The way to Get Increased Revenue Now That Money Curiosity Fee is Falling? Discover Dividend Revenue Funds?

I’ve a pal who pinged me relating to his monetary state of affairs.

He feels that his present money allocation of $580,000 is quite excessive and marvel whether it is a good suggestion to maneuver some to dividend shares or equal to get some passive revenue. Presently, he doesn’t have a revenue from work. He works on one thing however it isn’t paying him.

He rents out his HDB flat for $1,600 a month. The $580,000 in money is unfold amongst Singapore Financial savings Bonds and 6-month Treasury payments. That might give him some good curiosity revenue.

The issue to him, is that the market rate of interest has been dropping so… that implies that his revenue is dropping. That is the primary cause he is considering wanting into dividend shares or equal to offer the spending revenue.

My pal shared that his bills is $2,000-$3,000 a month however there are maybe a few months the place his bills will jack as much as $5,000-$6,000 a month attributable to gear restore, one-time taxes and visas.

I recognized him for someday. The primary time that I met him, we did a inventory take of the place he sees life sooner or later, what he want to obtain. We did a monetary inventory take of his state of affairs then and whether or not the cash can help the life he needs and if not, the attainable or potential trade-offs that he could make.

I perceive his affinity in the direction of sure investments, how he frames monetary safety in his thoughts.

This submit is what I’ll share with him, which can hopefully assist him in some methods.

The Most Efficient to Generate Passive Revenue for Him

I’m not going to alter my tune what I informed him years in the past. That is additionally not going to be very completely different from what I shared on Funding Moats:

- Have a portfolio of 40-75% fairness allocation.

- The remaining be in mounted revenue / money.

- Plan to spend 3% of the preliminary portfolio worth. That is the really helpful revenue to spend for the yr.

- Regulate the really helpful revenue for subsequent yr’s spending based mostly on the earlier yr’s inflation charge in order that your revenue retain the buying energy.

- Lastly, have a layer of security examine to regulate the really helpful revenue based mostly on market situation. If the market isn’t doing properly, he may wish to hold the really helpful revenue with out the inflation adjustment. Verify whether or not the revenue drawn divided by the present portfolio worth is lower than 7-8%. That is to forestall him from spending an excessive amount of, a lot so that it’ll impair his portfolio prematurely.

That is roughly how his present belongings appear like, with out his CPF and HDB flat:

I didn’t embrace his CPF as a result of his CPF is principally in CPF SA, and MA. The Medisave is for his future medical bills and he has attain CPF FRS for this CPF SA. Ultimately, the cash in CPF SA will go over to his CPF RA, which can ultimately be a part of his CPF LIFE annuity revenue.

I estimate his excellent mortgage is about $260,000.

In case you are confused the way to plan for your self, it’s all the time simpler if you determine if you’re financially impartial, how would you need your setup to be? Would you like reside within the present dwelling or get a smaller/larger place? Would you like a peace of thoughts with out having a big rigid mortgage expense?

I believe a setup with a better peace of thoughts could be one the place he assumes he can repay his mortgage anytime. This implies as an alternative of $1.4 million, the amount of cash he can take into consideration producing revenue is definitely $1.16 million.

The good factor is that if he don’t want to repay his mortgage, the $260,000 in SSB or Tbills might be able to earn an curiosity of $5,200 a yr based mostly on a return of two% p.a. I believe it’s safer to maintain them in SSB or TBills.

Now if we have a look at the remaining ($1.16 million), the fairness allocation is about 68% of $1.16 million. If I’m proper, at present he’s invested in iShares Core MSCI World UCITS ETF (IWDA). I believe that is ample fairness allocation. Maybe he can contemplate deploying the remainder of the money into mounted revenue.

Suppose we assume that that is the primary yr he’ll take out revenue from his portfolio, a really helpful revenue will likely be $1162000 x 3% = $34,860 yearly or $2,905 month-to-month. We plan for this revenue to retain his buying energy.

If we add $1600 to this, then the revenue he can work with is $4,500 a month and he wants $2000 to $3000 month-to-month. His portfolio at this stage is fairly properly setup.

If that’s the case, what’s the drawback right here?

Get Previous the Idea of Solely Spending Revenue Given to You

Primarily based on how an individual describes their plan revenue, their portfolio, I’ll get a sense how they have a look at issues.

