Reviewing the Nice Jap Funding Linked Coverage Sub funds.

I wish to assessment the sub-funds which can be out there to the individuals/buyers who’ve already invested in Funding-linked insurance policies (ILPs) which can be offered to them by their AIA and Prudential monetary representatives.

Within the first half, I reviewed the sub-funds unit belief out there for AIA Representatives. In case you personal an funding linked coverage (ILP) underneath AIA and want to to see how Singaporeans can change to sub-funds that higher align to your present funding philosophy, you may learn the article.

Within the second half, I reviewed the sub-funds unit belief out there for Prudential Representatives. In case you personal an funding linked coverage (ILP) underneath Prudential and want to to see how one can change to sub-funds that higher align to your present funding philosophy, you may learn the article.

I feel this will probably be my final train into profiling what an present policyholder of Funding-linked Coverage can do in the event that they want to higher align the investments choice to their up to date funding philosophy.

Once more, earlier than I begin, I want to be clear that:

I’m not recommending anybody purchase specific sub-funds. This text is supposed to assist these with an ILP and for numerous causes, aren’t getting correct, enough advise with sufficient sophistication and integrity from who ever sells them the coverage. The principle goal is for many who have resolve to maintain the ILPs, whether or not they can higher align the funding funds within the ILPs to their present funding philosophy.

You’ll be able to learn the second paragraphs in each my articles above about fund switches. Technically most 101 ILPs provide free switches and the switches are bid-to-bid, which suggests you don’t incur one time unfold prices. However it’s higher to learn your coverage paperwork simply to be extra sure.

The Sub-fund Unit Trusts which can be Accessible Underneath Nice Jap for Singaporeans to Switching.

Earlier than switching, you would possibly wish to discover out what are the opposite sub-funds which can be usually out there to modify to. These may additionally be funds that your adviser didn’t talked about to you.

I accomplished a part of the work by itemizing down a complete chunk of the funds which can be out there underneath Nice Jap that you could contemplate.

They’re taken from this Nice Jap Fund Screener web page.

Usually, the sub funds out there for Nice Jap ILP may be present in three teams:

- Greatlink Funds. These are the sub funds for the retail ILP policyholders. When you have a legacy fund, it would fall underneath right here as effectively. Your ILP needs to be named with one thing like GreatLink or SupremeLink or one thing Nice.

- Max Funds. Particular to a set of Max ILP product collection equivalent to MaxInvest, MaxGrowth, MaxSaver, MaxSeries. These are funds that sometimes bundled with safety and riders.

- Status Portfolio Funds. Funds out there for the excessive internet value (HNW) product strains

From what I perceive, if in case you have a Max Coverage, you can not purchase GreatLink-only Funds. The funds on Status Portfolio are primarily generic unit belief from say.. Constancy, Allianz, Pimco and so forth. This isn’t to say you can not get the identical funds on GreatLink and Max. In GreatLink and Max, Nice Jap creates a “mirror” fund, which primarily tracks an exterior fund equivalent to Allianz Revenue and Development.

