Your Monetary Discomfort Will Finally Boil Over

I met up with an ex-colleague final week.

My story of meet ups let me know that they might normally are available in bunches. However they’re purely coincidental. We attempt to discover patterns the place there normally isn’t.

My ex-colleague needed to hold on a earlier dialog we now have about cash. The final time we truly message was about 2 years in the past. We might normally meet up with one other ex-colleague of mine. The three of us occur to be mutual pals, joint up awkwardly because of mutual circumstances.

“Certain, I’m open to assembly up. We are able to do it subsequent week or…. I believe this Friday I’m probably out there as effectively.”

“I believe it’s higher if we meet up this week.”

Whoa. I used to be greatly surprised how pressing this appear to look. I hope there isn’t something dangerous taking place with the household.

I came upon there was nothing of that kind once we met up for dinner on Friday.

Fairly, she informed me that.. this was not the final time we had such cash conversations. The primary dialog was most likely nearly 6 years in the past in 2019. All these stay as conversations.

I give her area to suppose (as a result of individuals want area and its not my cash).

And life occurs.

So 6 years later, she is 37 and never 31 already.

Sooooooooo a lot time appear to have handed however what appears to be the fear?

We mentioned quite a lot of issues nevertheless it boils right down to one thing slightly easy:

I’ve some life targets. I’d be glad if I’ve taken care of those life targets 6 years in the past. However now I’m older, and I’ve not taken care of them. And I’m working out of time.

You exchange my good friend with your self and also you may see similarities there.

Taking good care of life targets normally means funding them to a sure diploma or ensuring that for all of your cash, are you funding the targets adequately?

“I see my dad going out and in of hospital and I see first hand what occurs if I don’t eat proper and maintain myself effectively.”

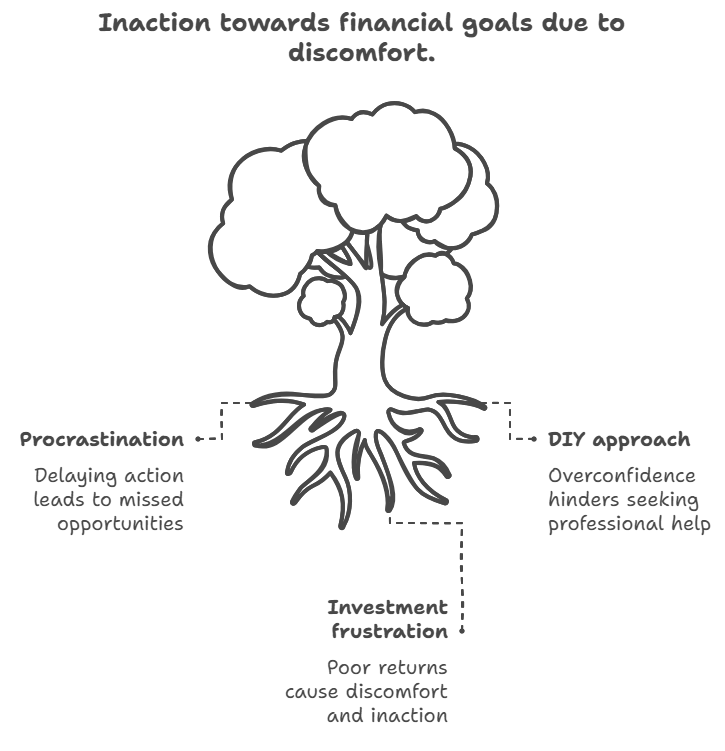

Typically I ponder if we at Providend or Havend truly deconstruct the method how individuals make selections and whether or not there are evergreen patterns. I believe we all know fairly early that many can take note of our content material and be inaction, or take motion in their very own approach.

No matter discomfort, if there are any discomfort they may begin compounding. Finally the discomfort will probably be so important that it’s going to push them to take motion.

Prior to now, they can not get previous the hurdle of paying different individuals to do issues… they suppose they’ll do themselves. In order that they do it on their very own.

Discomfort exists in numerous kinds. It may be for some motive you aren’t getting the returns. You retain shifting between investments however not getting wherever. You wish to make investments this fashion and also you tried however you don’t have the time. Principally, there is a perfect monetary setup in your thoughts, however you simply couldn’t get it proper.

The worth is assuaging this discomfort. This generally is a promise. I believe our difficult is delivering on the promise.

The discomfort builds and builds and so the worth of advise additionally builds and builds till you buay tahan and it’s essential get it remedy as a result of time is working out.

I can detect that my good friend finds her setup to be so primitive and backward. She “solely” has $550,000 in a single checking account, $150,000 in CPF SA, $250,000 in CPF OA and nothing else.

I can consider many worse off place than this. All of us really feel responsible as a result of we expect that we achieved lower than we should always or when in comparison with others. The hazard is once we blame ourselves and we discover ourselves shameful.

My job is to inform her that many would trade their monetary place to be in hers genuinely.

A clean piece of paper you can draw an exquisite image is best than one with quite a lot of issues scribble on it. You must first fxxking attempt to erase it first.

I shared along with her a couple of issues:

- She has reached CPF FRS. Which means that she has the equal of a flat $1,400 month-to-month revenue by the point she is 65 until she die. If she self-manage to maintain inflation, she has the equal of $1,000 month-to-month revenue.

- The surplus cash of about $200,000 in her OA will probably be accessible at 55. That may be thought of along with the remainder of her $550,000 in a single portfolio that the cash can come out at totally different time durations. Though that may not be accessible for 18 years.

- If we use two easy guidelines of thumb of two.5%, 3% secure withdrawal price, this can give her an concept in regards to the inflation-adjusted revenue potential of her $750,000 if she allocate them effectively:

- 2.5%: 750,000 x 2.5% = $18,750 yearly or $1,560 month-to-month. Tenure is 60 years or to perpetual.

- 3.0%: 750,000 x 3.0% = $22,500 yearly or $1,875 month-to-month. Lengthy tenure, conservative however doesn’t cowl probably the most disastrous sequences.

- Now that we now have a couple of numbers ($1k, $1.4k, $1.5k, $1.8k in revenue), her train is to determine how a lot her life-style right now, sooner or later will value. The extra she could be introspective in order that she will be able to join what she actually needs (which is safety) with the life-style she needs, the extra she will be able to get what she needs.

- I personally suppose that understanding how a lot of what you discover necessary is roofed by your present revenue (which is derive out of your belongings), offers individuals some extent of stability then telling individuals a sure or no.

- I confirmed her a fundamental financial institution, portfolio account routing framework, the spirit behind it in order that she will be able to higher compartmentalize her spending, but additionally simply inform how a lot she has in her revenue portfolio subsequent time. All she has to do is begin creating one financial savings account.

I believe that’s the begin for now.

Conversations will stay as conversations. Concepts stays as concepts. Till you do one thing about it.

If you wish to commerce these shares I discussed, you possibly can open an account with Interactive Brokers. Interactive Brokers is the main low-cost and environment friendly dealer I take advantage of and belief to take a position & commerce my holdings in Singapore, the USA, London Inventory Alternate and Hong Kong Inventory Alternate. They can help you commerce shares, ETFs, choices, futures, foreign exchange, bonds and funds worldwide from a single built-in account.

You’ll be able to learn extra about my ideas about Interactive Brokers in this Interactive Brokers Deep Dive Sequence, beginning with how one can create & fund your Interactive Brokers account simply.