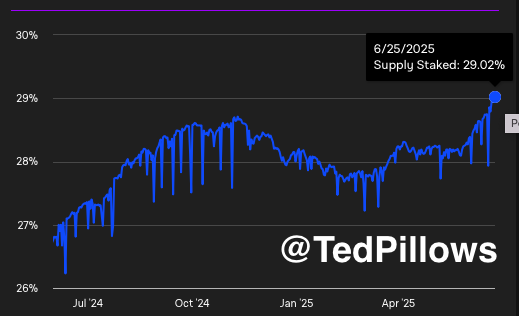

29.02% Of Provide Locked Alerts Lengthy-Time period Conviction

Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum is buying and selling at a essential degree after reclaiming the $2,400 mark, exhibiting resilience within the face of market-wide volatility. Bulls have managed to defend key assist ranges following a current fakeout beneath $2,200, however momentum stays fragile as ETH struggles to determine a transparent development. Regardless of makes an attempt to push increased, value motion is consolidating close to the mid-range, suggesting indecision amongst merchants. Nonetheless, basic power continues to construct beneath the floor.

Associated Studying

High analyst Ted Pillows highlighted a significant on-chain growth: the proportion of Ethereum provide being staked has reached a brand new all-time excessive. This milestone indicators rising confidence amongst long-term holders and validators, who’re more and more locking up ETH to safe the community and earn yield. Elevated staking ranges traditionally coincide with decrease energetic provide and lowered promote strain—an encouraging signal for bulls anticipating a breakout.

As macroeconomic uncertainty and geopolitical dangers persist, Ethereum’s value habits at this degree might decide whether or not the broader altcoin market lastly ignites. For now, ETH sits at a technical and psychological crossroads, with each bulls and bears getting ready for the subsequent main transfer. All eyes are on staking information and value construction to information what comes subsequent.

Ethereum Builds Bullish Momentum As Staking Hits All-Time Excessive

Ethereum has climbed 75% from its April lows, exhibiting robust restoration and resilience in a risky market. Regardless of this spectacular rebound, ETH stays practically 98% beneath its all-time excessive, leaving important upside potential. Many analysts imagine Ethereum could possibly be gearing up for a rally that will set off the long-awaited altseason. Nonetheless, warning nonetheless lingers out there resulting from ongoing world dangers and macroeconomic uncertainty, together with rising rates of interest and geopolitical tensions.

The rising optimism is supported by enhancing on-chain fundamentals. Ted Pillows highlighted a key metric exhibiting that the proportion of Ethereum provide staked has reached a brand new all-time excessive of 29.02%. This regular enhance in staked ETH displays robust long-term conviction from holders, who’re selecting to lock up their property to assist the community and earn yield slightly than promote throughout market turbulence.

Traditionally, excessive ranges of staking cut back energetic circulating provide, which might ease promote strain and gasoline bullish value actions. Mixed with technical power and rising confidence amongst long-term buyers, Ethereum seems well-positioned for a breakout, supplied bulls can maintain present ranges and reclaim resistance zones.

Associated Studying

ETH Reclaims Key Stage However Faces Resistance

Ethereum (ETH) is exhibiting renewed power after bouncing from its April 2025 lows and reclaiming the $2,400 degree. On the weekly chart, ETH is up over 10% this week, closing firmly above the 200-week easy shifting common (SMA) at $2,437.52 — a key threshold that beforehand acted as each resistance and assist in previous cycles. Reclaiming this degree is a bullish signal and exhibits that consumers are stepping again in after months of promoting strain.

Nonetheless, Ethereum now faces important resistance across the $2,625–2,660 zone, the place the 100-week and 50-week SMAs converge. This zone has traditionally served as a pivot for main value motion, and a transparent break above it could possible set off a broader rally concentrating on the $2,800–$3,000 vary.

Quantity has additionally picked up, signaling renewed curiosity, although it stays beneath early 2024 ranges. This means cautious optimism amongst merchants, particularly as world macro uncertainty and geopolitical tensions proceed to weigh on markets.

Featured picture from Dall-E, chart from TradingView