$1.403 mil Daedalus Revenue Portfolio Replace – April 2025

Right here is the replace for my Daedalus portfolio for April 2025. If work just isn’t too busy, I’ll attempt to present an replace the place doable.

I clarify how I constructed this portfolio in Deconstructing Daedalus Revenue Portfolio. You won’t perceive what I wrote beneath for those who haven’t learn this submit.

All my private planning notes comparable to revenue planning, insurance coverage planning, funding & portfolio building will likely be underneath my private notes part of this weblog. You may as well discover the previous updates within the part.

Portfolio Change Since Final Replace

The portfolio was valued at $1.456 million on the finish of March and is at $1.413 million on the finish of April.

We reported a portfolio change of $43,000 for April 2025.

As of fifth Could 2025, the portfolio is valued at $1.403 million.

Listed here are the first safety holding returns for the month-to-date and year-to-date:

The desk that reveals the fund holdings denotes the month-to-date and year-to-date efficiency of the funds that I personal, towards Main Index ETFs. The Main Index ETFs is current to match the efficiency. I don’t personal the main index ETFs per say simply to be clear.

The returns of all funds are in USD. This consists of the efficiency of the Dimensional funds, which I exploit the returns of the USD share class in order that the returns are comparable. I’ve additionally listed the main index ETF efficiency for comparability.

Everyone knows what occurred in April so I received’t repeat. In case you check out month-to-month value charts, there are a number of hammers this month as a result of costs went down like 10-15% and went up virtually 10-15%.

World, World + Rising Markets, Rising Markets, Mixture Bonds and Quick-term fastened revenue all did higher than the funds 100% US focus.

The principle drag to the portfolio is USSC, which was down 4.5%. AVGS, or the Avantis World Small Cap Worth and Dimensional World Focused Worth did barely higher as a result of 30% of AVGS is in worldwide small cap with Japan and UK being bigger proportions and so they have executed nicely. We are able to use the identical clarification to attribute the higher efficiency of World Focused Worth as nicely.

Avantis Rising Markets, or AVEM proceed to do higher than the EIMI index, reveals that worth and profitability work very nicely within the Rising Markets. Rising Markets Small Cap additionally did higher for the month.

The portfolio misplaced 2.80% because of the weakening USD towards the SGD.

Position of Portfolio

The purpose of the portfolio is to offer constant, inflation-adjusted revenue for my important and primary spending. The portfolio is sized based mostly on a conservative 2.0-2.5% Preliminary Secure Withdrawal Price (SWR) in order that the revenue can final even contemplating difficult historic sequences such because the Nice Melancholy, exterior struggle and 30 years of excessive inflation averaging 5.5-6% p.a.

The timeframe that the revenue stream to be deliberate for: 60 years to Perpetual

I’m presently not drawing down the portfolio.

For additional studying on:

- My notes relating to my important spending.

- My notes relating to my primary spending.

- My elaboration of the Secure Withdrawal Price: Article | YouTube Video

Based mostly on present portfolio worth, the quantity of month-to-month passive revenue that may be conservatively generated from the portfolio is

The decrease the SWR, the extra capital is required, however the extra resilient the revenue is.

Nature of the Revenue I Deliberate for

Totally different revenue methods offers you completely different traits of revenue streams. They are often extra constant or unstable, inflation-adjusted or non-inflation-adjusted, for restricted period or perpetual.

An revenue stream based mostly on the Secure Withdrawal Price framework is constant and inflation-adjusted, and if we use a low preliminary Secure Withdrawal Price of two.0-2.5%, the revenue stream leans in direction of a protracted period to perpetual.

Here’s a visible illustration of how the revenue stream will likely be based mostly on the present portfolio worth:

The revenue for the preliminary yr relies on a 2% Secure Withdrawal Price. The revenue for subsequent years relies on the inflation fee within the prior yr (confer with the underside pane of inflation within the earlier yr). If the inflation is excessive, the revenue scales up and if there’s deflation, the revenue is diminished.

Funding Technique & Philosophy

After making an attempt my finest to discover ways to make investments for some time, the portfolio expresses my ideas about investing at this level.

The portfolio is run in a

- Strategic: allocation doesn’t change by short-term occasions.

- Systematic: guidelines/decision-tree-based applied both myself or an exterior supervisor.

- Low-cost: funding implementation price is saved fairly low each on the fund degree and in addition on the custodian degree.

- Passive: I spend comparatively little effort mentally contemplating investments and in addition action-wise.

You possibly can learn extra on this be aware article: Deconstructing Daedalus My Passive Revenue Funding Portfolio for My Important & Primary Spending.

Portfolio Change Since Final Replace (Normally Final Month)

There have been zero strikes within the month.

