An Replace on FundSmith Fairness Fund’s Returns (Versus different High quality Funds)

My colleague Vincent was questioning about how is Fundsmith Fairness Fund’s efficiency over this era.

So it is a returns replace for a good friend and co-worker.

I final evaluation Fundsmith Fairness Fund’s efficiency in Sep 2023, so that’s nearly 2 years in the past. This can be a fund that’s fairly popularly offered by monetary advisers, notably in an Funding Linked coverage construction. I suppose the primary cause is sweet current efficiency makes the product promote itself.

You may learn extra of the put up right here: My Evaluation of Fundsmith Fairness Fund’s Efficiency

Within the article, I examine the fund towards what I believe are the correct comparables. Terry Smith has a top quality + worth and purchase and make little changes philosophy and he has proven coherence to that philosophy over time.

I gained’t go an excessive amount of into explaining high quality, profitability, and worth so this text is extra of an replace of the efficiency.

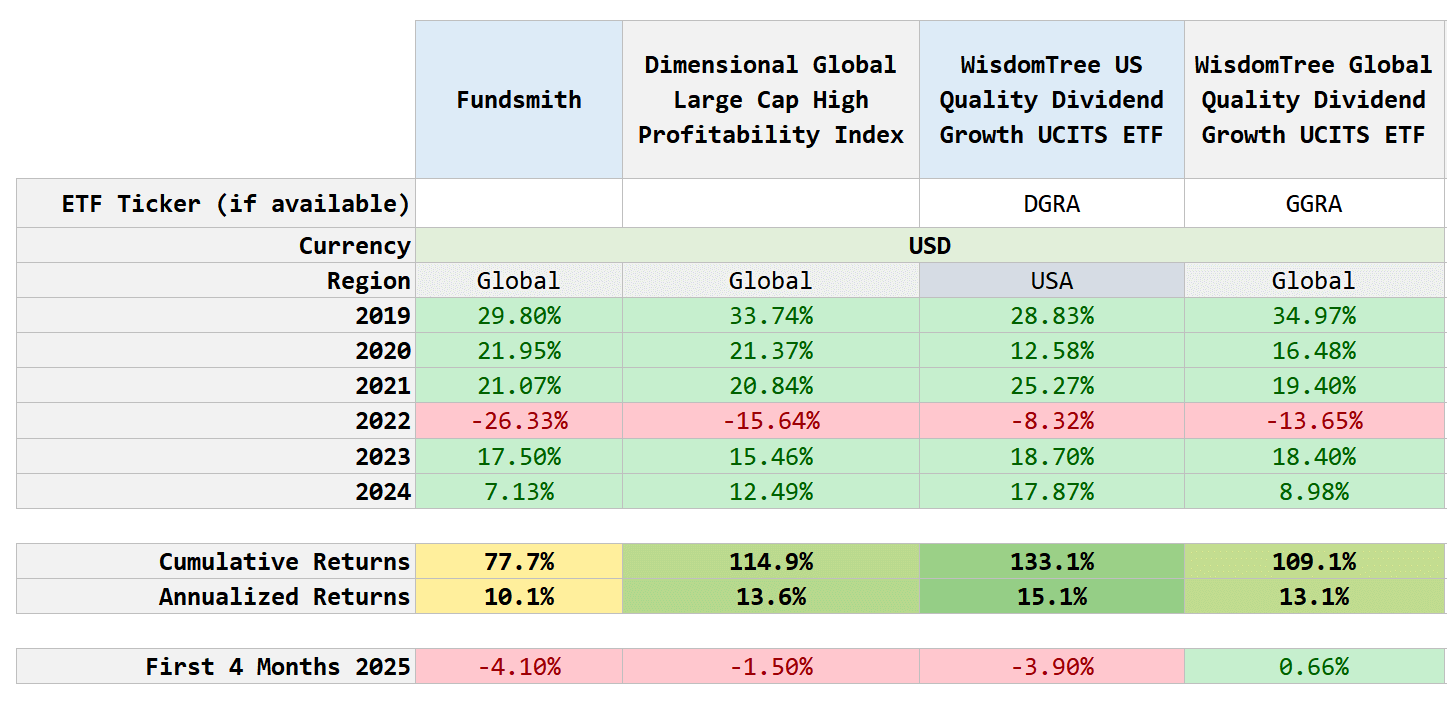

We can have:

- Full yr 2023 and 2024

- First 4 months of 2025

Performances to replace.

