Invesco, Galaxy Digital file to launch Solana ETF in Delaware amid SEC approval buzz

Key Takeaways

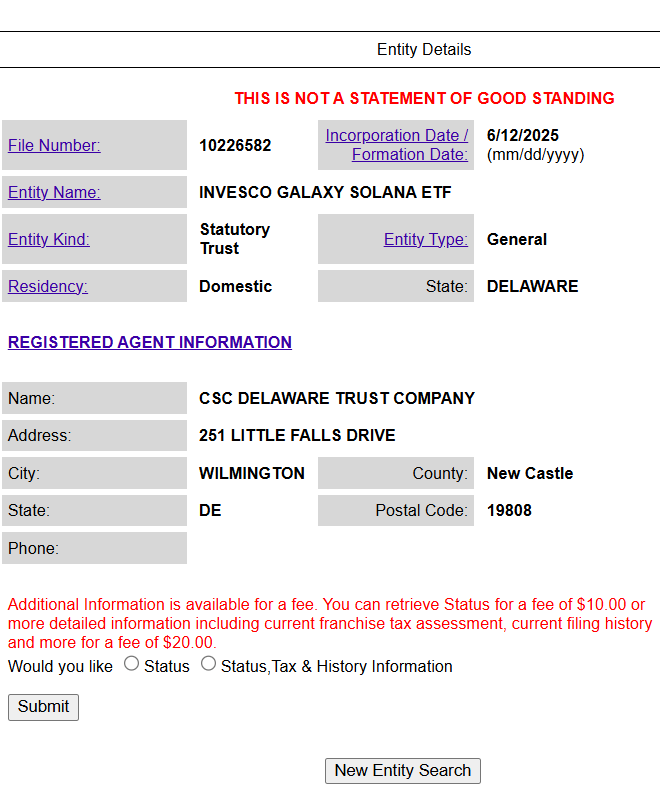

- Invesco and Galaxy Digital filed for a Solana ETF in Delaware amid expectations of SEC approval.

- The SEC could approve spot Solana ETFs inside an expedited timeline of three to 5 weeks.

Share this text

Invesco and Galaxy Asset Administration, the fund administration arm of Galaxy Digital, have filed to register a belief in Delaware for a proposed Solana ETF, a key early step towards launching the fund. The submitting suggests {that a} formal SEC software could also be imminent.

As soon as Invesco and Galaxy Asset Administration submit a proper software to the SEC, the companies will formally be a part of the rising record of asset managers searching for to launch a spot Solana ETF within the US.

To this point, that record consists of Grayscale, VanEck, Bitwise, 21Shares, Canary Capital, Franklin Templeton, and Constancy. In impact, almost each fund supervisor that gives US-listed spot Bitcoin and Ethereum ETFs is now pursuing a Solana-based counterpart, besides BlackRock.

The most recent transfer by Invesco and Galaxy comes amid rising optimism round potential SEC approval of spot Solana ETFs. Momentum picked up this week following reviews that the SEC had engaged immediately with ETF issuers, instructing them to submit revised S-1 registration statements.

The requested revisions counsel potential fast-tracking of the approval course of, which some sources consider may conclude inside three to 5 weeks. The SEC has additionally reportedly signaled its openness to staking inside the ETF construction.

Bloomberg ETF analysts Eric Balchunas and James Seyffart estimate a 90% probability of approval for Solana and Litecoin ETFs this 12 months, inserting them on the prime of their record. XRP ETFs observe carefully with approval odds of roughly 85%.

I wrote about this subject a bit at this time as properly. Could be learn at this hyperlink right here should you’re a Bloomberg Terminal Consumer:https://t.co/Tl3XfNq2Am pic.twitter.com/jAQ048Ewdr

— James Seyffart (@JSeyff) June 10, 2025

Solana ranks fifth by market cap, excluding stablecoins. SOL is buying and selling at round $147 on the time of reporting, down 7% within the final 24 hours, per CoinGecko knowledge.

Share this text