Shares: Continued Promote-off on Tariffs

April 4, 2025 (Investorideas.com Newswire) Will the S&P 500 discover a short-term backside after opening a lot decrease once more?

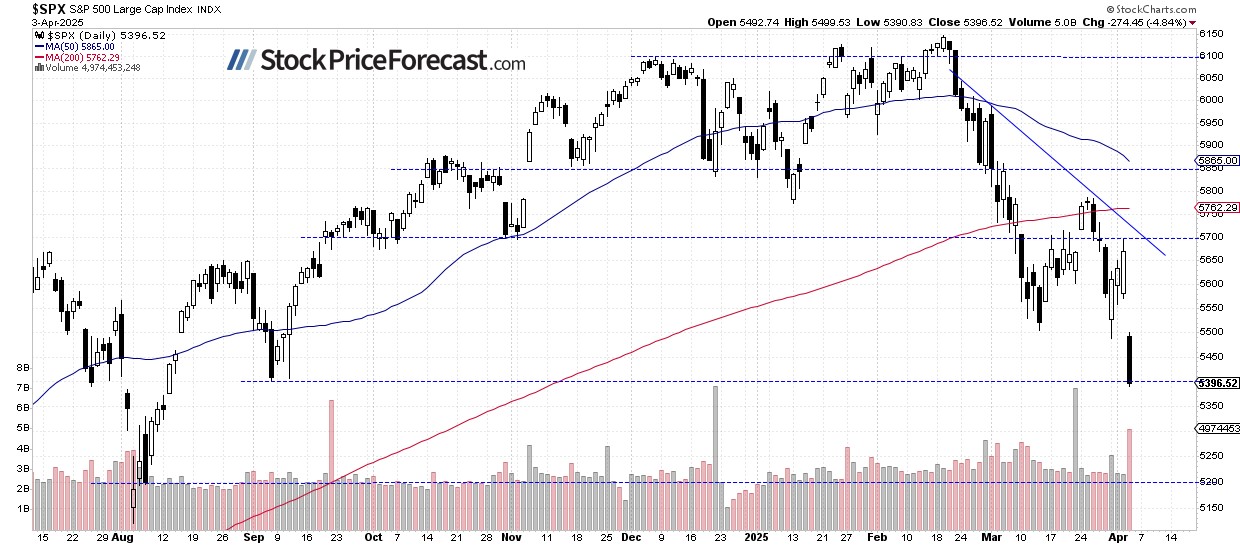

The S&P 500 plummeted 4.84% on Thursday, crashing under the 5,400 stage as traders reacted to the Trump tariff announcement. The index is now buying and selling at its lowest ranges since August, with futures indicating one other 2.7% drop at as we speak’s open following China’s retaliatory tariff announcement. Technical injury has been extreme, with a number of assist ranges violated.

This morning’s higher-than-expected Nonfarm Payrolls launch (+228,000) has had minimal impression on market sentiment amid the tariff considerations.

Investor sentiment has considerably worsened, as proven within the Wednesday’s AAII Investor Sentiment Survey, which reported that 21.8% of particular person traders are bullish, whereas 61.9% of them are bearish.

The S&P 500 is anticipated additional speed up its sell-off, as we will see on the day by day chart.

Nasdaq 100: Breaking Beneath Key Helps

The tech-heavy Nasdaq 100 plunged 5.41% on Thursday, accelerating its downtrend towards the 18,500 stage – its lowest level since early September. The index is anticipated to open 3.0% decrease as we speak, with the subsequent assist stage round 18,000.

VIX Spikes to 30

The VIX index surged to 30.02 yesterday, reflecting panic-level concern available in the market.

Traditionally, a dropping VIX signifies much less concern available in the market, and rising VIX accompanies inventory market downturns. Nevertheless, the decrease the VIX, the upper the chance of the market’s downward reversal. Conversely, the upper the VIX, the upper the chance of the market’s upward reversal.

S&P 500 Futures Contract Continues Promoting Off

This morning, the S&P 500 futures contract is buying and selling under the 5,300 stage after extending its sell-off on China’s tariff announcement. Present resistance is round 5,400, with potential assist at 5,200.

Conclusion

The inventory market has accelerated its downtrend considerably as traders value within the extreme escalation in world commerce tensions. Key assist ranges have been violated, confirming substantial technical injury throughout main indices. Regardless of this adverse value motion, the intense bearish sentiment readings and VIX spike recommend we could also be approaching a short-term backside that would ultimately result in a reduction rally.

This is the breakdown:

- The S&P 500 continues its sharp sell-off following Trump’s tariff announcement and China’s retaliation.

- Whereas no optimistic indicators are evident but, shares could also be nearing a possible short-term backside

- For my part, the short-term outlook is impartial.

The total model of as we speak’s evaluation – as we speak’s Inventory Buying and selling Alert – is greater than what you learn above, and it contains the extra evaluation of the Apple (AAPL) inventory and the present S&P 500 place. I encourage you to subscribe and skim the main points as we speak (with a single-time 7-day free trial). Inventory Buying and selling Alerts are additionally part of our Diamond Bundle that features Gold Buying and selling Alerts and Oil Buying and selling Alerts.

And in the event you’re not but on our free mailing listing, I strongly encourage you to hitch it – you may keep up-to-date with our free analyses that may nonetheless put you forward of 99% of traders that do not have entry to this info. Be part of our free inventory publication as we speak.

Thanks.

Paul Rejczak

Inventory Buying and selling Strategist

Extra Data:

Disclaimer/Disclosure: Investorideas.com is a digital writer of third social gathering sourced information, articles and fairness analysis in addition to creates unique content material, together with video, interviews and articles. Unique content material created by investorideas is protected by copyright legal guidelines apart from syndication rights. Our website doesn’t make suggestions for purchases or sale of shares, providers or merchandise. Nothing on our websites ought to be construed as a suggestion or solicitation to purchase or promote merchandise or securities. All investing entails threat and potential losses. This website is presently compensated for information publication and distribution, social media and advertising and marketing, content material creation and extra. Disclosure is posted for every compensated information launch, content material revealed /created if required however in any other case the information was not compensated for and was revealed for the only real curiosity of our readers and followers. Contact administration and IR of every firm straight concerning particular questions.

Extra disclaimer data: https://www.investorideas.com/About/Disclaimer.asp Study extra about publishing your information launch and our different information providers on the Investorideas.com newswire https://www.investorideas.com/Information-Add/

International traders should adhere to rules of every nation. Please learn Investorideas.com privateness coverage: https://www.investorideas.com/About/Private_Policy.asp