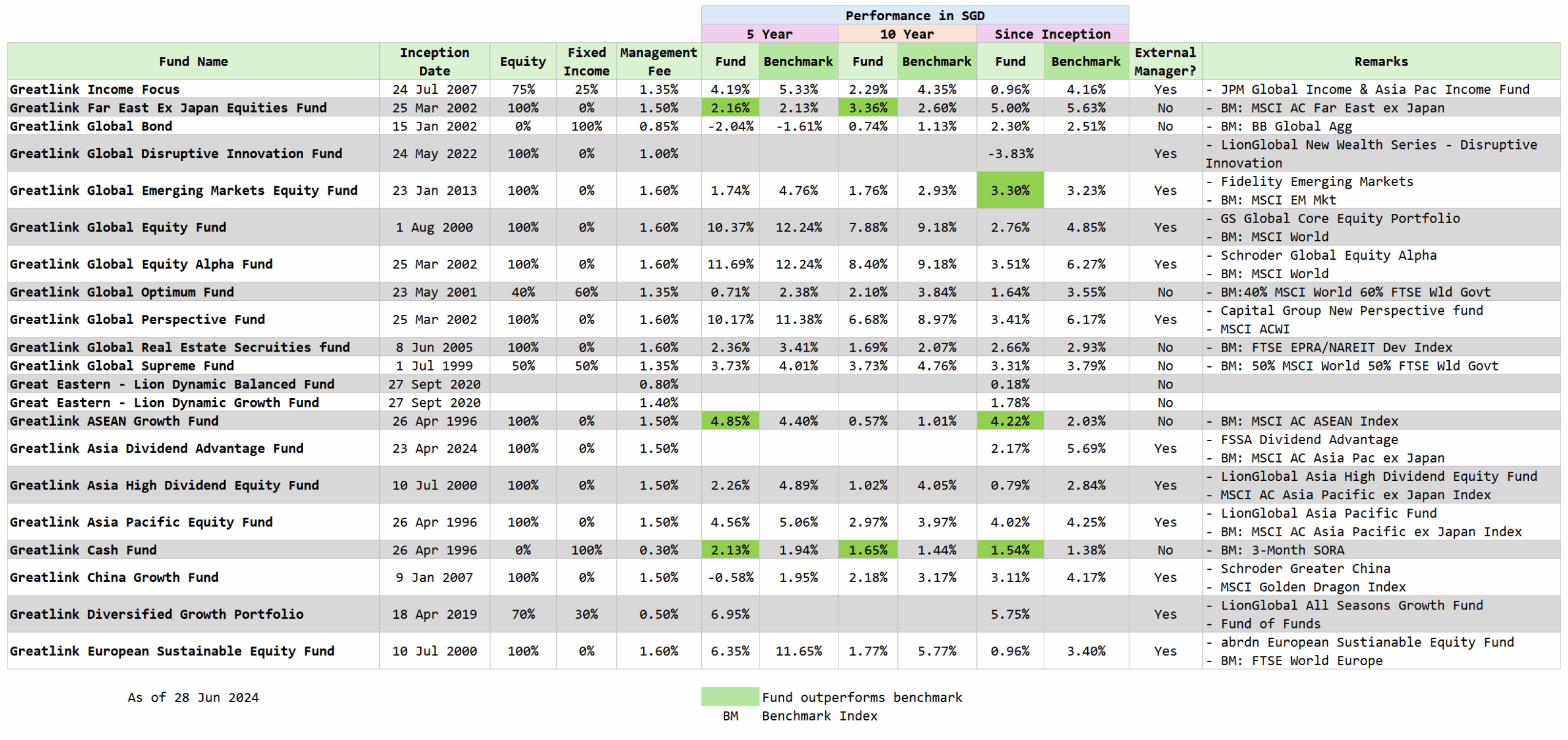

On this first two tables I’ve listed out the funds underneath GreatLink:

There may be about 39 GreatLink sub-fund unit belief right here. This desk is as of 29 Jun 2025.

You’ll be able to’t actually see the funds, or the efficiency of the funds except you click on to view a bigger desk.

I listed the

- fund inception date,

- its tough fairness to fastened revenue allocation,

- administration charge and

- the 5-year and 10-year efficiency and the corresponding benchmark performances.

Listed here are some issues to notice:

- I’m not specializing in the poor or good funding efficiency. I’m extra reviewing how lengthy the funds have been operating, in the event that they handle to maintain up with the benchmark (as a result of we all know most lively funds or portfolio underperform the index sometimes so that isn’t a shock).

- I deem that 5 and 10 years to be lengthy sufficient for us to mirror upon the funding performances.

- The returns are bid-to-bid returns, and would have factored within the bills and the administration charges.

- They don’t embrace the ILP coverage expenses and recurring ILP charges, that are sometimes charged by deducting items that you just personal.

- All performances are in SGD.

