The First 5 Years of Your Revenue Portfolio Return is Vital to Not Operating Out of Revenue.

Jeffrey Ptak, managing director at Morningstar Analysis have an excellent data-infused article on how necessary are returns within the first 5 years of our retirement.

I don’t suppose that is fairly stunning to me even earlier than studying. Right here is briefly what I do know:

- Returns in revenue spending is necessary however not a very powerful attribute.

- The primary 25-30% of your retirement interval is a very powerful half. For instance, when you want the revenue for 40 years, the primary 12 years is roughly a very powerful. When you have a poor 12 years and failed to handle them in your plan, you may… run out of cash.

- These difficult situations sometimes contain

- Early poor market returns (lengthy or nice magnitude of decline)

- Persistently excessive inflation (not one or two yr inflation however a persistently excessive inflation interval)

- Mixture of the 2 above.

- Lowering the volatility drag in these early years, don’t overspend relative to your portfolio, allocate to belongings that sustain with inflation, tends to be issues to bear in mind.

Right here’s Jeffrey’s article: How one can Keep away from Outliving Your Retirement Financial savings? It’s All within the Sequence

Jeffrey need to discover out whether or not is there a yr or level in your retirement the place you may breath a sigh of reduction you could have rid the destructive sequence of return monster.

They begin with a present analysis on the secure withdrawal fee for a 100% fairness portfolio:

This desk reveals the preliminary secure withdrawal fee for a 30-year revenue want interval. The horizontal axis is totally different likelihood of what number of simulations (that they did) the place the portfolio survive 30 years. The vertical axis reveals simulations on totally different fairness and stuck revenue allocations.

I ought to remind you that Morningstar didn’t do the normal Secure Withdrawal Price approach that Invoice Bengen did within the Nineteen Nineties. They use future anticipated returns, and their Secure withdrawal fee is at 90% likelihood of success and never on the excessive finish. You may see the primary row, which reveals 100% fairness allocation, whether it is 100% success the preliminary secure withdrawal fee is 0.8%!

Why so low?

In the event you do math simulation and need excessive success, the quantity goes to be this low and also you marvel how helpful that’s. This is the reason I might place extra weight on historic simulations (like the normal Secure Withdrawal Price) than the mathematical one (that’s not to say I don’t see their virtues).

So we see that the preliminary secure withdrawal fee (90% likelihood) is 3.1%, which suggests beginning with $31,000 yearly on a $1 million portfolio.

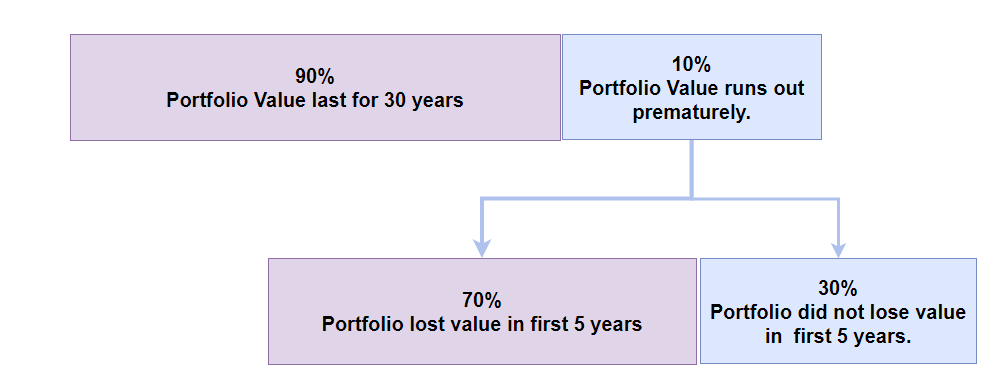

90% means there are 10% of those simulations that can run out of cash prematurely. The query is how necessary is returns?

Out of that 10%, 70% have decrease values by the tip of the primary 5 years. The opposite 30% didn’t lose worth, BUT they nonetheless fail.

This type of present how necessary the primary 5 years in returns is.

Jeffrey determined to invert and have a look at it the opposite approach: What if we group the returns by 5 buckets from the most effective return to the worst return?