My pal views that the solely revenue that he can spend is the revenue put properly into his checking account. If he must promote models from his IWDA or take from his money capital, that’s not a protected plan.

What my pal feels isn’t too completely different from a lot of you.

I believe it’s a main psychological block and why not everybody would have the ability to settle for this type of revenue technique.

My pal as soon as shared with me why he feels safe to put money into fairness. If he can spend from the revenue from the rental revenue, the curiosity from SSB and Tbills, it permits his IWDA to develop.

If that’s the case, WHEN are you going to the touch your IWDA?

It isn’t just like the IWDA haven’t executed properly. Since he has invested for the previous 4-5 years, the returns are virtually 60-77% up. Certainly it’s protected to simply spend like 5% of that?

I’m not forcing my pal to spend. I’m asking below what situations will he contact that IWDA. If he plans to by no means robust that IWDA fairness allocation… then possibly his portfolio is barely $365,000 (his money and stuck revenue)?

I believe how we body our investments in buckets, in obtained revenue, promoting models is what’s the primary drawback.

And that is the place I’ve restricted assist with.

I already clarify why it is a comparatively conservative factor (if he ever remembers). Whether or not he’ll ever really feel convicted sufficient to implement this or not will depend upon himself.

I don’t assume it’s all the time wholesome to strain individuals to make use of an revenue technique that they’re much less convicted in. However how would he be extra convicted?

I believe all of us should take the journey ourselves to try this work and actually perceive why it is a sound technique. This implies not listening to Kyith however utilizing what Kyith stated as a information and work out what the supplies try to say.

If my pal doesn’t work out, I believe it could be higher to simply swap from IWDA, which is an accumulating class of shares to one thing else that present revenue to him.

If not, I don’t assume he would ever contact these IWDA shares.

What Sort of Dividend Revenue Paying UCITS ETFs Ought to He Go For?

My pal made it clear he’s not comfy with particular person shares.

Which means we’re left with managed funds within the type of unit trusts.

Now right here comes the difficult half. What are the traits of a dividend paying fund that you just search for right here?

The straightforward reply is that if he’s comfy with IWDA, he can follow that philosophy and put money into the distributing class of the iShares Core MSCI World ETF (IWDD). This fund is fairly new and incepted in Jul 2023.

The final historic revenue yield is 1.34%.

I think that my pal will discover the revenue to be too little.

If he has comparable world philosophy, then he can go along with the MSCI World Excessive Dividend ETFs that I made movies about not too way back:

VHYD, or The Vanguard FTSE All-World Excessive Dividend Yield UCITS ETF USD Distributing, at present has a historic revenue yield of 2.96%. That is likely to be excessive sufficient for him.

However then the difficulty comes with the residual questions:

“However Kyith, how is the historic efficiency of those ETFs?” “Does the NAV go down?” “If I spend simply the revenue, will I’ve the revenue I want, but final for the interval I want?”

The fast reply is I don’t know. He has to search out out. I’m not his adviser.

Most significantly, he must rearrange some stuff in his head in terms of

- How do these ETFs match into his revenue plan?

- What are the important issues he must be searching for when evaluating these ETFs?

- How does he make sense of efficiency now that he owns one thing that gives revenue?

- How does he cope with a interval the place the fund NAV goes down or doesn’t develop?

To assist him, he can check out the factsheet if he Google “MSCI World Excessive Yield”, which can deliver up this factsheet of the MSCI World Excessive Yield Dividend Index as the primary entry:

The efficiency isn’t precisely VHYD however shut and you may see that within the latest years, it has underperformed the MSCI World index however earn a decent 7.6% in whole returns a yr.

How ought to he sees this? Once more, one thing completely different to cope with.

Now in one other timeline, if he requested me the identical query and his affinity in the direction of Actual Property Funding Trusts (REITS), I’d inform him that there’s a native NikkoAM-StraitsTrading Asia ex Japan REIT ETF, or CFA for ticker image. He can personal all the big REITs equivalent to Hyperlink REIT, Ascendas REIT, Mapletree Logistics and Keppel DC REIT.

The present revenue yield is 6.0%. Whether it is two years in the past I’d say the yield is 5.3% (I truly did a submit on the three REIT ETF in 2023 right here)

He has to take care of one thing completely different. Here’s a chart of CFA’s NAV:

The previous 6 years haven’t been type to REITs and if he adopted by means of with what I steered hypothetically his query will likely be “Kyith, do you assume I ought to nonetheless maintain on to the CFA? The worth of my fairness retains taking place.”

