New 6-Month Singapore T-Invoice Yield in Early-June 2025 Ought to Fall Barely to 2.18% (for the Singaporean Savers)

A Singapore Treasury Invoice difficulty (BS25111T) might be auctioned on Thursday, 05th Jun 2025.

If you happen to want to subscribe efficiently, you could place your order through Web banking (Money, SRS, CPF-OA, CPF-SA) or in individual (CPF) by 4th Might. Singaporeans, PR, and non-Singaporeans can all purchase these Singapore Treasury Payments.

You’ll be able to view the small print at MAS right here.

Up to now, I’ve shared with you the virtues of the Singapore T-bills, their best makes use of, and find out how to subscribe to them right here: How you can Purchase Singapore 6-Month Treasury Payments (T-Payments) or 1-Yr SGS Bonds.

The Tbill cut-off yield within the final public sale is 2.20%.

If you choose a non-competitive bid, it’s possible you’ll be pro-rated the quantity you bid and would yield 2.20%. If you need to make sure you secured all that you simply bid, it will likely be higher to pick out a aggressive bid, however it’s essential get your bid proper.

Some previous non-competitive auctions have been pro-rated. Listed here are some previous examples:

In aggressive bidding, in case your bid is decrease than the eventual cut-off yield (within the instance under), you’re going to get 100% of what you bid for on the cut-off yield (not the decrease yield that you simply bid for).

Gaining Insights In regards to the Upcoming Singapore T-bill Yield from the Every day Closing Yield of Present Singapore T-bills.

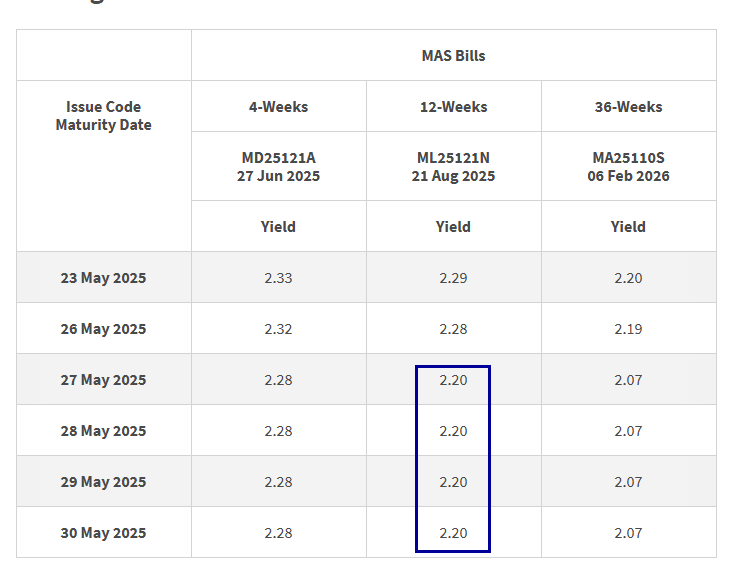

The desk under exhibits the present curiosity yield the six-month Singapore T-bills is buying and selling at:

The every day yield at closing offers us a tough indication of how a lot the 6-month Singapore T-bill will commerce on the finish of the month. From the every day yield at closing, we must always count on the upcoming T-bill yield to commerce near the yield of the final difficulty.

At the moment, the 6-month Singapore T-bills are buying and selling near a yield of 2.19%, a lot decrease than the yield two weeks in the past.

Gaining Insights In regards to the Upcoming Singapore T-bill Yield from the Every day Closing Yield of Present MAS Payments.

Sometimes, the Financial Authority of Singapore (MAS) will difficulty a 4-week and a 12-week MAS Invoice to institutional traders.

The credit score high quality or danger of the MAS Invoice needs to be similar to that of Singapore T-bills because the Singapore authorities points each. The 12-week MAS Invoice (3 months) needs to be the closest time period to the six-month Singapore T-bills.

Thus, we will achieve insights into the yield of the upcoming T-bill from the every day closing yield of the 12-week MAS Invoice.

