Technique’s Bitcoin holdings attain new excessive

Key Takeaways

- Technique broke the five hundred,000 BTC threshold following final week’s 6,911 buy.

- The acquisition was funded by the corporate’s Widespread ATM and STRK ATM initiatives.

Share this text

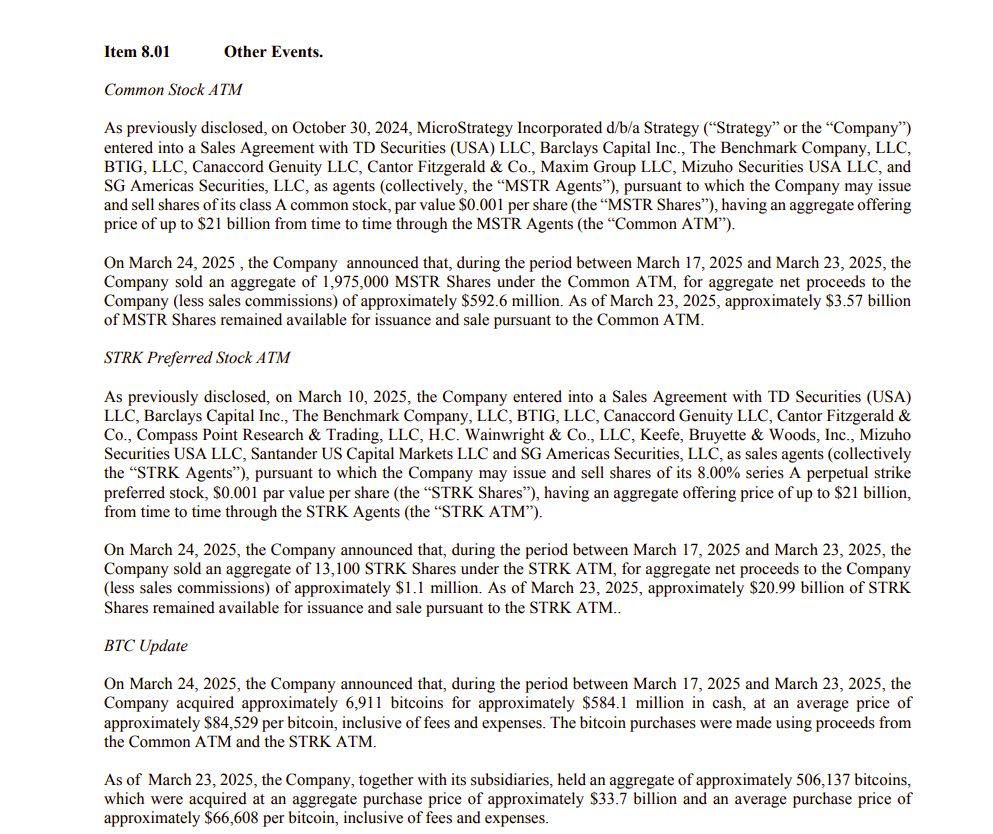

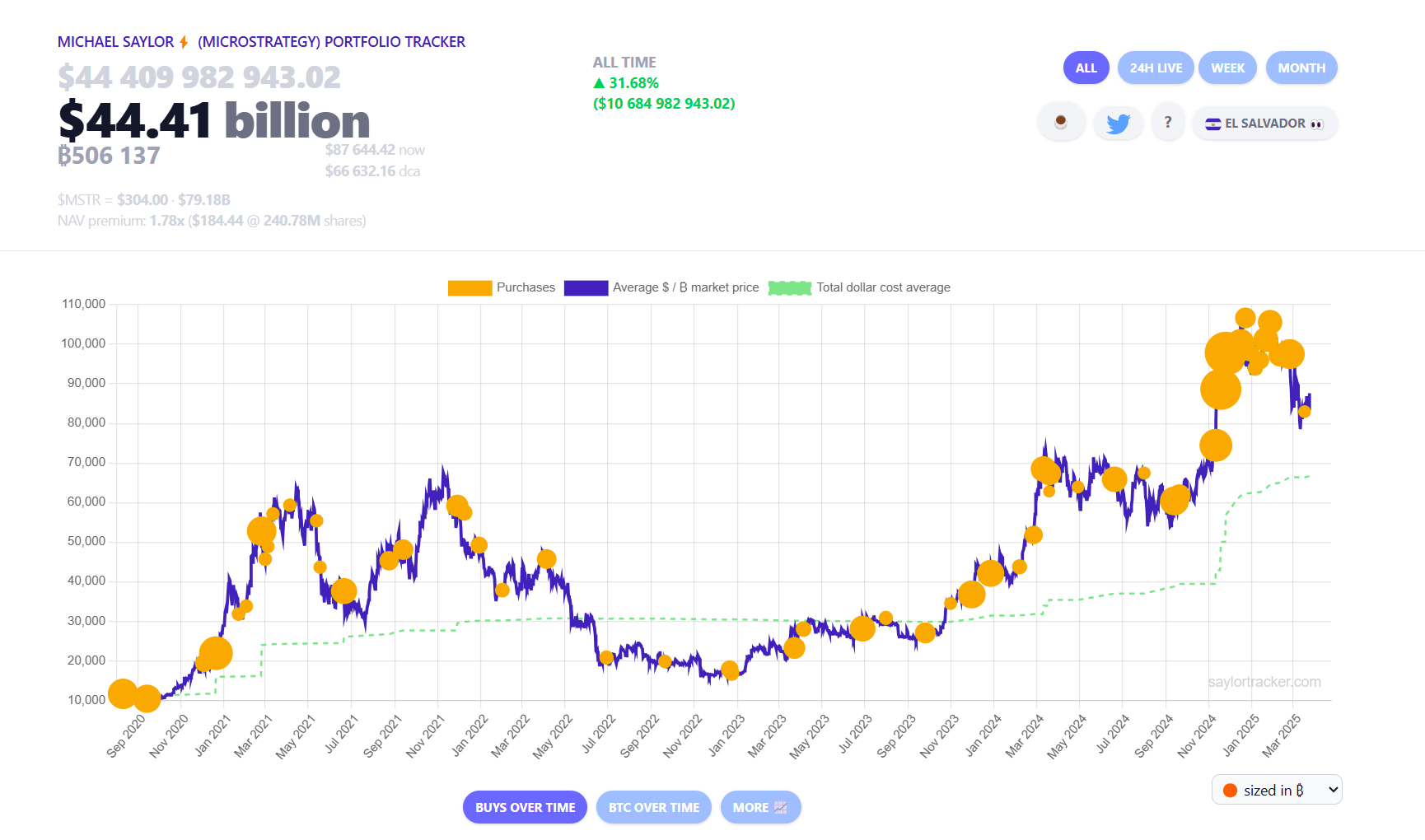

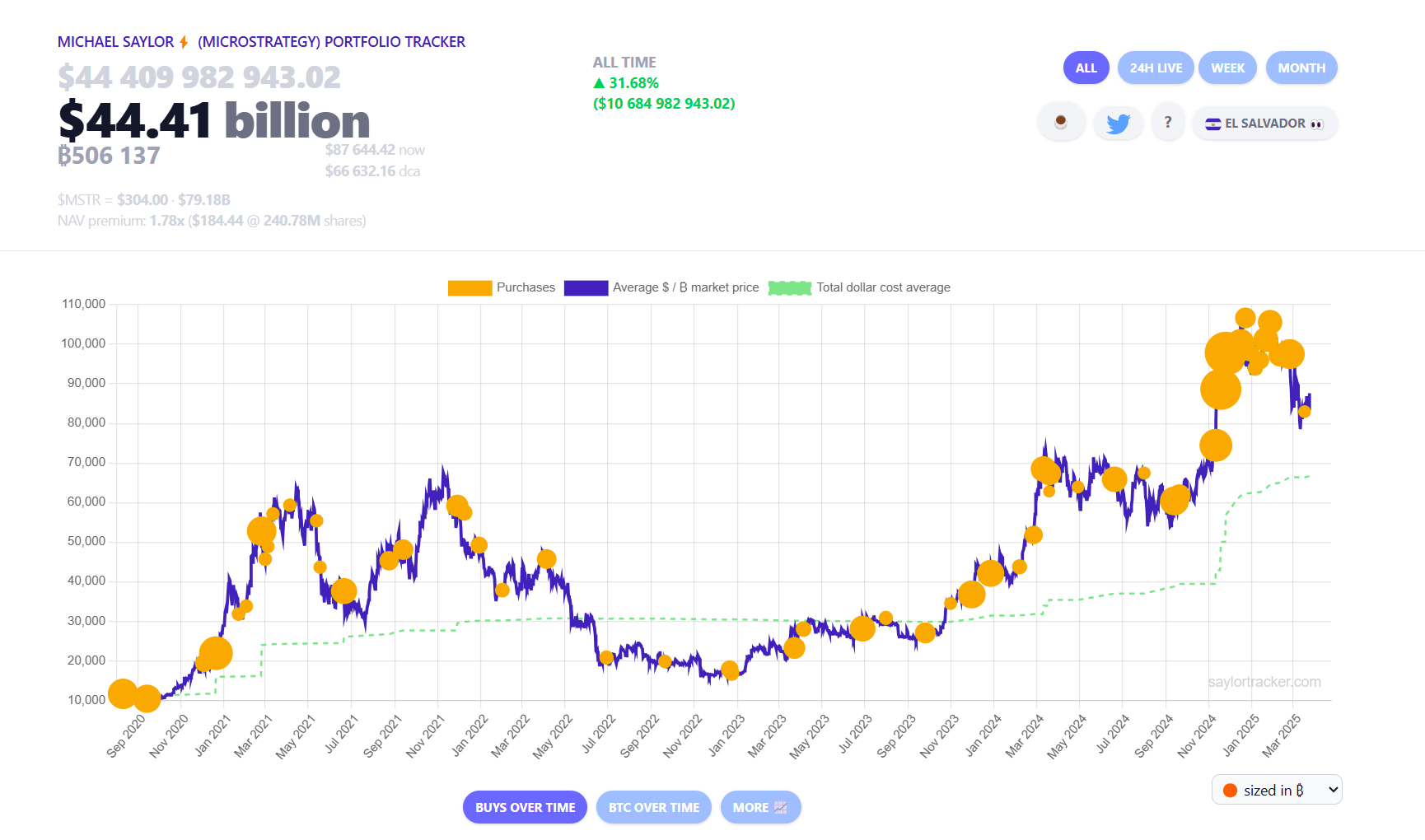

Technique, led by Michael Saylor, introduced Monday the acquisition of 6,911 Bitcoin between March 17 and 23 at a mean value of $84,529 per coin. This latest buy will increase the corporate’s whole Bitcoin holdings to round 506,000 BTC, valued at roughly $44.4 billion at present market costs.

Technique has acquired 6,911 BTC for ~$584.1 million at ~$84,529 per bitcoin and has achieved BTC Yield of seven.7% YTD 2025. As of three/23/2025, we hodl 506,137 $BTC acquired for ~$33.7 billion at ~$66,608 per bitcoin. $MSTR $STRKhttps://t.co/oM30PS9yqa

