A Additional Dialog about Pimco GIS Revenue Fund’s Returns.

I needed so as to add one thing to the 2 posts that I written in regards to the Pimco GIS Revenue fund.

Beforehand, I shared a number of the stuff that traders is perhaps considering these funds:

- Why Your Revenue Fund Pays the 3-7% Revenue partly from Capital

- Some Ideas Relating to Mari Make investments Revenue Answer and its Underlying Revenue Unit Belief.

Most who’re considering Pimco GIS Revenue could also be as a result of their bankers recommending it. Perhaps they’re drawn to the slightly excessive distribution yield of almost 6%, a excessive yield to maturity of seven% and a really constant earnings since 2013. Having a SGD hedged class of funds and month-to-month dividend distribution helps.

In my second article, I gone via that completely different share class of the fund has completely different charges and people price delicate traders might need to be aware of that.

Whenever you see a fund with a excessive distribution, a prudent investor would marvel if the payout is sustainable and so they have proven that they’re able to keep the identical month-to-month distribution per unit since 2013, earlier than growing the payout when rate of interest began to rise in 2022.

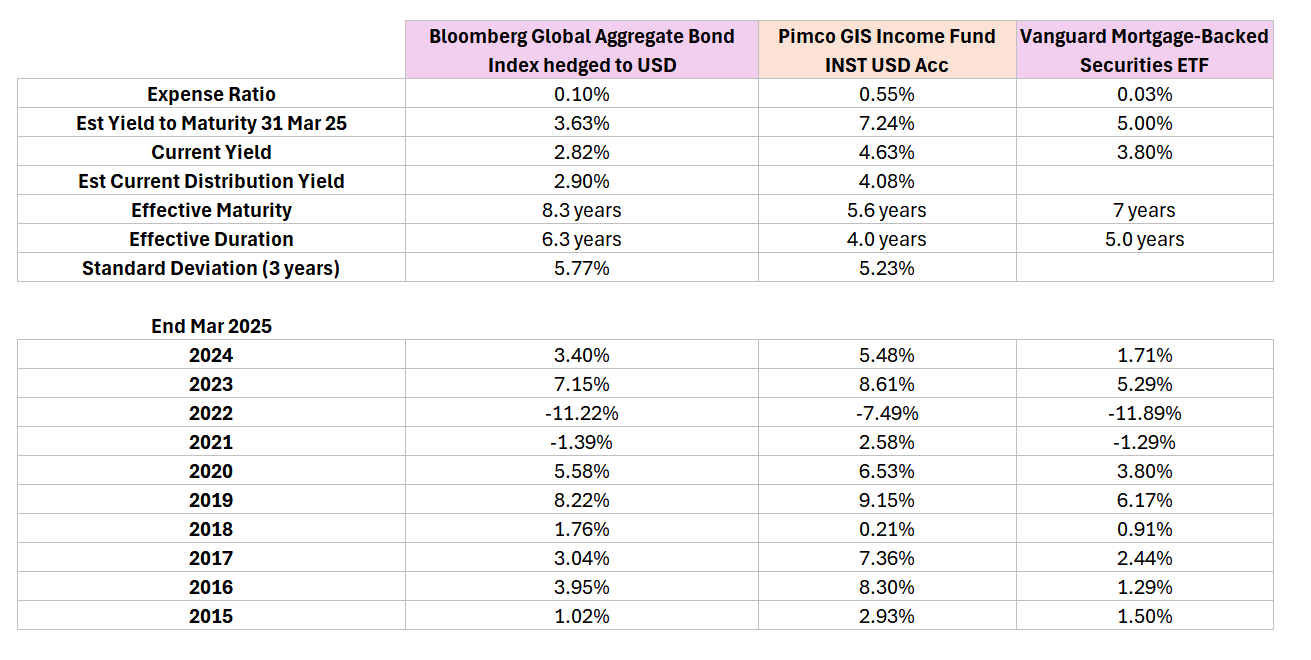

For a lot of investments, what drives returns is the underlying however on a deeper evaluation, I can’t simply inform the distinction in efficiency, with respect to the defacto index, the Bloomberg World Combination Bond Index (which you’ll be able to make investments through AGGU at IBKR, or Amundi Index World Combination Bond A12HS (C) SGD at Endowus or Poems).