My Observations in regards to the Historic Efficiency of the Nice Jap Sub-funds

Like Prudential, Nice Jap have extra funds which can be truly wrapped round an actively-managed unit belief managed by an exterior supervisor.

Nice Jap will all the time have some relationship with OCBC and in addition LionGlobal Buyers. In 1986, OCBC Asset Administration agency was based. Nice Jap established Straits Lion Asset Administration in 1996. In 2005, OCBC asset administration and Straits Lion merge to create what is called Lion International Buyers in the present day.

Thus, a whole lot of the sub-funds are funds managed by LionGlobal. However there are additionally mirror funds to different asset managers. I do discover that there have been much less funds underneath GreatLink created not too long ago.

Nice Jap have a whole lot of sub-funds which have longer than 20 years of historical past.

If you’re an investor inquisitive about fund efficiency, like whether or not lively funds can beat passive funds over the long term, you would possibly achieve some insights by reviewing the tables above. The annualized returns since inception could be 20 12 months returns.

The returns are what’s earned by the policyholders, earlier than the coverage expenses, insurance coverage expenses.

Funds that Beat their Benchmark Since Inception

If we evaluate the three main insurers, Nice Jap have essentially the most funds that beat their benchmark index since inception:

- Greatlink Lion Japan Development. That is an 18 12 months outdated fund that beat Topix since inception.

- Greatlink Lion Vietnam. That is an 17 12 months outdated fund that beat the benchmark since inception.

- Greatlink Brief Length Bond Fund. It is a 23 12 months outdated fund that beat the 3-Month SORA + 35 bps since inception.

- Greatlink International Rising Markets Fairness Fund. A 12 12 months outdated fund that beat the MSCI Rising Markets since inception.

- Greatlink ASEAN Development Fund. A 34 12 months outdated fund that beat the MSCI All Nation ASEAN Index since inception.

- Greatlink Money Fund. A 34 12 months outdated fund that beat the 3-month SORA since inception.

It’s extra disappointing that the nice performers turned out to be very area particular or short-term fastened revenue primarily based. These won’t be one thing you want to pivot to in a world portfolio.

Funds that Form of Stored Up with the Benchmarks

There are funds with long run efficiency that a minimum of put in some arduous work to be under the index however not too far off:

- Greatlink Lion India. 18 12 months outdated fund which did 4.57% p.a. vs 5.91% p.a for the benchmark.

- Greatlink Singapore Equities Fund. 23 12 months outdated fund which did 5.5% p.a. vs 6.6% p.a for the benchmark.

- The Greatlink Way of life Collection. There are 5 totally different portfolios right here and the Progressive, Regular and Safe stored up with their benchmark fairly effectively.

- Greatlink Far East Ex Japan Equities Fund. 23 12 months outdated fund which did 5.0% p.a. vs 5.6% p.a for the benchmark.

- Greatlink International Bond. 23 12 months outdated fund which did 2.3% p.a. vs 2.5% p.a for the benchmark.

- Greatlink International Actual Property Securities Fund. 20 12 months outdated fund which did 2.7% p.a. vs 2.9% p.a for the benchmark.

- Greatlink International Supreme Fund. 26 12 months outdated fund which did 3.3% p.a. vs 3.8% p.a for the benchmark.

- Greatlink Asia Pacific Fairness Fund. 34 12 months outdated fund which did 4.0% p.a. vs 4.3% p.a for the benchmark.

The Unit Belief Sub Funds Accessible Underneath Status

There are like 100 unit belief that’s out there if you happen to personal a Status ILP. These aren’t mirror funds however principally you may spend money on the unit belief as if you happen to purchase them on iFAST FSMOne. Simply that they’re underneath this ILP Construction.

Sadly, I’m not going to undergo all of the funds.

I’m nevertheless going to assist record the Prime 20 funds primarily based on Efficiency Since Inception and for the Previous 10 Years.