Present Holdings – By Greenback Worth and Percentages

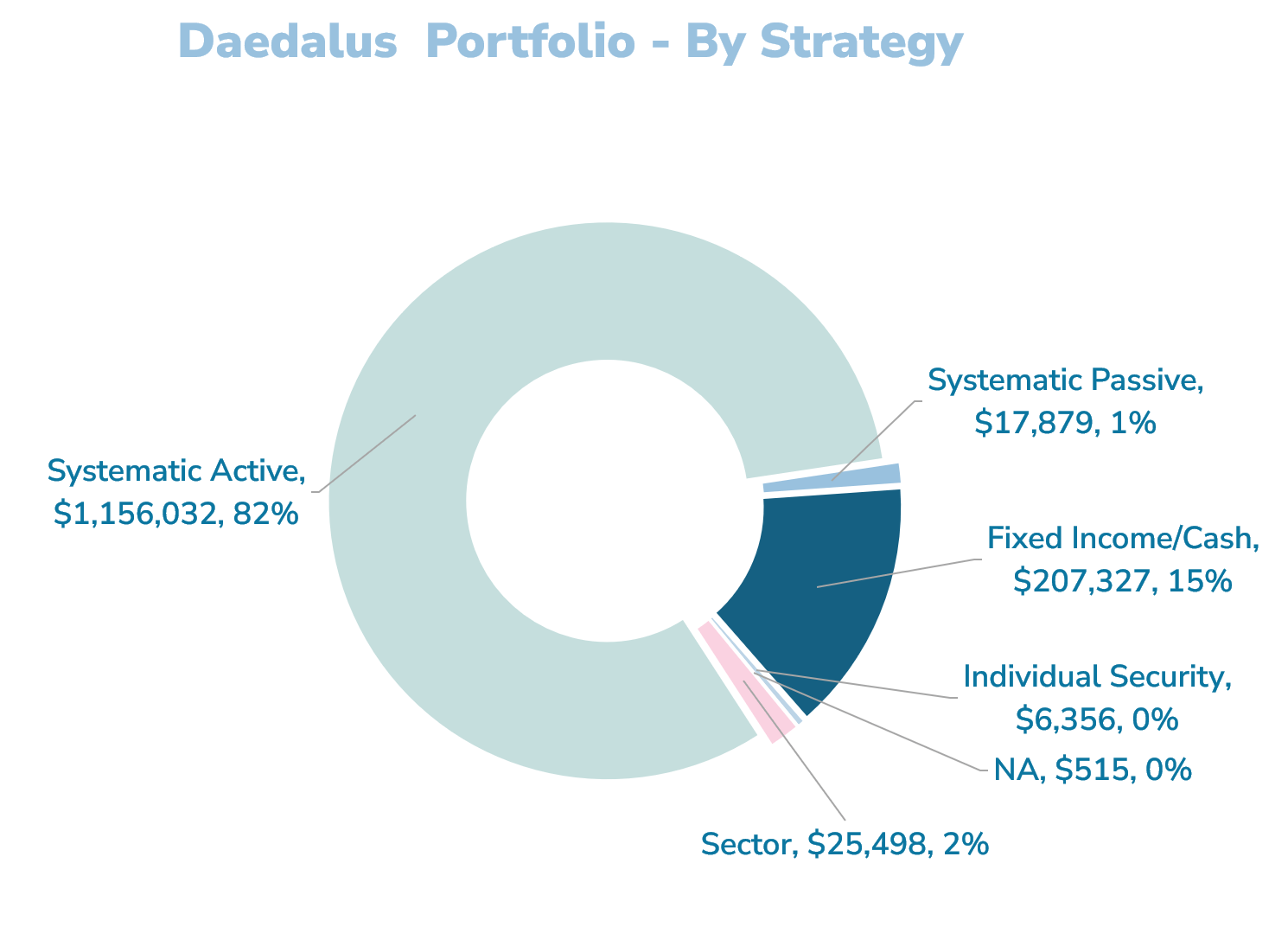

The next desk is grouped based mostly on common technique, whether or not they’re:

- Mounted Revenue / Money to cut back volatility.

- Systematic Passive, which tries to seize the market danger in a scientific method.

- Systematic Energetic, which tries to seize numerous confirmed danger premiums comparable to worth, momentum, high quality, excessive profitability, and dimension in a scientific method.

- Lengthy-term sectorial positions.

Portfolio by Account Location

Portfolio by Area of Securities

Portfolio by Fund, Money or Particular person Safety

Portfolio by Technique.

Principal Custodians

The present custodians are:

- Money: Interactive Brokers LLC (not SG)

- SRS: iFAST Monetary

If you wish to commerce these shares I discussed, you possibly can open an account with Interactive Brokers. Interactive Brokers is the main low-cost and environment friendly dealer I exploit and belief to take a position & commerce my holdings in Singapore, the USA, London Inventory Change and Hong Kong Inventory Change. They will let you commerce shares, ETFs, choices, futures, foreign exchange, bonds and funds worldwide from a single built-in account.

You possibly can learn extra about my ideas about Interactive Brokers in this Interactive Brokers Deep Dive Collection, beginning with tips on how to create & fund your Interactive Brokers account simply.