A Chasing Sunsets Fund – A Higher Method to Plan Good-to-Haves in Monetary Independence.

One of many spending wants that lots of you’ll contemplate as a part of the earnings wants on your monetary independence (FI) or FIRE, is to have the funds for for among the “higher issues in life”.

Many felt that even when you’ve got the capital to supply a recurring portfolio earnings that gives for a fundamental life that’s not adequate.

What for will we work so exhausting solely to stay a naked minimal life?

They’d measure the standard of life they want to save for, with their present high quality of life. A top quality of life that they stay on a recurring foundation. In the event that they really feel happy with spending $7,000 a month on every little thing then that is the life-style they need to FIRE with.

It shouldn’t be a shock that even when they attain a capital near this initially (allow us to use a 3% secure withdrawal price as a rule of thumb for dialogue and say the capital wanted is {$7k x 12}/0.03 = $2.8 mil), they could really feel insufficient.

It is because as life modifications, particularly with youngsters:

- There are experiences that have to be paid that they forgot to contemplate beforehand.

- They’re undecided what number of of those experiences they’ve missed out, so they could want extra earnings.

- Issues appear to price extra these days.

As a result of all of us view that we wanted these experiences yearly, we are going to want a higher recurring earnings stream, which for those who use that rule of thumb of three% means an ever bigger capital.

I believe there may be one other strategy to contemplate to dimension up the capital we have to put aside for these necessary issues in life and experiences and on this brief article I want to lay out my ideas about it.

How Rigid is Our Want for Higher Issues in Life?

Once we do earnings planning, if our spending is quite rigid, which implies we can not count on to spend lesser than the quantity that we plan, then what we’d like from our earnings is quite rigid.

And the extra rigid is our earnings want, normally that defaults to… requiring extra capital.

Should you inform me: “Kyith, I want $2000 a month for among the stuff that I like up to now, and in addition among the issues that I fail to expertise final time however that I’d do after I cease work, and I want each single cent of this $2000, are you able to inform me how a lot in capital, the earnings technique and methods to make investments? I need to put together for 50 years.”

Should you want such a sturdy, inflation-adjusted earnings stream, for such a protracted earnings tenure, I’d mechanically be conservative and use say, a 2.8% secure withdrawal price to estimate the dimensions of the capital.

That may come as much as ($2,000 x 12)/0.028 = $857,000.

“You imply to inform me if I need to be sure that I’ve these higher experiences, I have to put aside that a lot? How come your earnings technique is so weak!! I ought to simply search for another person!”

Nicely you’ll be able to go forward and search for another person to seek out an earnings technique that recommends you much less capital, and get you what you need to need.

I’m simply providing you with my technical perspective based mostly on what I learn about your needs. However it’s possible they offer you some fancy technique with much less capital, however will work solely in conditions the place the market returns, and inflation is extra optimistic (good market returns, beneath common long run inflation).

Should you count on “not a single cent much less”, then I acquired to deal with the situation the place even after 14 years, your portfolio went nowhere and inflation is larger than common. Not what others normally show you how to dimension up.

However I believe most of you don’t suppose that means.

Spending on experiences are good to have:

- If my portfolio returns are usually not so good, I’ll cut back the grade of the expertise I spend on. As a substitute of travelling for 15 days, I’ll cut back the variety of days. As a substitute of shopping for such a rock strong laptop to play the sport I’ll make do with a lower than strong one.

- For some, they could plan to completely do with out (however in my view, most can not try this and it is usually not wholesome to plan like this).

If we’re extra versatile, we would be capable of use a method the place the earnings is extra unstable, say 5% of the prevailing portfolio worth. The capital that we’d like is perhaps ($2,000 x 12)/0.05 = $480,000.

A lot lesser.

The large dedication of how a lot you want is the depth of your needs.

Nonetheless, I’ll make a case that your needs is extra rigid than versatile.

In case your time on earth is restricted, and there are issues that can carry you pleasure, then would such experiences or the issues that show you how to expertise this be versatile?

I don’t suppose so.

You wouldn’t need to compromise. This what individuals would seek advice from as their bucket checklist or issues to test off once they die.