Greatest efficiency since inception:

| Fund Title | Inception Yr | Annualized Return | Since Inception |

| Janus Henderson Horizon International Tech Leaders A2 Acc SGD | 1996 | 17.8% p.a. |

| LionGlobal Japan Development Hedged SGD | 1999 | 11.5% p.a. |

| Templeton Asian Smaller Firms A Acc SGD | 2008 | 11.3% p.a. |

| LionGlobal India Acc SGD | 1999 | 11.1% p.a. |

| Allianz US Fairness AT NAV SGD | 2006 | 9.7% p.a. |

| BlackRock GF Sustainable Power Fund A2 SGD-H | 2001 | 9.1% p.a. |

| LionGlobal Korea Acc SGD | 1998 | 8.7% p.a. |

| abrdn India Alternatives SGD | 2004 | 8.6% p.a. |

| LionGlobal China Development Acc SGD | 1994 | 8.5% p.a. |

| Franklin US Alternatives A Acc SGD | 2000 | 8.4% p.a. |

| abrdn Singapore Fairness SGD | 1997 | 8.2% p.a. |

| JPM Japan Fairness A Dis NAV SGD | 1988 | 8.2% p.a. |

| Schroder Asian Development SGD | 1991 | 8.1% p.a. |

| Schroder Singapore Belief A SGD | 1993 | 8.0% p.a. |

| Constancy World A Ac SGD | 1996 | 8.0% p.a. |

| JPM US worth A Acc NAV SGD | 2000 | 7.6% p.a. |

| abrdn Pacific Fairness SGD | 1997 | 7.3% p.a. |

| abrdn Thailand Fairness SGD | 1997 | 7.3% p.a. |

| BlackRock GF World Healthscience A2 Hedged SGD | 2001 | 7.0% p.a. |

| LionGlobal Singapore Belief Acc SGD | 1989 | 6.9% p.a. |

Greatest efficiency for previous 10 years:

| Fund Title | Inception Yr | Annualized Return | Since Inception |

| Franklin US Alternatives A Acc SGD | 2000 | 10.5% p.a. |

| LionGlobal Taiwan Acc SGD | 2000 | 9.7% p.a. |

| Allianz US fairness AT NAV SGD | 2006 | 9.5% p.a. |

| Schroder International Gold A Hedged Acc NAV SGD | 2016 | 9.1% p.a. |

| LionGlobal Japan Development Hedged SGD | 1999 | 9.1% p.a. |

| BlackRock GF World Gold A2 Hedged SGD | 1994 | 7.7% p.a. |

| Constancy India Focus A SGD | 2004 | 7.6% p.a. |

| Schroder International Local weather Change Fairness A Acc NAV SGD | 2007 | 7.5% p.a. |

| LionGlobal Vietnam Acc SGD | 2007 | 7.4% p.a. |

| AB Sustainable International Thematic Fund A SGD | 1991 | 7.4% p.a. |

| LionGlobal India Acc SGD | 1999 | 7.1% p.a. |

| JPM US Worth A Acc NAV SGD | 2000 | 6.9% p.a. |

| JPM Japan Fairness A Dis NAV SGD | 1988 | 6.7% p.a. |

| LionGlobal Singapore Belief Acc SGD | 1989 | 6.6% p.a. |

| Allianz Revenue and Development AM (H2-SGD) | 2011 | 6.0% p.a. |

| JPM Asia Pacific Fairness A Acc NAV SGD | 2009 | 5.9% p.a. |

| abrdn India Alternatives SGD | 2004 | 5.8% p.a. |

| Constancy European Dynamic Development A SGD | 2001 | 5.7% p.a. |

| BlackRock GF World Mining A2 Hedged SGD | 1997 | 5.5% p.a. |

| abrdn Singapore Fairness SGD | 1997 | 5.3% p.a. |

I’m not advocate you to spend money on the highest performing fund. Slightly, there are funds, on this ILP construction, that’s out there to you, that has accomplished returns that many would acknowledge assist individuals compound their wealth effectively.

