Sure, Diligent Singaporeans with Modest Salaries Can Grow to be CPF Millionaires — If…

Chuin Ting from MoneyOwl bought on a podcast to debate a put up they did whether or not you can turn out to be a CPF Millionaire even should you don’t high up your CPF:

It may be motivating to know that you might have $1 million in your CPF by the point that you’re close to your retirement at 65 years outdated. We can’t simply see it as a result of firstly, our impression of the development is closely influenced by how we’re acquainted with one thing and normally our first impression is once we are younger, and comparatively low in revenue to our later years.

It is just someplace within the later years that almost all grew to become extra severe, both:

- As a result of we’re searching for methods to scale back our taxable revenue, forcing us to be taught extra concerning the system.

- We’re nearer to the age the place we are able to entry to the cash.

- The cash is extra substantial that we ponder if we’re doing a superb job managing it.

The MoneyOwl staff simulated the CPF development if a graduate begins off with salaries of $2,400, $2,900 and $4,000 month-to-month. These are the median beginning wages of ITE, polytechnic and college graduates respectively.

All three can have $1 million in CPF individually by 65 years outdated.

I feel the naysayers will retort: “What are you able to do with $1 million in 20-40 years time?”

That’s legitimate level, and if that’s not sufficient, you higher do higher in life to complement that $1 million since you appear to assume you want greater than that a number of a long time later.

The extra essential level is that if we don’t let you know, does this $1 million determine come simply to you if you consider your accumulation journey? Personally, I didn’t even ponder about this a lot as a result of most of my focus has been on the money portion of my portfolio.

If there’s one flaw on this evaluation, it’s that many Singaporeans use their CPF peculiar account to fund their mortgage.

This is without doubt one of the purpose most may by no means assume how a lot their CPF can accumulate to. For those who think about the mortgage cost, might you be a CPF millionaire?

That’s one thing for me to work on subsequent time, if I’ve extra bandwidth.

For now, you would need to dwell with my humble instance.

Kyith for one, by no means high up his CPF ever.

Once we say high up there are two kinds:

- The Retirement Sum Prime Up or RSTU for brief. Yearly, you possibly can high up $8,000 (was once $7,000) to your CPF SA or MA (in any combi) to get pleasure from tax aid. You too can high up $8k to your selective love ones to get pleasure from additional tax aid.

- Voluntary Contribution Prime as much as all 3 Accounts or VC3A for brief. In case your CPF contribution is lower than $37,740 for the yr, you possibly can high as much as that quantity, not for tax aid however to spice up extra into your CPF.

These two methods, along with the outdated high as much as your Medisave account, are methods you might put extra money into your CPF to fatten it.

I’m by no means one to think about placing extra in as a result of:

- For many of my profession, I by no means earn excessive sufficient wage to think about RSTU to be viable for tax aid. I simply pay the taxes.

- I worth the liquidity for the cash.

- If I understand how to speculate, my alternative value shouldn’t be 2.5%, or 4% p.a. however a better hurdle charge. So why would I discover the CPF returns to be so attractive?

- The cash locked within the CPF can solely be entry at 55, which is such a very long time to a 30 yr outdated.

The one high up I did was to switch about $40,000 later in my life from my CPF Abnormal Account to my Particular Account after I notice most certainly, I don’t want the cash for housing so what the heck.