The GIS Revenue maintain a good bit extra of Mortgage Again Securities examine to the World Combination Bond Index, however I don’t suppose that drives the efficiency.

My hunch is that:

- That is an energetic fund and so they actively cut back the quantity of short-term fastened earnings allocation.

- They’re selective in regards to the fastened earnings devices inside the maturity, and the yield curves they most well-liked.

- They earn choices premiums which provides to the end result.

Returns of Pimco GIS Revenue Institutional Class vs Bloomberg World Combination Bond Index

The desk beneath exhibits a number of the fund’s metrics and the returns once we put them aspect by aspect with the World Agg Index:

The yield is greater, shorter in maturity and shorter in length. For the reason that brief finish of most yield curves all over the world have excessive returns, their yield will look significantly better. That is an actively-managed fund in comparison with an index that’s to maintain the length of the fastened earnings portfolio fixed. So you’ll count on the yield, maturity, length profile to vary now and again.

The exceptional factor is they’re able to have a superb efficiency versus the benchmark index. You’ll be able to say that they transfer their positions and they’d take some losses in the event that they maintain the portfolio of fastened earnings which can be much less suited to sure environments and that losses could be within the end result above. The calendar 12 months returns contains the coupon funds, and considers the distribution earnings.

10-11 years is an effective timeframe for us to replicate upon the outcomes of an actively managed fastened earnings fund. Whereas some might have the impression that fastened earnings is less complicated to handle, we are likely to see returns to be worse than the benchmark index or at most comparable. You’ll be able to actually do sufficient silly issues to cock up the returns. So this result’s fairly good in case you ask me.

One factor to notice is the above comparability is completed on the share class that has the bottom price (0.55%) and naturally not internet of any advisory, ILP coverage prices, wrap price that your adviser or platform prices.

I’ve tabulated the Establishment class and retail class returns, which have a 1.45% p.a. expense ratio as an alternative:

The whole returns are nonetheless fairly good.

Does Pimco World Bond Fund Did Simply as Properly?

The goals of the GIS Revenue fund might compel the supervisor to handle the fund in a sure approach that may be very completely different from the benchmark Index. The Index function is to specific a basket of fastened earnings that’s extra consultant of the worldwide fastened earnings market and to not present earnings.

Nonetheless, the World Combination bond index is Pimco’s chosen benchmark and I seen sufficient of funds not beating their index.

I believe it begs the query: Is the fund good or is the supervisor (on this case Pimco) good?

We’d have the ability to know if we examine the Bloomberg World Combination index to a extra comparable fund. The Pimco World Bond Fund’s goals must be nearer to the index and within the desk beneath, I tabulated the metrics and efficiency:

As we will see the length, maturity profile is far nearer to the index, however the yield to maturity remains to be a lot greater.

The distinction when it comes to maturity profile of the portfolio is that the Pimco World bond have a lot much less publicity to the fastened earnings maturity above 10 years (7% vs 20%) and extra of the fastened earnings within the 3-5 years maturity.

The efficiency of the Pimco World Bond fund is far nearer to the index, however nonetheless did comparatively higher. You bought to offer Pimco credit score for having the ability to constantly do higher. In your info, this fund is incepted in 1998 in order that since inception efficiency is about 26 years.

However in an oblique approach, it type of additionally offer you an thought of how a lot outperformance energetic administration can do and the way a lot of the efficiency is as a result of time interval, and holding a portfolio of bonds basically. I don’t suppose many will complain in the event that they earn 4.1% p.a. on the Bloomberg World Combination bond ETF vs 4.9% in the identical time interval and lament I ought to have chosen energetic administration.

Keep in mind additionally that we’re are evaluating the share class with the bottom charges. You’ll be able to simply shave 1% off the efficiency of the Pimco World bond to offer a sensing of the return in case you are utilizing a retail class.