However in a means, we compromise on this as a result of we’re open to the concept our portfolio won’t achieve this properly.

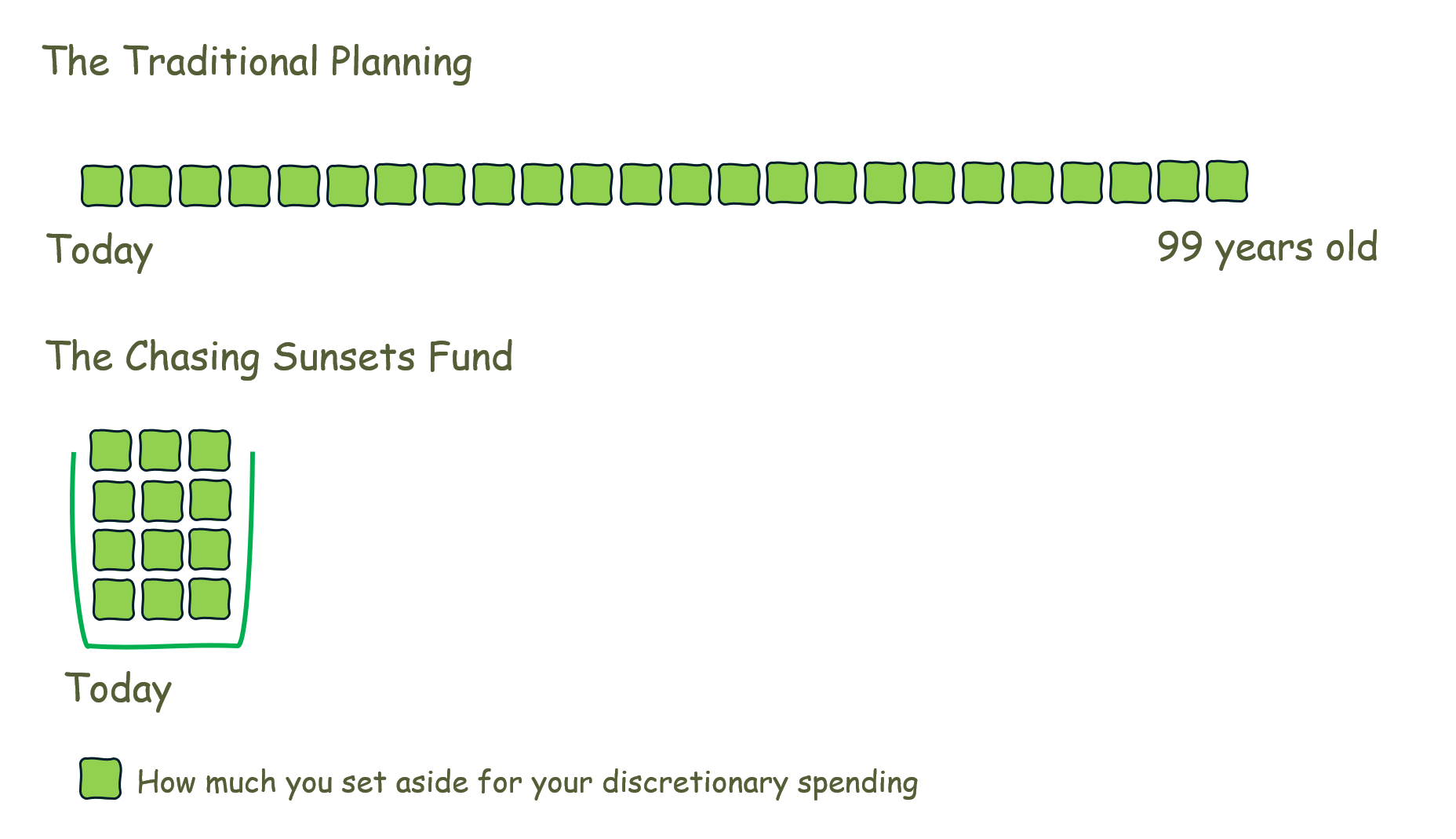

Consider Making a Sinking Fund to Fund the Most Vital Experiences.

