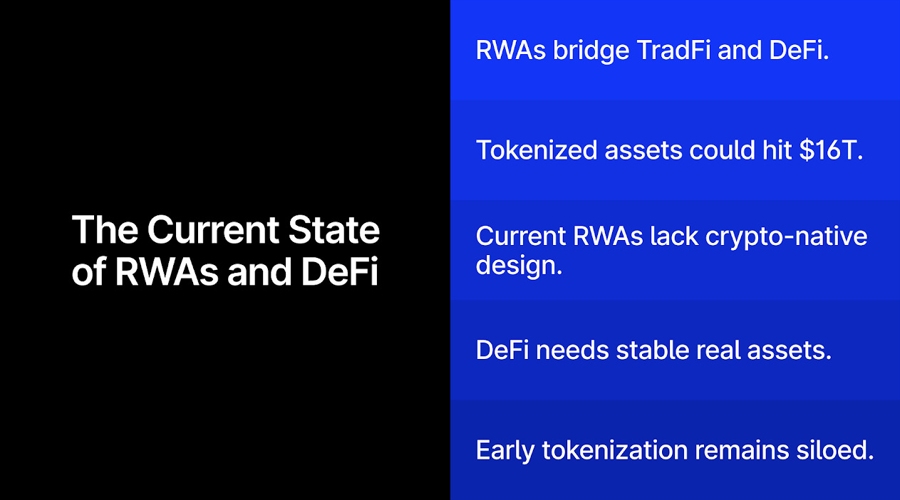

AR Tokens, Which Can Shut the Hole Between TradFi and DeFi

Over the previous yr, curiosity in bringing real-world belongings

(RWAs) on-chain has grown quickly. From tokenized U.S. Treasuries to artificial

equities, the imaginative and prescient is evident: to mix the steadiness of conventional finance

(TradFi) with the pliability of decentralized finance (DeFi).

But, present RWA implementations typically fall wanting this

promise. Many exist in authorized grey areas, are locked in custodial programs, and

resemble conventional securities greater than crypto-native belongings. These

buildings might dwell on-chain in code, however they not often perform that approach in

apply.

The chance, nevertheless, is huge. In keeping with the

Boston Consulting Group, tokenized RWAs might attain a price of $16 trillion by

2030. At current, lower than $23 billion of RWAs are tokenized on-chain—only a

fraction of the potential.

Establishments are paying consideration. BlackRock has

highlighted tokenization as a spotlight. HSBC is increasing its tokenized product

choices. The Financial institution for Worldwide Settlements is working pilots with

central banks within the U.S., Japan, and France.

However regardless of these developments, most RWA infrastructure

at this time is being constructed by way of a TradFi lens: permissioned, centralized, and

troublesome to make use of inside DeFi protocols.

DeFi Wants Actual-World Publicity

At the moment, most DeFi exercise facilities on crypto-native

belongings which are risky and speculative. With out secure, real-economy belongings

like bonds or actual property, DeFi lacks the inspiration to draw long-term

capital. Sustainable development requires greater than yield farming—it wants entry to

belongings that mirror actual financial worth.

Early tokenization efforts—through artificial derivatives or

regulated wrappers—struggled to ship on that promise. They continue to be siloed,

rigid, and sometimes unusable inside main DeFi protocols like Aave or

Uniswap.

Catch the recording of DeFi Applied sciences President & @ValourFunds CGO @Forson at @MaximGrp‘s 2025 Digital Tech Convention.

He breaks down our enterprise, our development technique, and the way we’re bridging TradFi and DeFi. $DEFT $DEFI.NE pic.twitter.com/dHy4TrVE5w

— DeFi Applied sciences (@DeFiTechGlobal) June 17, 2025

Asset-Referenced Tokens: A Sensible Different

That is the place Asset-Referenced Tokens (AR tokens) current a

promising path. AR tokens are totally backed by real-world belongings however are

designed to function natively throughout the crypto setting.

In contrast to conventional

tokenized securities, they aren’t weighed down by restrictive custody fashions

or safety classifications. As a substitute, they align with evolving regulatory

regimes just like the EU’s Markets in Crypto-Belongings (MiCA) framework, which treats

them as crypto belongings.

