The Prices and Bonus of the HSBC Pulsar ILP Construction – Framed the Smart Manner.

Somebody in my neighborhood was saying the HSBC Pulsar is a crap Funding-linked Coverage (ILP).

I believed it’s good to check out how the construction will appear to be. Whereas I don’t advocate you to take a position by means of such an ILP construction, I do suppose that folk take a look at ILP the flawed method as effectively. Some mechanically default to saying it’s not good… as a result of everybody say it’s not good. Maybe generally it’s good to have some good reasoning behind it.

I managed to check out an previous Pulsar Product Abstract which can give details about the construction. Whereas there are often safety parts in an ILP, the first goal is for funding. And often for funding, we’re searching for an extended funding timeframe.

I don’t suppose is honest that if the choice is to put money into a Vanguard FTSE All-World UCITS ETF (VWRA) for the long run, you must consider holding an funding in a HSBC Pulsar for brief time period.

A typical ILP construction is one the place there are bonus models given however you might be additionally paid different payment. I’ve summarized them in a 30-year funding tenure diagram like beneath:

The inexperienced cells are constructive advantages you obtain and the purple cells are the prices/charges that you need to pay.

You’ll be able to select to pay premiums for at least 11 years to 30 years however on this case, allow us to assume that you just select to pay roughly 20 years.

Many take a look at the associated fee however didn’t account for the models given.

The problem is as a result of many can’t do the mathematics of how the inexperienced and purple cells would work out.

Suppose you’ve got the choice of investing in a index-tracking funding that ultimately provides you 8% p.a. after 30 years.

The online impact of this construction will scale back that 8% Inner charge of return to 6.69% p.a. So that may be a 1.31% p.a. shave.

These construction turns into extra expensive when your funding time horizon is shorter. For those who make investments for 20 years, the associated fee will probably be increased.

In a method, these constructions have value and rewards earlier and it rewards you the longer you make investments. So if the relative make investments for 40 years, the “loopy excessive” account upkeep payment isn’t existent.