What we’re restricted with is we expect that we have to expertise this yearly for 50-60 years. And as a consequence of balancing the trade-offs with different spending right now, and saving for the long run, we restrict our finances. Our retirement earnings finances can also be that means as a result of we don’t know if we are going to run out of cash, so we plan for a restricted finances.

If we body a very powerful experiences that we acquire in your reminiscence, your partner’s reminiscence, your kids’s reminiscence as a few however very wealthy experiences, then we would not have to plan for the spending to be so recurring.

You’d quite expertise one thing good that you simply may have to spend $50,000 on as a substitute be restricted by your annual finances of $24,000.

As a substitute of viewing these earnings wants as a versatile, discretionary spending, extract them and create a sinking fund to ensure you expertise them.

That fund might be referred to as:

- Golden Chapter Vault

- Wanderlight Fund

- Passport to Which means

- Second Bloom Fund

- Moments that Matter

- The Tapestry Fund

- Chasing Sunsets Fund

- Now or By no means Fund

I believe the names will clarify issues higher than Kyith ever does.

As a substitute of restricted by the constrains of recurrence, give attention to what are much less non-negotiable, can’t missed out upon and rigid.

How a lot to fund a Wanderlight Fund then?

There are a couple of doable methods to dimension it up:

- If you have already got a listing of issues that you simply want to do, then how a lot do they price right now? Improve the frequency based mostly on what number of instances you need to expertise them.

- Calculate based mostly on years you need to expertise and an annual finances. For instance your annual finances is $10,000 and also you need to plan for 20 years initially, then it’s $200,000

- Out of your present belongings, a fairly vital quantity that you simply really feel can be satisfactory to stay sufficient good experiences.

After I talk about this with my buddy, he tells me you’ll be able to expertise a whole lot of issues with $200,000.

I can consider somebody that suppose this isn’t sufficient. Perhaps.

However you need to justify to me why that isn’t sufficient and what’s a greater quantity.

As a result of we’re:

- Not guaranteeing the fund retains up with inflation.

- Making certain longevity of the fund.

- Buffering to make sure yearly we’ve satisfactory to spend on..

We are able to plan with a lot much less capital than the standard means.

Moments that Matter Fund helps to Compartmentalize If You might be Funding Your Goals Sufficient

Should you do earnings planning with an all-in-one earnings, you’ll have to mentally take into consideration when you’ve got sufficient buffers, how a lot for the fundamentals, for the discretionary.

You find yourself with a lot issues.

Maybe my mind is extra structural.

I’d quite know that even when I spend end a fund that known as Moments that Matter and it doesn’t compromise the cash meant for my future crucial care wants, my future medical insurance coverage premiums, or my most important meals.

This is the reason I choose a sinking fund idea based mostly round

- The which means behind the spending wants.

- How versatile/rigid is the character of want.

- How lengthy we’d like it.

- How periodic we are going to spend from it.

- Does spending want go up exponentially?

Every spending is exclusive, pivoting round these few attributes.

Whereas this may look tedious, would you quite:

- Fear about when you’ve got sufficient on your fundamental spending and so reduce down on so referred to as discretionary spending?

- Know precisely an quantity particular for the Moments that Matter that’s not suppose to cater on your fundamental spend?

I are likely to suppose #2 requires monitoring however could give readability subsequent time.

What’s the Asset Allocation?

This query will finally come out for those who learn Funding Moats lengthy sufficient.

I believe such a fund can end in 5 years or 10 years, and based mostly on the earnings wants, it must be predominately fastened earnings. I believe the common maturity matter much less however it might be higher you retain it lower than 10 years to cut back the sensitivity to rate of interest fluctuations.

A few of you may need to overfund this quantity, make it last more however you do have to contemplate the volatility and I are likely to suppose a 40% fairness 60% fastened earnings allocation is extra acceptable.

How one can Spend from such a Chasing Sunsets Fund?

You inform me how you’ll do it!

I are likely to suppose if there’s something that you simply really feel sturdy and intriguing about, how would you are feeling for those who missed out? Should you suppose you may really feel horrible and you’ve got sufficient funds for it, then do it.