So listed here are the performances:

I believe it’s a bit small and I do know a few of you won’t be capable of click on into it so let me break up it up:

Maybe some introduction is so as. I can benchmark and examine Fundsmith with a couple of issue indexes that systematically selects corporations that exhibit high quality traits similar to low debt to fairness, debt to belongings, excessive return on fairness, excessive return on belongings, constant earnings. There are additionally systematic indexes that selects corporations which have greater profitability similar to (working earnings – curiosity expense) divide by ebook worth, or 5-years of constant dividend raises.

There are funds or ETFs which are obtainable to you that you may spend money on.

So here’s what is introduced:

- MSCI USA Sector Impartial High quality Index – IUQA through IBKR

- MSCI World Sector Impartial High quality Index – IWQU through IBKR

- GMO High quality Funding Fund – Fund through Endowus

- DFA US Hello Relative Profitability Index – Mutual Fund not obtainable to Singaporeans

- Dimensional World Giant Cap Excessive Profitability Index – Analysis Index not obtainable.

- WisdomTree US High quality Dividend Development UCITS ETF – DGRA through IBKR

- WisdomTree World High quality Dividend Development UCITS ETF – GGRA through IBKR

Out of all this, GGRA is in Daedalus Earnings Fund as a strategic holding. A Word is that we don’t have the April 2025 knowledge for GMO High quality Funding Fund so we don’t have any efficiency for the fund in 2025.

We’ve got about 6 full years of calendar years so we are able to see the cumulative and annualized returns. Fundsmith Fairness Fund returns are in GBP, so I did some forex conversion.

Normally, if we use a top quality and profitability display to pick shares, you find yourself with healthcare, shopper staples and data know-how dominant allocation. The worth earnings of the general portfolio tends to be excessive as nicely.

And prior to now yr the efficiency of healthcare and data know-how have been the alternative. Efficiency in US can be higher than Worldwide.

These funds with higher efficiency are usually much less healthcare, extra info know-how, extra US focus.

However as you possibly can see, these with worldwide publicity, the worldwide funds did higher within the first 4 months of the yr.

I believe Vincent would have an interest within the corresponding efficiency of the Dimensional World Core Fairness and the MSCI World Index for the interval, so I introduced this under:

I’ve additionally added the Dimensional US Excessive Profitability ETF (DUHP) to the combo. DUHP is a US-listed ETF by Dimensional that systematically curates the businesses that exhibit greater profitability. It didn’t have such an extended historical past however I believed its good to place it out right here for readers to take be aware.

So after all you will get entry to those funds:

- Dimensional World Core Fairness – Fund through Endowus

- MSCI World – SWDA through IBKR

- Dimensional US Excessive Profitability ETF – DUHP through IBKR

The underlying message could also be: When you have an funding philosophy that we should always systematically spend money on corporations that exhibit greater high quality traits, there are a lot of choices on the market which are accessible to you.

If you wish to commerce these shares I discussed, you possibly can open an account with Interactive Brokers. Interactive Brokers is the main low-cost and environment friendly dealer I exploit and belief to take a position & commerce my holdings in Singapore, america, London Inventory Change and Hong Kong Inventory Change. They permit you to commerce shares, ETFs, choices, futures, foreign exchange, bonds and funds worldwide from a single built-in account.

You may learn extra about my ideas about Interactive Brokers in this Interactive Brokers Deep Dive Collection, beginning with create & fund your Interactive Brokers account simply.