Understanding US Withholding Taxes for Non-US Individuals with Very Skilled Interactive Brokers CPA (for Singaporean Buyers)

I attended a Webinar hosted by Interactive Brokers on Wednesday/Thursday morning.

I can’t do not forget that nicely as a result of it takes place at 12 midnight Singapore time and lasted round 1.5 hours.

However I feel it’s fairly an insightful presentation as a result of I can detect how enthusiastic Nancy Nelson, the CPA at Interactive Dealer needs to assist us make sense. Nancy has been in accounting for the previous 40 years, and with Interactive Brokers for the previous 15 years.

She attempt to clarify the earnings tax issues for Non-US Individual. Sadly, she didn’t cowl property taxes (which she referred to as a really advanced subject. Nancy additionally tries to elucidate the aim of the Type 1042S, which try to be inform that you simply obtain, and the W-8BEN type that we crammed up so regularly. This actually assist me perceive the spirit behind these type in order that i can interpret them higher.

We don’t must motion upon the Type 1042S as a result of as Singaporeans, we don’t must reclaim again any earnings taxes attributable to our abroad investments. Nonetheless, in case you are dwelling in a rustic with a Tax Treaty to the US, the Type 1042S could also be helpful so that you can offset your house taxes.

Additionally it is fairly insightful to listen to how several types of money flows have been lined.

Nancy assist us perceive that there’s a distinction between declaring and being taxed. Placing it within the type is a declaration however you wouldn’t be taxed. Conversely, in the event you select to not declare, Nancy additionally clarify the repucussions.

I listened to the Webinar once more and supply the next notes. In case you have any tax questions, Nancy could possibly show you how to. You possibly can e-mail the inquiries to [email protected].

I prefer to thank the parents at Interactive Brokers for taking good care of their non-US, worldwide purchasers with such assist. It’s the little issues like this that tells us whether or not a service firm needs to type a deeper relationship with us with webinars which are very relevant to a distinct segment group of their purchasers.

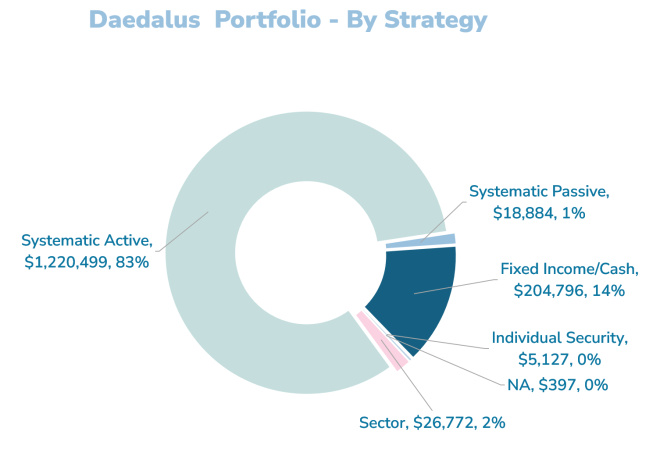

It is among the cause why their the popular custodian for my earnings portfolio Daedalus. In case you are in search of a low-cost dealer that allows you to commerce many, many exchanges world wide, which were working for a very long time, with close to spot forex alternate, do examine Interactive Brokers out.

US Individual Versus a Non-US Individual

Whether or not you’re based mostly abroad or within the US, you can be subjected to a US world-wide taxation guidelines. Which means if a US individual decides to retire and go reside in Spain, he would nonetheless must file US taxes.

In case you are a authorized resident of US:

- Doing a job on a piece visa.

- Inexperienced card holder.

You might be additionally thought of as a US individual and you’re liable to US taxes. This webinar doesn’t apply to you.

Particular conditions:

- International scholar within the US on a scholar visa.

- Worker of a international authorities (Embassy, World Financial institution, UN)

- Entertainers and athletes, incomes earnings 30 days or much less.

You’ll stay as a non-US individual. In case you are entertainers and athletes that earn 30 days or extra, you pay earnings tax for that 12 months.

It’s good to trace:

- How lengthy you’re employed within the US.

- How a lot you earn.

What We Have to Know in regards to the Tax Cuts and Jobs Act (TCJA)

TCJA is a change in tax guidelines in 2017. The final change previous to this modification was in 1986.