And I’d reply “But it surely offers you the form of revenue you need isn’t it?”

“I’m afraid that if this doesn’t cease, my portfolio won’t final so lengthy.”

And my reply could be “There are going to be lengthy intervals the place a sector doesn’t do properly. REITs is an actual property buy-to-let sector by itself. The long run return of REITs is identical as MSCI World. The truth is, the returns are barely higher. There are some buyers who’re going to reside by means of a interval the place the efficiency of equities, or a specific sector don’t do properly. You is likely to be in a single. In case you are diversified sufficient, it’s going to recuperate over time.”

I’m not positive if it will work properly for him.

I seen how the boldness of individuals investing in a REIT ETF like CFA modified. They began wanting revenue and wish to greenback price common into it. Then they cease as a result of they questioned the transfer. And I defined the identical manner.

The reality is that each shit goes by means of this and whether or not you might be much less fortunate to see the ugly shit.

However it’s best to anticipate it.

My pal ought to even anticipate his IWDA (MSCI World) to do one thing like this. From 1999 to 2009, an IWDA would have executed 1.0% p.a. for ten years.

He has to dig in to search out out the place his conviction in equities, or in mounted revenue comes from, such that it permits him to stay invested in virtually $800,000 in equities. And he has to get by means of the residual questions on how does this ETF work higher than his present plan.

Does He Need a Extra Sustainable Lengthy Time period Revenue Mannequin?

I ponder if it comes as a shock to him that the revenue he will get from Singapore Financial savings Bond and Treasury Payments is risky.

Intuitively, this must be apparent to many in my view.

However I think the lured of protected, non-volatile capital and excessive curiosity money is an excessive amount of such that individuals assume much less of it.

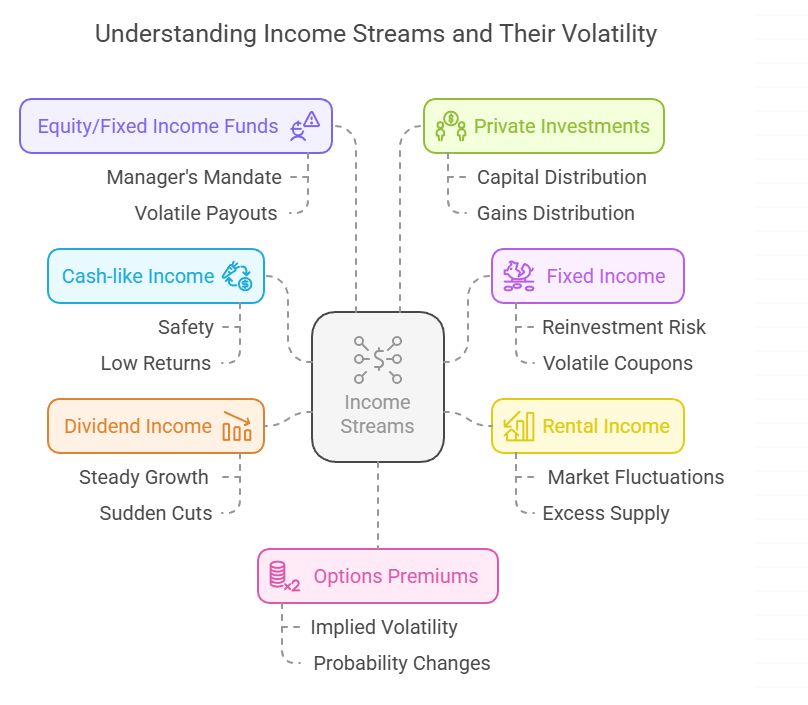

I’ve invested for nearly 20 years at this level, and work in wealth advisory for five years and the next are an inventory of truism of revenue:

- There’s some type of volatility and unsure that you must cope with interval.

- Money-like stuff is protected however the long run returns are low.

- The revenue you get from cash-like stuff can be risky.

- Brief-term mounted revenue as a basket is comparatively protected as properly, however the revenue can be risky as a result of the underlying mounted revenue matures quick and their coupons are volaile.

- Funding-grade, or excessive yield mounted revenue matures and once they mature you confronted reinvestment threat that the coupon that you just get is completely different from the earlier one.

- Rental revenue goes up by 30% and goes down by 30% at the least.