Are There Nice Jap International Sub Funds if Singaporeans need a One-Fund Fairness Answer?

I feel your decisions underneath Greatlink is reasonably restricted. You’re left with:

- Greatlink Sustainable International Thematic Fund which is an Allianz Bernstein fund

- Greatlink International Fairness Fund which is a Goldman Sachs fund

- Greatlink International Fairness Alpha Fund which is Schroder International Fairness Alpha

- Greatlink International Views fund which is Capital Group New Perspective Fund

All 4 is a minimum of 23 years outdated. Their returns since inception isn’t that nice however I think that they didn’t do effectively for the primary 10 years. In case you observe, their final 10 years return will not be too unhealthy.

If I have been to do it for myself I’d simply stick to Greatlink International Fairness fund or the Alpha one and hope that they study to be closet indexers.

In case you personal an ILP that spend money on the Max funds, I don’t suppose there’s a international fund that matches the International Allocation profile.

When you have an ILP primarily based on the Status Collection, there are a whole lot of funds. However truly you might be additionally left with:

- Constancy World A Acc SGD

- Schroder ISF International Fairness Alpha USD

- BlackRock GF International Dynamic Fairness A2 USD

- JPM US Worth A Acc NAV SGD

- Allianz US Fairness AT NAV SGD

- Franklin US Alternatives A Acc SGD

A reasonably restricted record. I’ve to increase to USD denominated funds with the intention to have a wider international fairness selection. Since US makes up 60-70% of International Allocation, a few of you may be comfy in having that ILP be in US fairness as a part of your international allocation if the ILP isn’t such a big allocation.

All of the International funds underperform the MSCI World index so that is attempting to make do with no matter we’ve.

Positioning Your ILP as A part of Your International Allocation.

One other technique is to place your ILP as one of many product that offers you publicity to a sure area.

In case you did your assessment, you would possibly get a view of your portfolio in area:

Your returns is predicated on whether or not you’ll be able to seize the danger publicity of various area. And if you wish to seize the potential returns globally, you will have to have enough publicity.

In case your investments are made up of assorted merchandise presently, by switching to a different fund, it could provide help to weave the ILP effectively in order that your complete funding technique appears to be like cohorent.

We reviewed the funds within the earlier part and you’ll see what are a few of the funds which can be extra sound that you could possibly take your likelihood and weave them in higher:

- Greatlink Lion Japan Development.

- Greatlink Lion Vietnam.

- Greatlink International Rising Markets Fairness Fund.

- Greatlink ASEAN Development Fund.

- Greatlink Lion India.

- Greatlink Singapore Equities Fund.

- Greatlink Far East Ex Japan Equities Fund.

- Greatlink Asia Pacific Fairness Fund.

We have now about 3 funds that offers you rising markets/asia pacific publicity. There may be 1 Singapore fund.

Increasingly, I see that positioning your ILP as a part of your international allocation to be extra smart as a result of a lot of the Nice Jap and Prudential funds do higher regionally than globally.

Conclusion.

I hope individuals get the spirit behind this text and hope individuals don’t give me feedback like “ILPs are a rip-off!” or “They’re so pricey!” or “They need to simply give up the coverage even when they get zero a refund!”

That is extra for these individuals who have dedicated and wish to attempt to make one of the best out of their present state of affairs now that they’re extra financially conscious. Typically it’s simple for us to say as a result of it’s not our personal cash.

If you wish to commerce these shares I discussed, you may open an account with Interactive Brokers. Interactive Brokers is the main low-cost and environment friendly dealer I exploit and belief to speculate & commerce my holdings in Singapore, the USA, London Inventory Trade and Hong Kong Inventory Trade. They help you commerce shares, ETFs, choices, futures, foreign exchange, bonds and funds worldwide from a single built-in account.

You’ll be able to learn extra about my ideas about Interactive Brokers in this Interactive Brokers Deep Dive Collection, beginning with how you can create & fund your Interactive Brokers account simply.