TCJA is about to run out on the finish of 2025.

Nancy thinks that it will have an effect on the US Individual it stays to be seen if it will have an effect on the non-US Individual. Maybe tax treaties will likely be amended or created. The best potential is the present 30% withholding tax for non-US Individual in case you are dwelling in a non-treaty nation.

Up to now this withholding tax was 35% or larger.

No matter congress do needs to be income impartial which implies that in the event that they cut back income at one place, they’ve to extend income at one other place. Withholding tax is one thing that have an effect on the US folks much less and subsequently could also be a better potential goal.

The charges with international locations that the US have with tax treaties are more durable to vary and probably much less doubtless.

Nancy suppose that these cross-border employees equivalent to US employees to Canada/Mexico and vice versa may additionally be affected however not a subject for as we speak.

The Webinar Focus Solely on Funding Revenue and Not Different Taxes equivalent to Property Taxes (Type 1042S)

The webinar is extra give attention to the earnings that’s offered in a Type 1042S.

For Interactive Brokers purchasers, you’d have obtained this type 1042S robotically.

You possibly can go to your Aspect Bar in your Cell Utility, underneath Statements & Tax, Obtain Tax Varieties,

Why We Have to Fill Our W-8BEN Type

After we first open our brokerage accounts, people like us are advised to refill a W-8BEN type if we want to put money into US securities. There are completely different types if we’re partnerships, associations, companies and trusts. Nancy thinks that the opposite types will be tough to fill out accurately.

The W-8BEN type tells Interactive Brokers, or every other US Establishments your standing. It establishes your tax residence nation, whether or not you’re in a tax treaty nation and eligible for treaty advantages.

This way is for Interactive Brokers to fulfill their compliance to the Know Your Buyer (KYC) rule.

The W8-BEN type additionally tells FATCA ( International Account Tax Compliance Act) who to share the knowledge with. You would want to maintain the shape up to date.

Your W-8BEN type stays with Interactive Brokers. This way shouldn’t be despatched to the Inner Income Service (IRS). Your data is for IBKR to know extra about you and never for the IRS.

FATCA – What If You Determine to not Declare

This subsequent slide present the true intentions of FATCA:

FATCA is 15 years previous and almost certainly not going away quickly.

Nancy describes what occurs in the event you determined to not reveal a lot data. If you don’t declare your tax standing, the US tax authorities will put a withholding tax (at the moment 30%) on every thing.

For instance, in the event you reside in Spain which is a treaty nation. not declaring will provide you with 30% tax as a substitute of 15% tax.

Should you make a capital acquire in your securities, usually you gained’t be taxed in the event you declare your standing, but when you don’t, they’ll tax you 30% on the proceeds from the sale.

What’s Subjected to US Tax Withholding

Financial savings Pursuits:

- Pursuits earned from checking account. You possibly can take into account curiosity earn on cash from a US financial institution.

Funding Pursuits:

- From company bonds.

- US Treasuries.

- Business paper.

- Pursuits earned from an funding account. Your IBKR is taken into account as an funding account and subsequently not subjected to withholding taxes.

Funding curiosity is NOT subjected to withholding tax whereas financial savings curiosity is.

Funds in lieu happens in case you are a part of a inventory mortgage program. Somebody borrows a inventory and as a substitute of getting a dividend, you’re going to get a funds in lieu. Thus, it’s a completely different type of dividends.

Inventory mortgage charges are funds you get for loaning out your shares. That is generated by Interactive Brokers and never by their clients however are subjected to withholding.

The Withholding Tax Price

They won’t maintain withholding on features or proceeds from sale in the event you correctly declared in your W-8BEN.

Right here is the hyperlink to the listing of Nations with Tax Treaties with the US.

Most treaty international locations are 15%.

Direct enterprise earnings arises in case you have offered seed cash to your cousin’s enterprise within the US and your cousin have paid you one thing again. That is tax as enterprise earnings at 37% and needs to be filed by your cousin.

When Apple pays you a dividend, it’s credited to your account by Interactive Brokers. You will notice the dividends coming in and on the identical time the tax withholding going out. You get a web cost.