— Technique (@Technique) March 24, 2025

In line with a Monday submitting with the SEC, Technique funded the most recent BTC buy utilizing proceeds from its “Widespread ATM” and “STRK ATM” applications.

Between March 17 and March 23, Technique offered 1,975,000 shares of its Class A typical inventory, yielding internet proceeds of roughly $592 million, and 13,100 shares of its 8.00% Collection A perpetual strike most popular inventory, leading to over $1 million in internet proceeds.

The acquisition got here after the Tysons, Virginia-based agency disclosed plans to challenge 8.5 million shares of its ‘Collection A Perpetual Strife Most popular Inventory,’ a rise from the initially deliberate 5 million. The providing goals to finance extra Bitcoin purchases and help working capital wants.

The Collection A Perpetual Most popular Inventory carries a ten% annual dividend price, payable quarterly in money. Unpaid dividends compound quarterly at escalating charges, as much as a most of 18% yearly. This construction allows Technique to boost capital with out diluting the voting rights of frequent shareholders.

The inventory providing was underwritten by main monetary establishments, together with Morgan Stanley, Moelis & Co., Citigroup International Markets, and Barclays Capital.

Since its first Bitcoin buy in 2020, Technique has steadily expanded its holdings, cementing its standing as the biggest publicly traded company holder of the cryptocurrency.

Regardless of Bitcoin’s well-known volatility, the corporate’s place has appreciated by 32%, representing an unrealized achieve of over $10.6 billion.

Share this text