Does Pimco GIS Revenue’s bigger FNMA Place Drive A lot of the Return?

I’m wondering what number of traders could be unsettled after they see a lot FNMA within the high 10 holdings of Pimco GIS Revenue fund:

FNMA stands for Federal Nationwide Mortgage Affiliation, generally referred to as Fannie Mae.

Within the context of fastened earnings:

- FNMA securities are bonds or mortgage-backed securities (MBS) issued or assured by Fannie Mae.

- Fannie Mae is a U.S. government-sponsored enterprise (GSE) that gives liquidity to the mortgage market by shopping for mortgages from lenders and packaging them into MBS.

- These securities are sometimes thought-about high-quality and low-risk, as they’re implicitly backed by the U.S. authorities, though they don’t carry an express assure.

The curiosity on FNMA tends to be fastened for 30-years and so they are usually comparable if not greater than the common yield to maturity of Bloomberg World Combination Bonds.

Whereas the fund contains primarily of FNMAs, I believe it would nonetheless be all the way down to the securities collection of Pimco that drives the returns. We will examine the efficiency of GIS Revenue in opposition to a Vanguard Mortgage-Backed Securities ETF.

If the upper yield, good efficiency is instantly attributed solely to FNMA, then a Mortgage-backed safety ETF ought to do higher than a Pimco GIS Revenue or World Combination Bond index for the matter proper?

Seems, in all probability not a lot. Even the calendar whole return of a portfolio of mortgage-backed securities (Ginnie Mae (GNMA), Fannie Mae (FNMA), and Freddie Mac (FHLMC)) didn’t do significantly better than each.

Final Phrases

The return of a fund can sometimes be deconstructed to some components:

- The continuing value, be it expense ratios, buying and selling and advertising and marketing charges, entry charges.

- The efficiency of the underlying allocation or what it holds.

- The supervisor’s ability.

And normally 1 brings down the return, 3 is often a non issue and even works the identical approach as 1. A lot of the return comes from 2.

Pimco is the uncommon fund (and I actually imply uncommon) that regardless of 1, 3 could also be a giant purpose why the efficiency is healthier.

Whereas 12 years of efficiency could seem lengthy to you, within the subsequent 12 years the efficiency could also be poor. That is what people have to think about when invested in an actively-managed fund. I believe Pimco’s file managing the World Bond fund over 26 years is lengthy sufficient for us to evaluation their administration competency however it additionally highlights that the outperformance will not be so dramatic versus a Bloomberg World Combination Bond index. The efficiency since inception ought to present you that good fastened earnings efficiency can come naturally to purchase and maintain a portfolio of fastened earnings securities and after the heavy retail value, the efficiency distinction will not be that a lot completely different.

And in case you marvel why it’s best to have a World Combination Bond as an alternative of a brief time period fastened earnings allocation these two years, this efficiency information might make you marvel if the lens that you simply view investments is simply too short-term focus, otherwise you imagine the present atmosphere will stay for the following 30 years.

I don’t suppose the traders in a World Combination Bond index ought to take into consideration switching to a Pimco GIS Revenue fund until they particularly see that they need a portfolio of 100% fastened earnings for earnings wants.

However you’ll at all times have this lingering query once you put money into energetic funds that carry out so nicely just like the Pimco GIS Revenue fund: If it does nicely prior to now, will it proceed to do nicely? The previous information exhibits that managers do change typically and the way seemingly will the nice supervisor reside throughout the time you’re invested in such a fund?

If you wish to commerce these shares I discussed, you possibly can open an account with Interactive Brokers. Interactive Brokers is the main low-cost and environment friendly dealer I take advantage of and belief to take a position & commerce my holdings in Singapore, the US, London Inventory Trade and Hong Kong Inventory Trade. They mean you can commerce shares, ETFs, choices, futures, foreign exchange, bonds and funds worldwide from a single built-in account.

You’ll be able to learn extra about my ideas about Interactive Brokers in this Interactive Brokers Deep Dive Collection, beginning with how you can create & fund your Interactive Brokers account simply.