How Does US Giant, Mid and Small Cap 2025 Earnings Development Look?

The primary quarter left 1 month of earnings reporting to go however I believed I’d simply share some consensus working earnings and income estimates for the businesses in S&P 500, S&P 400 and S&P 600.

They’d symbolize the US giant cap, mid cap and small cap earnings.

Why are the earnings vital?

Properly, in case you purchase a US fairness index now, the index would have priced in what they know at present in all probability. The earnings, revenues, revenue margin of what was introduced. The index additionally priced within the development within the earnings, revenues sooner or later on this worth.

So what is going to transfer the value is when the earnings outlook adjustments for the more severe or higher, when they’re finally introduced or close to announcement.

Some traders don’t like to purchase when or don’t purchase costly stuff and we all know the present worth, it could be good to understand how valuation look, relative to the previous.

So lets get began. This text gained’t be lengthy.

S&P 500 – US Giant Cap

The primary chart exhibits the US giant cap annual income development forecast:

The blue line represents the 2024 forecast, which we all know have already occurred. You may see the half in 2025 the place I drew the pink circle. The income had a bounce which is probably going not a forecast however what truly occur after the latest This fall 2024 monetary announcement.

Income got here in barely higher than anticipated however its not too far off. Income for 2024 for giant cap was so constant even going again to 2023.

The crimson line exhibits the 2025 or this years forecast and inexperienced line 2026. The remark is with the latest steering from particular person inventory reporting income is anticipated to be decrease in 2025, with the identical anticipated development price in 2026.

The chart under exhibits the working earnings development forecast:

The blue line (2024) exhibits a surge from 10% to greater than 11%, indicating that earnings development was higher than anticipated within the latest announcement. The crimson line (2025) exhibits that development in 2025 will take a plunge however the fall in earnings development will likely be from 14% to lower than 12%.

Based mostly on the analyst estimates, which sort of hyperlink to the steering present by corporations, we’re nonetheless anticipating double digit earnings development for this 12 months.

S&P 400 – US Mid Cap

We begin off with the income development forecast of the shares that type the mid-cap index:

The blue line (2024) present a shock to the upside, however the distinction with the big cap is that the crimson line (2025) exhibits a shock to the upside relatively than draw back. In fact, all these are estimates as a result of the forecast could go down over time because the monetary market adjustments.

The mid cap inventory earnings for the final quarter is healthier than anticipated however that brings as much as virtually 0% earnings development for 2024. However what the analyst are anticipating is decrease 2025 earnings development than anticipated falling from about 14% to 12%.

That won’t be too completely different from the US giant cap shares.

S&P 600 – US Small Cap

So right here is the income development forecast for the US Small Cap shares:

The income for 2024 (this time blue line) got here in weaker as extra and most bulletins occur such that the income development in 2024 is sort of 0%. The 2025 income forecast (crimson line) was greater, which brings income development to be inline with the mid cap shares.