The cut-off yield for the most recent MAS invoice auctioned on twenty sixth Might (5 days in the past) is 2.19%. The MAS invoice is 9 foundation factors decrease than the final difficulty two weeks in the past.

At the moment, the MAS Invoice trades near 2.20%.

On condition that the MAS 12-week yield is at 2.20% and the final traded 6-month T-bill yield is at 2.19%, what’s going to seemingly be the T-bill yield this time spherical?

What we’re observing is:

- The rate of interest within the 3-month maturity is the bottom a part of the yield curve.

- The charges at 3-month and 6-month rate of interest is un-inverting. This implies the 3-month rate of interest is changing into decrease than the 6-month, which is the often form of the yield curve.

Given the place issues are I’m incline to suppose that yields might be at barely decrease at 2.18%.

Listed here are your different Increased Return, Protected and Brief-Time period Financial savings & Funding Choices for Singaporeans in 2023

You could be questioning whether or not different financial savings & funding choices offer you greater returns however are nonetheless comparatively protected and liquid sufficient.

Listed here are totally different different classes of securities to contemplate:

| Safety Sort | Vary of Returns | Lock-in | Minimal | Remarks |

|---|---|---|---|---|

| Mounted & Time Deposits on Promotional Charges | 4% | 12M -24M | > $20,000 | |

| Singapore Financial savings Bonds (SSB) | 2.9% – 3.4% | 1M | > $1,000 | A great SSB Instance.” data-order=”Max $200k per individual. When in demand, it may be difficult to get an allocation. A great SSB Instance.”>Max $200k per individual. When in demand, it may be difficult to get an allocation. A great SSB Instance. |

| SGS 6-month Treasury Payments | 2.5% – 4.19% | 6M | > $1,000 | How you can purchase T-bills information.” data-order=”Appropriate you probably have some huge cash to deploy. How you can purchase T-bills information.”>Appropriate you probably have some huge cash to deploy. How you can purchase T-bills information. |

| SGS 1-Yr Bond | 3.72% | 12M | > $1,000 | How you can purchase T-bills information.” data-order=”Appropriate you probably have some huge cash to deploy. How you can purchase T-bills information.”>Appropriate you probably have some huge cash to deploy. How you can purchase T-bills information. |

| Brief-term Insurance coverage Endowment | 1.8-4.3% | 2Y – 3Y | > $10,000 | A great instance Gro Capital Ease” data-order=”Make sure that they’re capital assured. Often, there’s a most quantity you should purchase. A great instance Gro Capital Ease“>Make sure that they’re capital assured. Often, there’s a most quantity you should purchase. A great instance Gro Capital Ease |

| Cash-Market Funds | 4.2% | 1W | > $100 | Appropriate you probably have some huge cash to deploy. A fund that invests in mounted deposits will actively provide help to seize the very best prevailing rates of interest. Do learn up the factsheet or prospectus to make sure the fund solely invests in mounted deposits & equivalents. |

This desk is up to date as of seventeenth November 2022.

There are different securities or merchandise that will fail to fulfill the factors to present again your principal, excessive liquidity and good returns. Structured deposits include derivatives that enhance the diploma of danger. Many money administration portfolios of Robo-advisers and banks include short-duration bond funds. Their values could fluctuate within the quick time period and will not be best when you require a 100% return of your principal quantity.

The returns supplied will not be forged in stone and can fluctuate primarily based on the present short-term rates of interest. It’s best to undertake extra goal-based planning and use probably the most appropriate devices/securities that will help you accumulate or spend down your wealth as an alternative of getting all of your cash in short-term financial savings & funding choices.

If you wish to commerce these shares I discussed, you may open an account with Interactive Brokers. Interactive Brokers is the main low-cost and environment friendly dealer I take advantage of and belief to take a position & commerce my holdings in Singapore, america, London Inventory Change and Hong Kong Inventory Change. They permit you to commerce shares, ETFs, choices, futures, foreign exchange, bonds and funds worldwide from a single built-in account.

You’ll be able to learn extra about my ideas about Interactive Brokers in this Interactive Brokers Deep Dive Sequence, beginning with find out how to create & fund your Interactive Brokers account simply.