This method opens the door for AR tokens to perform

throughout DeFi protocols—used as collateral, traded on decentralized exchanges,

and built-in into composable programs—whereas remaining compliant and safe.

Designing for Crypto from Day One

DeFi’s long-term success relies on its capacity to anchor

itself in the true financial system. That requires extra than simply infrastructure; it

requires belongings that mirror the world we dwell in. The convergence of

regulation , institutional curiosity, and blockchain maturity has created the

circumstances to convey RWAs on-chain in significant methods.

However to unlock that potential, tokenized belongings have to be constructed

to perform like crypto from the outset. AR tokens provide a path ahead—not by

mimicking TradFi, however by enhancing it—laying the inspiration for a monetary

system that’s extra open, resilient, and interoperable.

Over the previous yr, curiosity in bringing real-world belongings

(RWAs) on-chain has grown quickly. From tokenized U.S. Treasuries to artificial

equities, the imaginative and prescient is evident: to mix the steadiness of conventional finance

(TradFi) with the pliability of decentralized finance (DeFi).

But, present RWA implementations typically fall wanting this

promise. Many exist in authorized grey areas, are locked in custodial programs, and

resemble conventional securities greater than crypto-native belongings. These

buildings might dwell on-chain in code, however they not often perform that approach in

apply.

The chance, nevertheless, is huge. In keeping with the

Boston Consulting Group, tokenized RWAs might attain a price of $16 trillion by

2030. At current, lower than $23 billion of RWAs are tokenized on-chain—only a

fraction of the potential.

Establishments are paying consideration. BlackRock has

highlighted tokenization as a spotlight. HSBC is increasing its tokenized product

choices. The Financial institution for Worldwide Settlements is working pilots with

central banks within the U.S., Japan, and France.

However regardless of these developments, most RWA infrastructure

at this time is being constructed by way of a TradFi lens: permissioned, centralized, and

troublesome to make use of inside DeFi protocols.

DeFi Wants Actual-World Publicity

At the moment, most DeFi exercise facilities on crypto-native

belongings which are risky and speculative. With out secure, real-economy belongings

like bonds or actual property, DeFi lacks the inspiration to draw long-term

capital. Sustainable development requires greater than yield farming—it wants entry to

belongings that mirror actual financial worth.

Early tokenization efforts—through artificial derivatives or

regulated wrappers—struggled to ship on that promise. They continue to be siloed,

rigid, and sometimes unusable inside main DeFi protocols like Aave or

Uniswap.

Catch the recording of DeFi Applied sciences President & @ValourFunds CGO @Forson at @MaximGrp‘s 2025 Digital Tech Convention.

He breaks down our enterprise, our development technique, and the way we’re bridging TradFi and DeFi. $DEFT $DEFI.NE pic.twitter.com/dHy4TrVE5w

— DeFi Applied sciences (@DeFiTechGlobal) June 17, 2025

Asset-Referenced Tokens: A Sensible Different

That is the place Asset-Referenced Tokens (AR tokens) current a

promising path. AR tokens are totally backed by real-world belongings however are

designed to function natively throughout the crypto setting.

In contrast to conventional

tokenized securities, they aren’t weighed down by restrictive custody fashions

or safety classifications. As a substitute, they align with evolving regulatory

regimes just like the EU’s Markets in Crypto-Belongings (MiCA) framework, which treats

them as crypto belongings.

This method opens the door for AR tokens to perform

throughout DeFi protocols—used as collateral, traded on decentralized exchanges,

and built-in into composable programs—whereas remaining compliant and safe.

Designing for Crypto from Day One

DeFi’s long-term success relies on its capacity to anchor

itself in the true financial system. That requires extra than simply infrastructure; it

requires belongings that mirror the world we dwell in. The convergence of

regulation , institutional curiosity, and blockchain maturity has created the

circumstances to convey RWAs on-chain in significant methods.

However to unlock that potential, tokenized belongings have to be constructed

to perform like crypto from the outset. AR tokens provide a path ahead—not by

mimicking TradFi, however by enhancing it—laying the inspiration for a monetary

system that’s extra open, resilient, and interoperable.