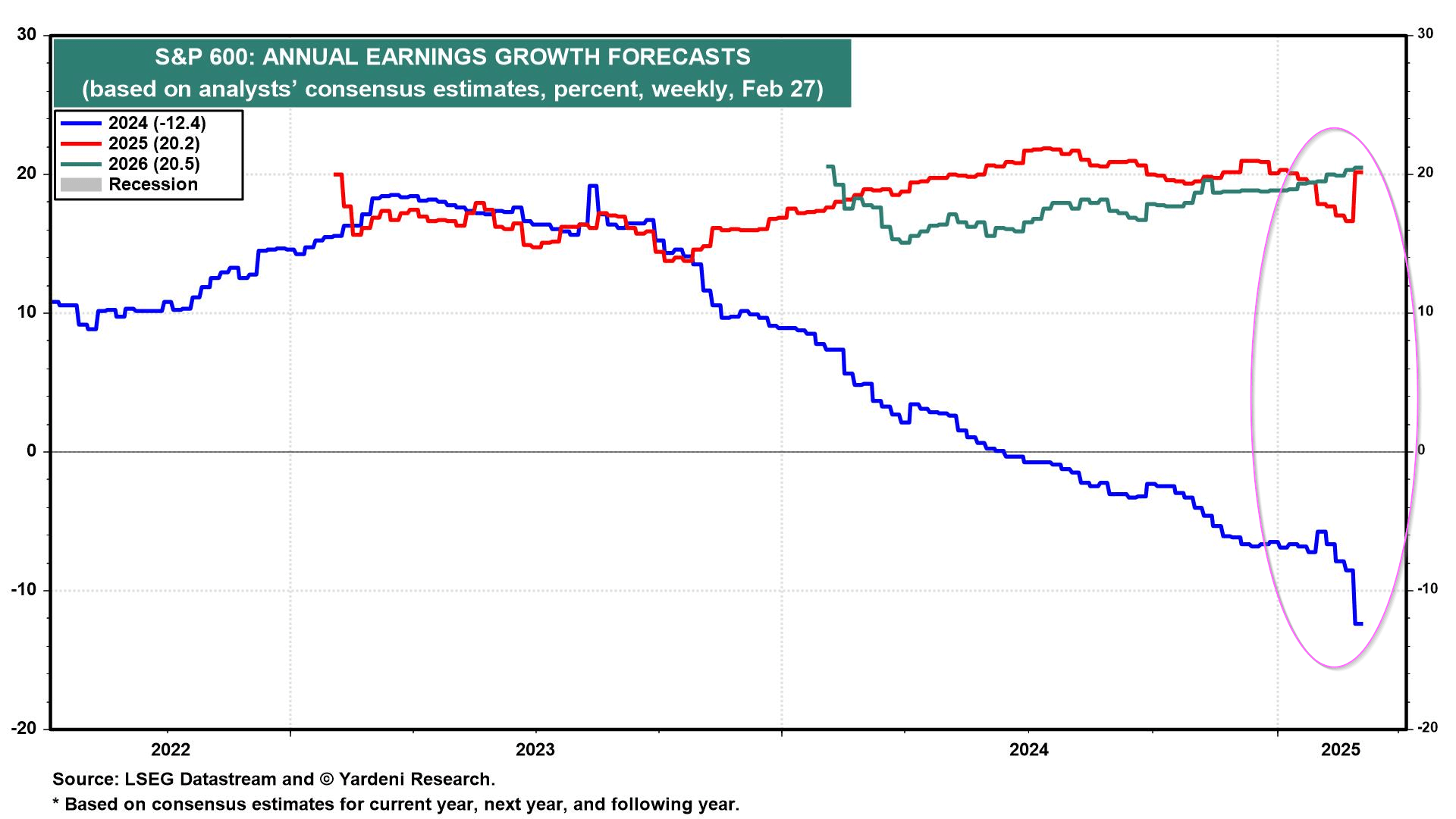

Just like the income, the 2024 earnings development (blue line) completed even worse. Small cap registered a -12% earnings development in 2024. The earnings development line for 2025 (crimson) present a extra risky estimation the place earnings development forecast was heading decrease earlier than an upward changes. That is very completely different from the identical time in 2024 (observe the beginning of the blue line in 2024) the place the forecast simply headed down.

Small cap earnings are estimated to develop at 20% in 2025.

Maybe analyst is anticipating higher earnings from extra rate of interest easing.

So Giant Cap and Mid Cap each anticipated to develop at 10-12% and Small Cap 20%.

Present Giant, Mid and Small Cap Index Valuations

Why not let’s evaluation the place we’re at with valuations. The valuations from Yardeni Analysis is predicated on ahead earnings forecast.

Right here is the S&P 500:

If we take out these euphoric and depressive instances, giant cap ahead earnings usually keep round 15 instances. That is so within the nicely rising early Nineteen Nineties. The 2010 to 2020 present a recovering and valuation growth from low valuation to the 15 instances valuation.

It is just within the final 5 years the place we see 20 instances valuation to be the norm.

Whereas costs have corrected, US giant cap continues to be about 22 instances ahead earnings.

Right here is the S&P 400:

From the chart, the mid-cap usually trades barely above 15 instances. We should always observe that in contrast to the S&P 500, we solely have knowledge from 1999 onwards so we can not evaluate how issues are earlier than this. Discover that valuations by no means shot previous 20 instances ahead earnings.

Anytime the index dip under 15 instances may be a superb alternative in case you have more cash to tranche in. And we shouldn’t be affected by excessive 20 instances PE valuation of the US giant cap as a result of the character of the mid caps look relatively completely different.

Right here is the S&P 600:

Valuations for the small cap look relatively just like the mid-caps. They’d usually commerce above 15 instances. What’s attention-grabbing is within the 2000-2008 interval, the place we all know small-caps (and mid-caps) did higher than giant caps, valuations stayed across the 15 instances area.

I assume the US giant cap underperformed as a result of valuations went close to 25 instances they usually corrected all the way in which down to fifteen instances. In the event you take 25/15 -1 that could be a massive massive drop. The small cap valuation didn’t grew to become extreme.

Lengthy story quick, we talked about extreme US valuations, relative to historic. However by all accounts, maybe what’s completely different is within the US giant cap.

You get good efficiency up to now, however you would need to have your individual self speak relating to the upper relative valuations.

If you wish to commerce these shares I discussed, you possibly can open an account with Interactive Brokers. Interactive Brokers is the main low-cost and environment friendly dealer I exploit and belief to take a position & commerce my holdings in Singapore, the US, London Inventory Change and Hong Kong Inventory Change. They let you commerce shares, ETFs, choices, futures, foreign exchange, bonds and funds worldwide from a single built-in account.

You may learn extra about my ideas about Interactive Brokers in this Interactive Brokers Deep Dive Sequence, beginning with tips on how to create & fund your Interactive Brokers account simply.