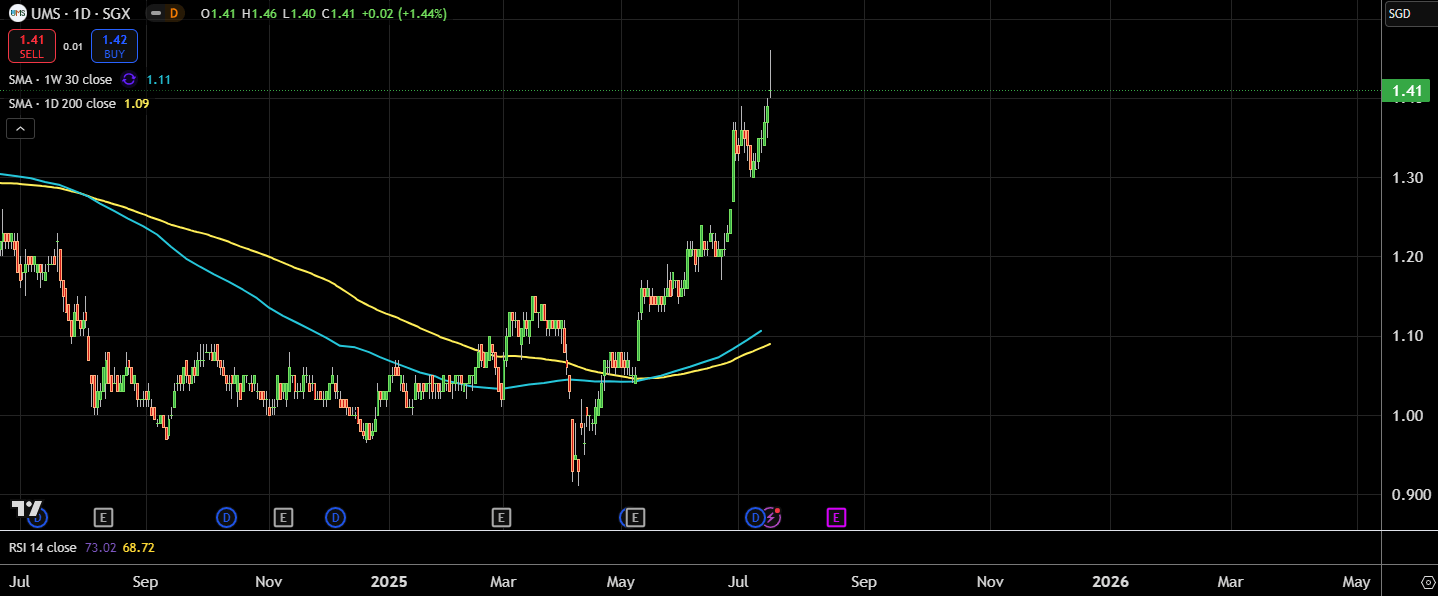

14% since April.

16% for the Chocolate associated enterprise.

Jardine is so unfamiliar to the group of buyers right this moment however was two of the most important shares in STI.

It’s up like 36% because the low.

Up 51% from the lows, which is able to deliver them again to the highs of 2021.

Has not moved but.

Coincidentally, my mates at Fifth Particular person dropped this:

I’ll type of cease right here. What can be the reason for this?

I believe it may not be one issue:

- The weakening USD, and the outlook, made buyers extra unsure and capital flowing again into SGD needing to discover a house.

- The shares usually are not too costly traditionally as nicely.

- Might be the results of the non-US wave of fairness markets restructuring that I’ve talked about. In Singapore, it will be the S$5 billion Fairness Market Improvement Program: Commentary: Singapore’s S$5 billion wager on the inventory market

- A part of the principles to setup extra household places of work right here.

Finish of the times flows and participation does matter to the vibrancy of the market. In the event you encourage fund managers to take part, then that may assist a bit. I’m often skeptical about numerous these initiatives as a result of they’re often fairly non-starting however I can see a number of prongs working.

And I wonder if there will likely be a change in sentiments and vibe across the market.

Coincidentally, I received right into a debate in regards to the Singapore market which began off with this particular person posting the next remark:

It’s type of associated to Amundi’s latest launch of Amundi Singapore Straits Occasions AS Acc ETF.

And I assume that’s the sentiments. Solely 3 banks value it.

I chuckled when folks miss the REITs, which grew to become so dominant of the index within the 2010 to 2020 interval in all probability as a result of they haven’t been doing nicely.

It type of exhibits me that people

- Have gaps of reminiscence losses.

- Maybe usually are not all the time a scholar of historical past.

Most of all, have this concept that an index does nicely due to only one or two shares, one or two sectors, one or two areas.

And completely lacking the purpose on the essential parts that make a portfolio of diversified securities extra smart than investing in a concentrated variety of particular person shares.

The extra I see this conduct brewing beneath the Singapore small caps, the extra I thought of this text from John Huber that I got here throughout just lately: Quiet Compounders and a Hidden Moat at an 18% FCF Yield.

John Huber of Saber Capital was identified extra of a High quality/Excessive Profitability at an affordable/honest valuation particular person however just lately, he mirrored and received re-acquainted with the normal worth investing. Generally, you’ll want to undergo experiences, so that you can distinction after which going again to one thing provides you a special perspective.

John is broadly adopted within the circle as a result of his High quality/Excessive Profitability inventory take was good, and it’s outstanding for people with profitable technique to contemplate different views.

Psychologically it’s rattling tough to vary a profitable system.

I believe it’s the case examine instance that John put out within the article that caught in my thoughts as a result of its the second order of conventional low-cost worth investing. These days, that is dismissed in comparison with development investing, momentum investing, market-cap index monitoring approaches.

However my commentary is that worth investing (not the standard/excessive profitability one) works its simply that not many individuals wish to do it or can do it.

However that could be the best enjoying subject for these .

Could be rattling to see the latest Singapore Small Cap Efficiency these few months haha. I’ll shared it when the information is in quickly.

If you wish to commerce these shares I discussed, you’ll be able to open an account with Interactive Brokers. Interactive Brokers is the main low-cost and environment friendly dealer I take advantage of and belief to take a position & commerce my holdings in Singapore, the US, London Inventory Alternate and Hong Kong Inventory Alternate. They permit you to commerce shares, ETFs, choices, futures, foreign exchange, bonds and funds worldwide from a single built-in account.

You’ll be able to learn extra about my ideas about Interactive Brokers in this Interactive Brokers Deep Dive Collection, beginning with learn how to create & fund your Interactive Brokers account simply.