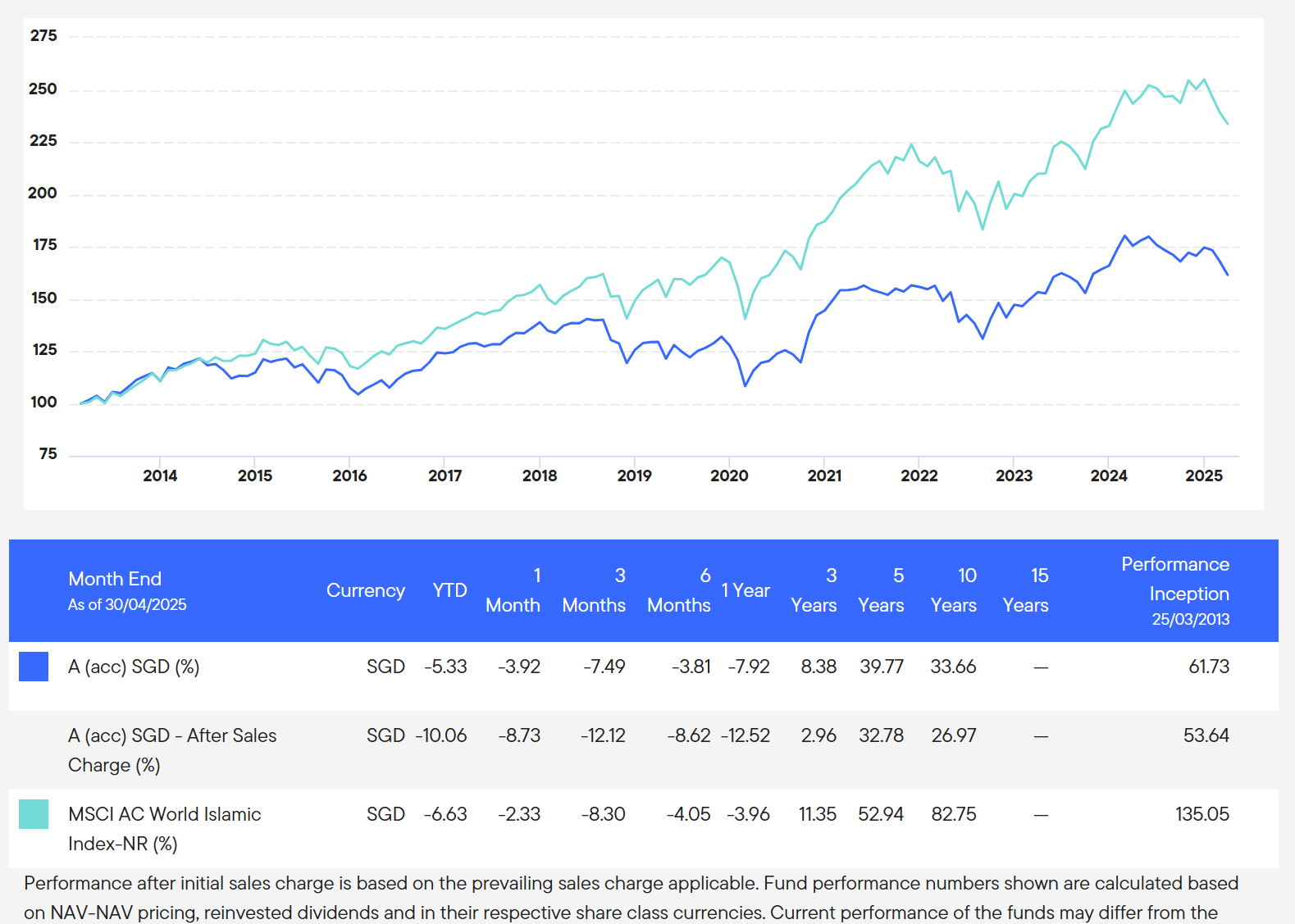

The truth is that the fund chosen Templeton Shariah World Fairness Fund didn’t do effectively.

Whereas the ILP construction isn’t low cost, we’d hope that the advice is respectable. However the fund chosen is an actively-managed fund that’s not systematic, very concentrated and the returns underperforms the index over a number of long run timeframes.

Finally, the ILP is an advise construction.

However should you didn’t obtain high quality advise that both lets you keep invested, provides you a better chance of reaching your monetary or life targets, then you might need overpaid for it.

An ILP can be a construction that doesn’t match your planner’s compensation with the interval that they want that can assist you keep invested. On this case, in case you are to put money into the long run, majority of their compensation is paid to them within the first few years. That is fairly a misalignment in financial incentive and all of us would surprise what number of planners would obtain the cash upfront and but totally dedicated to guiding the shoppers regardless of not incomes any extra compensation when coping with this shopper.

Listed below are some definitions of the payment and bonus.

Bonuses and Price Definition

Begin-up Bonus

The beginning-up bonus is a one-time enhance in models. It’s based mostly on the common premium of the first 12 months x the speed x premium cost time period.

The speed relies on the quantity you set in, which determines the band and the way lengthy you pay the premium.

So in my instance of 20 years, you may type of derive the start-up bonus is about 64-96% relying on my premium paid. I exploit a mid sufficient level of 80% in my 30-year instance.

Whether it is 30 years then its 168%!

However the common premium for 30 years is lesser than that of 10 years.

So these are actually psychological gymnastics of how impactful that is.

Loyalty Bonus

For those who pay premium for 20 years or extra, they are going to pay a one-off loyalty bonus on the tenth 12 months.

This is the same as the yearly premium x 10 x 4%. So that’s about 40% one time.

Account Upkeep Price

For the reason that premium time period is 20 years, we are going to mainly pay 20 years of 4%.

That is on the Account Worth of Preliminary Items, which is often the premiums. Since your start-up and loyalty bonus models are allotted to the Preliminary Items account, so this payment additionally will increase with the bonus models.

Coverage Upkeep Price and Price Refund

A coverage payment is payable for the premium cost time period.

For those who diligently pay, they are going to 100% refund the full coverage upkeep payment paid through the premium cost time period.

Administration Price

The administration payment is a flat-fee that’s levy for the entire time you’ve got the coverage. This one isn’t on the preliminary models however on the models you accrued.

Funding Administration Price

The funding administration payment is a 1.5% p.a. ongoing payment so long as you keep invested. That is most likely probably the most painful payment.

If you wish to commerce these shares I discussed, you may open an account with Interactive Brokers. Interactive Brokers is the main low-cost and environment friendly dealer I exploit and belief to take a position & commerce my holdings in Singapore, the USA, London Inventory Trade and Hong Kong Inventory Trade. They permit you to commerce shares, ETFs, choices, futures, foreign exchange, bonds and funds worldwide from a single built-in account.

You’ll be able to learn extra about my ideas about Interactive Brokers in this Interactive Brokers Deep Dive Collection, beginning with how one can create & fund your Interactive Brokers account simply.