The worst return has about practically 80% failure charges, or the portfolio worth not lasting 30 years. However it’s fascinating that even with the most effective return, there are additionally most likely 1 or 2 failure!

Distinction Between Gaining Reasonably than Dropping Cash Via the First 5 Years of Revenue

There’s a distinction when you see achieve quite than misplaced in worth inside the first 5 years.

The chart above reveals the share of trails that can fail if there are extra losses and extra achieve. Even a primary yr achieve cuts the failure likelihood by half, relative to if it’s a loss.

When Can we Breathe a Sigh of Reduction?

If we deem failure to be having losses within the first 5 years of your revenue spending, what number of extra years do we’ve got to attend till we keep away from losses?

The information reveals that at yr 15, or half of the retirement, you may cut back the prospect of loss to simply 1%. that’s fairly good.

Jeffrey concludes that it’s much less possible the losses exterior of the primary 5 years to trigger the plan failure.

I assume for versatile spending system just like the Guyton and Klinger withdrawal technique, when you handle to keep away from a destructive sequence of return within the first 15 years, you may don’t modify your spending after that.

Maybe knowledge type of attain the identical place.

What Can You Do to Tweak Your Plan so That Your Revenue can Final Longer?

The crux of this text is to spotlight how important the sequence of return danger is.

However it additionally type of highlights one other important issue: Returns or market volatility within the later years matter much less. Notice I say much less, not doesn’t matter however why is that this important? I’ll clarify later.

And so there are a bunch of issues that helps to alleviate destructive sequence of return dangers:

- Use a conservative income-to-portfolio worth ratio or in different phrases a conservative secure withdrawal fee (SWR)

- Cut back the volatility of the portfolio by money, fastened revenue, however have sufficient equities to make sure the portfolio can develop. The trick is at all times to discover a stability. The money, fastened revenue is to be spent when you encounter a poor first few years. This offers extra time for the fairness to recuperate.

- Have determination guidelines to not modify for inflation when portfolio doesn’t do effectively within the preliminary years. You’ll lose buying energy, so there’s a tradeoff however your portfolio is healthier.

- Bond Tent

Here’s what I do:

- For my most important spending that I clarify right here, that’s deliberate to fund with my revenue portfolio Daedalus, I exploit a low preliminary secure withdrawal fee of two%. There are a couple of historic sequence which can be risky to the downsize reminiscent of Nice Despair, 1973, 1968 and if we begin our spending then with a conservative secure withdrawal fee, the revenue ought to stand a great likelihood to final a very long time.

- For my fundamental spending defined right here, I’ll begin with 3% as a substitute of two%, however I’ll have a versatile spending determination tree with it.

- For many of my future medical sinking fund for medical insurance premium and CI premium, I’ll fund it by a mix of CPF OA monies and CPF OA monies in a 80/20 portfolio with sufficient funding.

Don Ezra, who used to work at Russell Investments, an actuary and advise a couple of pension boards, craft 5 years of money in his retirement portfolio with the remaining equities. [How to get happy income]

I assume we are able to see how necessary is the primary 5 years.

If most money and stuck revenue is to handle the primary 5-10 years, then why do folks nonetheless do issues like “promote from equities into money/fastened revenue to replenish the fastened revenue”?

I believe:

- They don’t precisely know what’s the large danger on the market and subsequently can’t be extra focused in learn how to deal with it.

- This feels psychologically extra comforting.

There are failures even after first 5 years of fine returns however I believe we must also remember that these are edge instances and when you want to replenish fastened revenue or money, which may not at all times remedy the issue as a result of the difficult sequence may be better important spending attributable to persistently excessive inflation.

If you wish to commerce these shares I discussed, you may open an account with Interactive Brokers. Interactive Brokers is the main low-cost and environment friendly dealer I exploit and belief to take a position & commerce my holdings in Singapore, the USA, London Inventory Change and Hong Kong Inventory Change. They help you commerce shares, ETFs, choices, futures, foreign exchange, bonds and funds worldwide from a single built-in account.

You may learn extra about my ideas about Interactive Brokers in this Interactive Brokers Deep Dive Collection, beginning with learn how to create & fund your Interactive Brokers account simply.