Nonetheless, some experiences with the children may depart a extra lasting impression when they’re older, and so there is perhaps extra issues.

The concept just isn’t take into consideration doing it yearly, however to gather distinctive ones.

What If You Run Out of Cash Prematurely?

I believe there won’t be a prematurely however that you simply felt that you simply need to expertise sure issues extra however not sufficient cash.

That would occur.

The main target of such a fund is to ensure you expertise issues the traditional finances couldn’t and also you run the prospect the expertise is so good that you simply need to expertise that once more.

However had you intend the standard route, you may pander and never even contemplate the expertise in any respect.

If it’s so good, would you return to work in an effort to expertise it a couple of instances?

I believe a few of you’ll.

I Don’t Have a Identify For Mine But

Each time I take into consideration discretionary spending, I’d at all times bear in mind that it’s a recurring however versatile earnings fund based mostly round 4-5% of a portfolio worth.

Extra so, I got here spherical to the thought at 45 yr outdated, that planning idea won’t be appropriate.

I ought to simply put aside a hard and fast sum and simply spend it.

I stay a prudent sufficient life and did all of the accountable factor and what’s left is to spend it.

The identify is much less necessary however I do really feel that now I see among the names that I generated with AI instruments, significant names reminds you why you’re employed so exhausting to put aside the cash and why you want it.

You Would possibly Not Want so A lot to Be Glad

I met up with my buddy Samuel and he shared with me this:

“Think about what you realize as what you’ll be able to see when you’ve gotten a lamp. What you didn’t know, that’s past what you’ll be able to see with the lamp is perhaps so, so, a lot huge. However to look past into the darkness might be fairly scary for some.

If curiosity of what’s past doesn’t tickle you adequate, you’ll be able to stay within the security of what you’ll be able to see within the mild. However if you’re really interested by what’s on the market, it might harm extra for those who don’t enterprise and discover out.”

And I suppose that’s the identical with life.

I’m wondering at our deathbed, will we bear in mind the experiences that we do yearly, or would we be extra glad we do a couple of distinctive issues or experiences which are near coronary heart?

I believe it’s the latter.

If that’s the case, then there is perhaps a flaw within the conventional means of planning. It made us think about we have to work a lot extra for it, when with much less, we would obtain the identical impact.

Let me know what you concentrate on life experiences and methods to fund them.

How a lot would you place in your Chasing Sunsets Fund?

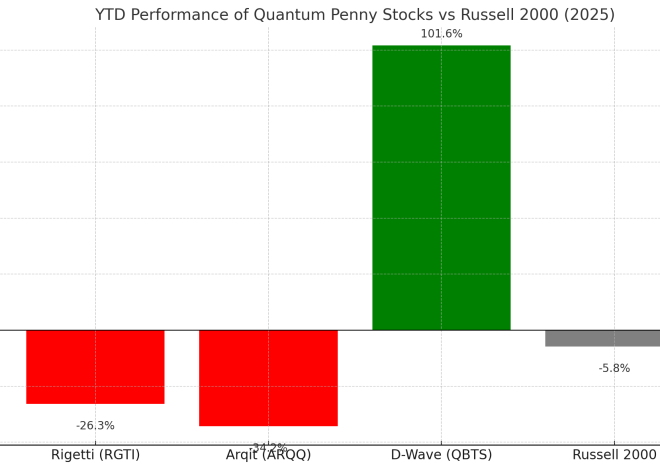

If you wish to commerce these shares I discussed, you’ll be able to open an account with Interactive Brokers. Interactive Brokers is the main low-cost and environment friendly dealer I take advantage of and belief to take a position & commerce my holdings in Singapore, the USA, London Inventory Alternate and Hong Kong Inventory Alternate. They let you commerce shares, ETFs, choices, futures, foreign exchange, bonds and funds worldwide from a single built-in account.

You possibly can learn extra about my ideas about Interactive Brokers in this Interactive Brokers Deep Dive Sequence, beginning with methods to create & fund your Interactive Brokers account simply.