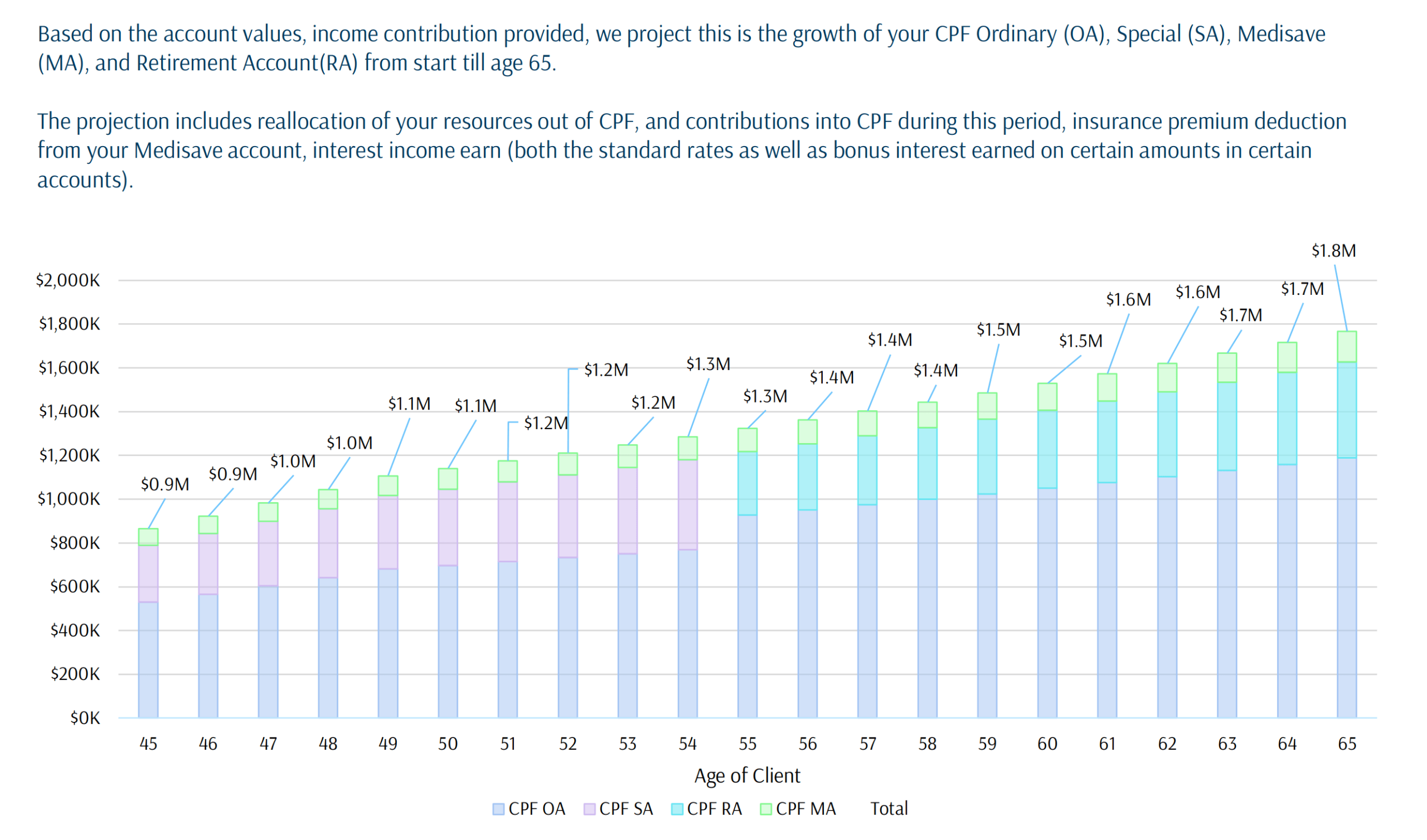

The chart above is taken from an inside CPF Projector and it exhibits the development in my CPF account values from now (age 45) until 65. I’ve a modified model of our CPF Projector in comparison with the one our Providend purchasers will see of their report however the math behind how the numbers are computed is identical.

It’s simply that I favor to generally see issues in chart kind reasonably than a desk filled with numbers. I feel my common contributions to my CPF have been averaging round $25,000 or so. Positively not the total $37,000 that some actively sought to high up.

Listed below are the precise numbers. It additionally type of means by the point I’m 55, the Full Retirement Sum is near $289,000.

What can also be essential is to determine the buying energy of the stream of CPF LIFE revenue as we speak. I feel I could have a extra distinctive means of viewing the annuity stream evaluate to different folks. Whereas others prefer to undertaking their bills to the age of 65 by way of inflation adjustment, I simply work out the buying energy of that revenue stream as we speak.

It’s about $1.2k to $1.3k month-to-month and should you want to know the revenue if you wish to self handle the inflation, it is going to be nearer to $1k.

So in case you are somebody who has reached Full Retirement Sum in your CPF, you possibly can take into consideration your spending in these three revenue figures. How a lot of your spending are you able to squeeze into this month-to-month determine. For those who felt that this isn’t sufficient, you may must high up extra!

Truthfully, the numbers shocked me. And since I’ve calculated the numbers for different employees, they have been additionally shocked by the numbers. Why is that?

I feel numbers are simply stunning as a result of we gained’t absolutely comprehend issues till we see it. I’ve sufficient experiences the place the precise numbers grew to become extra optimistic or pessimistic than I initially think about that I’d reasonably see the precise numbers earlier than commenting.

And I feel there’s an excessive amount of dialogue concerning the Kungfu of various top-up and all types and not sufficient concentrate on how a lot it might have grown to.

If you realize that by staying employed, you might have this a lot (even when it isn’t $1 million) would you assume otherwise about your cash in your CPF? Would you may have different deeper questions on it?

I feel some would.

Assume my colleague Jiamin shall be very upset with me for not factoring in mortgage.

You aren’t with out choices should you use your CPF Abnormal Account to service your mortgage. You are able to do a Voluntary Housing Refund or VHR for brief, the place you possibly can put an equal quantity of what you may have taken from the CPF again into your CPF Abnormal Account. That is most likely the one option to put cash into your CPF Abnormal Account. This can be a selection that Singaporeans need to make. Those that dump their properties will even see a part of their proceeds when it comes to the capital and accrual curiosity return to their CPF, so that can carry them again to parity with Singles corresponding to Kyith who didn’t use their CPF to pay for housing.

I feel I’ll depart it for the subsequent article if I’ve the time to determine this out. I’ll depart my feedback after I see the mathematics. Once more, the numbers may shock us.

Lastly, we couldn’t have construct such a complete CPF Projector for our purchasers if not for a number of useful souls alongside the way in which. I wish to thank Chris Tan, Lena Teng, Eddy Cheong and Tan Chong Hwee for serving to me alongside the way in which.

If you wish to commerce these shares I discussed, you possibly can open an account with Interactive Brokers. Interactive Brokers is the main low-cost and environment friendly dealer I take advantage of and belief to speculate & commerce my holdings in Singapore, the US, London Inventory Alternate and Hong Kong Inventory Alternate. They let you commerce shares, ETFs, choices, futures, foreign exchange, bonds and funds worldwide from a single built-in account.

You may learn extra about my ideas about Interactive Brokers in this Interactive Brokers Deep Dive Sequence, beginning with the right way to create & fund your Interactive Brokers account simply.