Reclassified funds: This happens extra for mutual funds (unit belief) and fewer with company funds. If a dividend is reclassified as a return on capital, the withholding tax will likely be refunded to you.

As soon as they concern you the Type 1042S, Interactive Brokers can’t refund you the withholding tax anymore.

Establishments remit the withholding taxes on a Tuesday in the event that they obtained the dividends on a Friday for example.

Enterprise Revenue equivalent to Rental Properties

Extra About Your Type 1042S

Type 1042S is a type that can go to the IRS.

Distinctive type identifier is meaningless to us however one thing for IBKR and IRS.

Listed here are the codes underneath 1 Revenue Codes:

A few of the stuff right here like 01 – curiosity (funding) shouldn’t be subjected to withholding however it’s right here to establish what that is. There may be one other part that can clarify that this earnings shouldn’t be subjected to withholding.

30 – curiosity -original concern low cost: Associated to most well-liked shares. Zero coupon bonds additionally go right here.

31 – short-term unique concern low cost: Brief time period treasury bonds.

54: That is what Interactive Brokers declared in the event you didn’t declare your standing (and almost certainly every thing will likely be taxed at 30%).

06: These will likely be all our dividends from shares.

34: Mortgage out shares and also you get a substitute cost.

52 and 53: Similar as 54 in the event you didn’t declared correctly.

09 – Capital Features: In case you have capital features out of your mutual funds within the US, that’s not subjected to withholding taxes. Nancy shared that notably quick time period capital features have been subjected to withholding tax on and off up to now 15 years. That is probably the place a change might happen.

14: REITs, MLP earnings funds right here.

IRC 1446: Covers enterprise earnings earned within the US by a non-US Individual.

Playing winnings are subjected to Withholding Taxes!

36: These are long run capital features and these are NOT subjected to withholding taxes.

37: Return of capital can also be not subjected to withholding taxes.

04: Should you go to the US, chances are you’ll be exempted underneath this.

