Ethereum MVRV Ratio Nears 160-Day MA Crossover – Accumulation Development Forward?

Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum is as soon as once more below heavy promoting strain after dropping the crucial $2,000 stage — a psychological and technical zone that bulls have struggled to defend in current weeks. With worth motion turning more and more bearish, investor sentiment is weakening, and analysts are warning {that a} deeper correction could also be on the horizon. As Ethereum slides decrease, considerations are rising throughout the broader crypto market, which regularly depends on ETH’s energy to steer restoration phases.

Associated Studying

The present scenario is each tense and delicate. Ethereum’s incapacity to carry key assist ranges has rattled short-term holders and is now testing the resolve of long-term buyers. Many are actually carefully expecting any indicators of stabilization or contemporary accumulation.

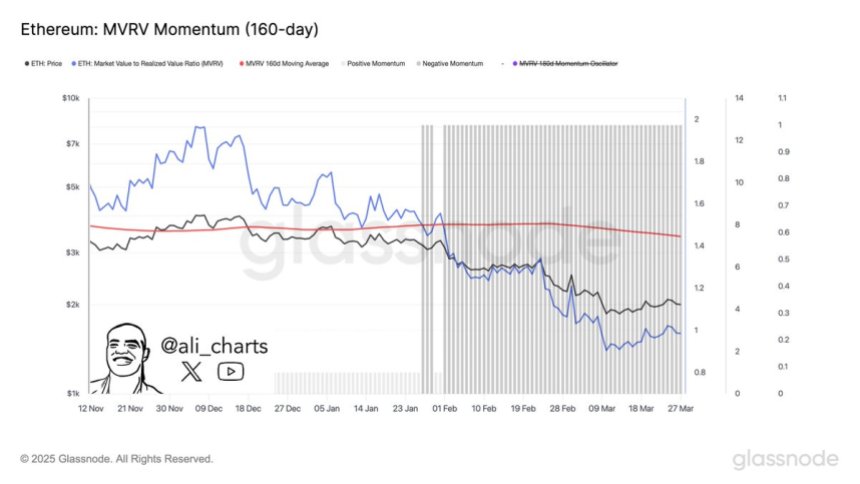

One promising on-chain sign comes from Glassnode’s MVRV (Market Worth to Realized Worth) metric. Traditionally, a crossover of the MVRV ratio above its 160-day transferring common has marked the start of sturdy Ethereum accumulation zones — usually previous vital worth rebounds. That sign is now approaching as soon as once more, and if confirmed, it may provide a glimmer of hope to bulls ready for a shift in momentum. Till then, Ethereum stays in a fragile state.

Ethereum Faces Essential Breakdown As Accumulation Sign Nears

Ethereum is now in a crucial place, with bulls persevering with to lose management as key assist ranges break one after the other. Promoting strain has intensified over the previous few weeks, dragging ETH additional into a chronic downtrend that started in late December. Macroeconomic uncertainty, rising rates of interest, and heightened international tensions proceed to create a hostile surroundings for threat belongings — and the crypto market has felt the affect most severely.

Presently, Ethereum is buying and selling 55% beneath its native excessive of $4,100, reached earlier this cycle. The sharp decline has shaken investor confidence, and the continued breakdown in worth construction leaves little room for error. With no swift restoration and robust protection of assist zones, Ethereum dangers additional draw back, with analysts warning of continued weak spot if sentiment doesn’t shift quickly.

Amid the decline, some analysts are watching carefully for indicators of a possible backside. Prime analyst Ali Martinez shared a key perception on X, pointing to the MVRV (Market Worth to Realized Worth) ratio as a dependable indicator of accumulation zones. In response to Martinez, when the MVRV ratio crosses above its 160-day transferring common, it has traditionally marked sturdy accumulation phases — moments when long-term buyers start quietly positioning for the subsequent leg larger.

This crossover has not but occurred, however it’s approaching. If confirmed, it may sign that Ethereum is coming into a high-value zone regardless of the present bearish situations. Whereas the market stays fragile, such on-chain metrics provide a glimmer of hope that accumulation is quietly underway — whilst worth motion continues to look weak on the floor. Bulls might want to act rapidly to reverse the pattern, however for now, Ethereum’s outlook stays on edge.

Associated Studying

Bulls Defend Essential $1,800 Help

Ethereum is buying and selling at $1,830 after struggling a pointy 14% drop since final Monday, reflecting renewed promoting strain throughout the crypto market. The steep decline has pushed ETH towards a crucial assist stage at $1,800 — a zone that now stands as a must-hold for bulls. This stage has traditionally acted as a robust pivot level, and dropping it may set off a deeper correction.

If ETH fails to carry above $1,800, the subsequent vital assist lies close to the $1,500 zone, which might mark a dramatic shift in market construction and sure speed up bearish sentiment. A breakdown to this stage would erase a lot of the yr’s beneficial properties and deal a critical blow to investor confidence.

Nevertheless, if bulls handle to defend $1,800 efficiently, a rebound may comply with, probably pushing ETH again above the $2,000 mark. Reclaiming this psychological stage would assist restore momentum and open the door for a broader restoration.

Associated Studying

The following few days shall be essential for Ethereum’s short-term outlook. With macroeconomic uncertainty nonetheless looming, bulls should step in with conviction — as a result of if $1,800 breaks, the autumn might be quick and steep.

Featured picture from Dall-E, chart from TradingView