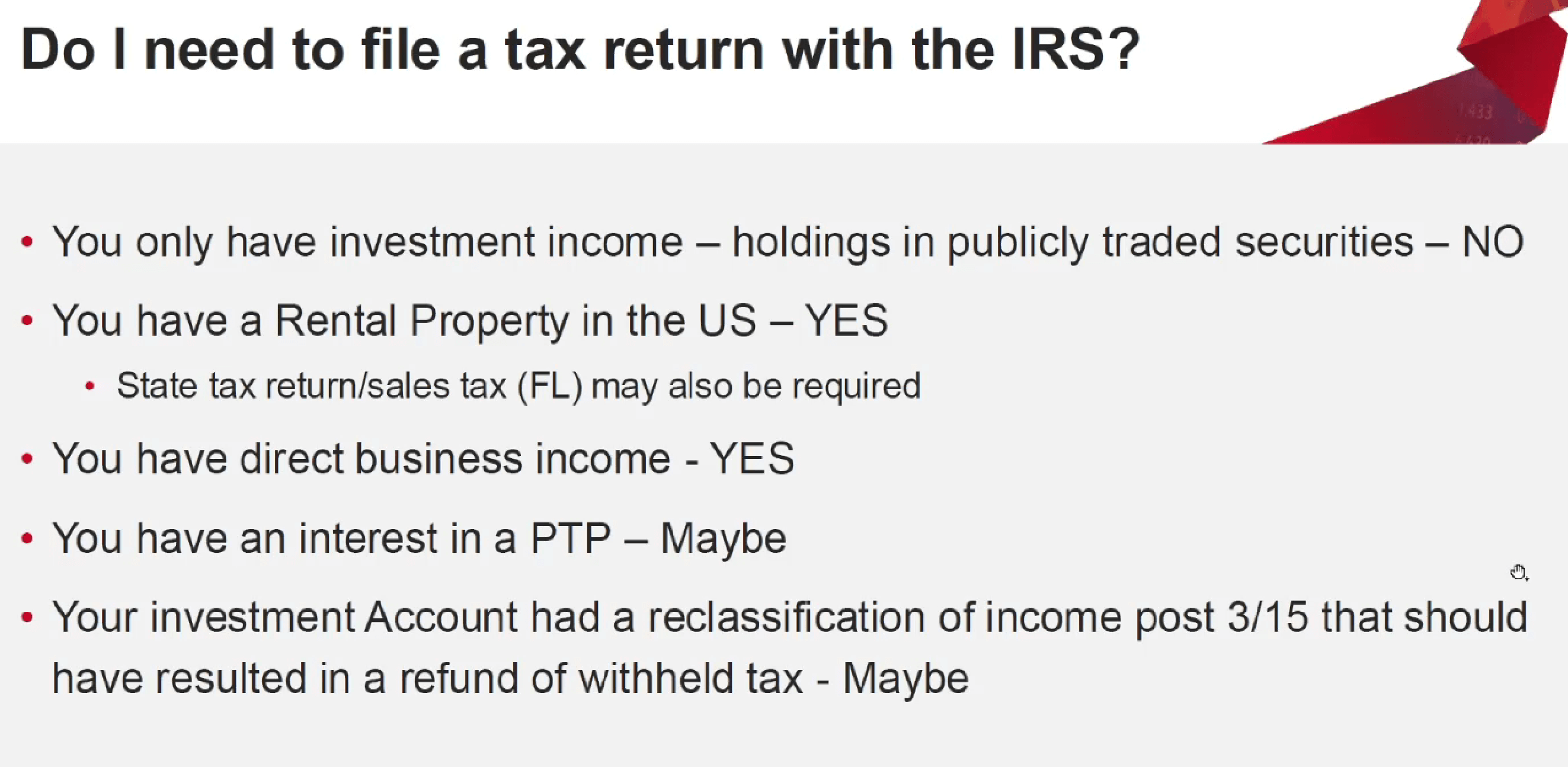

Do You Have to File Taxes?

I feel that is the slide that may make clear the questions of many. In case you are solely holding public traded securities then you definitely don’t have to take motion and file taxes.

When IBKR ready the Type 1042S, they’re already uploaded to the IRS.

For Non-US Individual Staying in Tax Treaty Nations

In case you are staying in a tax treaty nation, the Type 1042S will likely be helpful to get refunds from the taxes you pay in your house nation.

Withholding Taxes on ADR Shares

Case Research: Shell which is domiciled in Netherlands. The dividend withholding tax in Netherlands is 15%.

When a Shell ADR pays a dividend within the US, that tax is withheld in Netherlands earlier than that ADR dividend cost ever reaches the US.

IBKR by no means sees the withholding taxes paid to Netherlands. So if the dividends paid out is $100, IBKR will see $85.

If You Commerce Choices

The 1042S type will doubtless present funding curiosity for which there isn’t any withholding. You aren’t incomes any dividends in order that is probably not too relevant.

My Complete Interactive Brokers How-to Guides

Interactive Brokers is a superb low-cost, financially sturdy brokerage platform that may be the usual dealer for holding your long-term investments. You possibly can entry 150 world exchanges, together with exchanges equivalent to Singapore, the US, Hong Kong, London, European and Canada.

You’ll take pleasure in low cost commissions and nil minimal recurring platform charges or upkeep charges. Convert your funds to completely different currencies at near-spot charges, paying a flat US$2 payment.

To get began or grow to be accustomed to Interactive Brokers, try my previous articles on the best way to make investments with Interactive Brokers. I hope the guides make your life and investing expertise simpler and brighter.

An Straightforward Step-By-Step Information to Setup Interactive Brokers (IBKR)

Easy methods to Fund & Withdraw Funds from Your Interactive Brokers Account

Easy methods to Convert Currencies in Interactive Brokers

Easy methods to Purchase and Promote Shares and Securities on Interactive Brokers

How Aggressive are Interactive Brokers Commissions Pricing?

How Protected is it to Custodized Your Cash at Interactive Brokers? The issues they do higher than different brokers.

How Protected is it to Custodized Your Cash at Interactive Brokers (2)? Monetary power of IB throughout latest banking disaster and through Nice Monetary Disaster

Easy methods to commerce after-hours and premarket

Create Custom-made Stories and robotically ship them to your e-mail

Ship Cash from TransferWise to Interactive Brokers

Interactive Brokers’ Fluid Curiosity Revenue on Money

Introducing IMPACT by Interactive Brokers