- There are intervals the place you possibly can solely be a worth taker as a result of there’s extreme rental provide.

- Dividend revenue can go up steadily at 3% to 10% a yr however they’ll get lower instantly if the underlying corporations don’t do properly.

- You possibly can go along with excessive yielding dividend securities however they’re excessive yielding for a cause as a result of both they’ve some points and due to this fact they’re buying and selling at a excessive yield or that they’ll really pay a excessive yield. If it’s the former, is that this it? Is that this the purpose that the problems are irrecoverable and so they begin going downhill or is it a fixable drawback? In case you consider just a few of those shares, you’ll spend your days considering (and hoping) round these uncertainties.

- The revenue of an fairness or mounted income-based unit belief is risky due to two causes:

- The revenue relies on the distribution of the underlying securities and the payouts of the underlying securities is all the time risky.

- The supervisor of that fund has a mandate however they don’t seem to be your monetary adviser. Their goal is to ensure the fund doesn’t die to not firstly offer you revenue.

- If they offer a assure that the revenue is constant, or index to inflation, that may be a big and difficult obligation which is difficult to maintain to for them. Thus, it’s their curiosity NOT to make these ensures or write this into their mandates. It’s all the time safer to inform those who they pay out what they’ll pay out (no matter meaning).

- You will get distributions out of your personal investments. A part of it’s your personal capital and a part of it’s the actual revenue or your positive aspects. You’ve to have the ability to make sense which is which, when you don’t wish to spend them down.

- Revenue generated from choices premiums is risky as a result of

- Implied volatility, which determines how a lot choices premiums you possibly can promote at, modifications.

- The likelihood that the underlying safety (a inventory or an index) expires in-the-money or out-of-money modifications through the completely different time interval you write at, but additionally on a buying and selling day foundation.

- It is rather widespread that you just made 1-3% a month for just a few months, solely to offer quite a lot of it again when the likelihood goes in opposition to you.

What all this implies is that there’s some type of revenue uncertainty that you must take care of. There are a point of effort that you’d take, some sophistication you’d enterprise into.

However the important query my pal might want to ask himself is: If all the things is unsure, how do I create a long run sustainable revenue mannequin for myself?

If he doesn’t reply that query, then this factor isn’t as passive. Passive is a lie as a result of he would have sorted this half out for some time, just for a change in worth or nature of revenue to place one other worrying query in his thoughts.

He’ll really feel like he’s residing his life combating revenue volatility hearth on a frequent foundation.

If he encounters volatility along with his long run rental shopper, that will likely be extra annoying as properly.

The answer to that is to easy out the volatility in some methods. However the way to do it? That’s in all probability a rabbit gap right down to it.

I offered the smoothing system in that protected withdrawal charge framework already. But when individuals don’t perceive it… and can’t relate to those revenue uncertainty truism… they might want to craft their very own smoothing system.

He Must Body His Spending/Revenue in a Higher Method

Totally different individuals have a look at their spending otherwise and based mostly on what I see, I can form of inform a little bit.

In case you inform me that your spending is $2000-$3000 month-to-month, however that there are months the place your spending instantly go as much as $5000 month-to-month, I’ll let you know that you just want $60,0000 a yr in revenue this yr and that having $1.1 million won’t be actually sufficient to final greater than 50 years.

We’re quite versatile individuals in terms of spending typically however will we have a look at our planning this manner?

The problem with revenue planning is that

- The underlying belongings that generate the revenue are usually unsure.

- Your revenue spending is unsure.

Added collectively, the entire plan can have a spectrum of final result with one finish doing very properly and the opposite finish the place my pal will run out of cash prematurely.

You possibly can management the number of the belongings you utilize to generate the revenue to manage the uncertainty. The largest management will be the spending revenue half.

My pal must discover a higher construction.

I have a look at most of my planning as an annual factor. There are spending that’s not a shock and has to plan for. In order for you this life-style of renting, you bought to be ready for hire to go up by 60%. This was what the native of us instantly should face with.

The shock comes from being shock the volatility could be -60% +60%.

Issues will break down. He has to plan for the upkeep of his HDB flat and the gear he use. Yearly, though he’s not spending he must continually refill a bucket that may ultimately pay for these lumpy spending.

How he appears to be like at his revenue wants, will drive peace of thoughts.

Lately, my pal Cents of Independence wrote about how a dialog with me change how she teams her spending a little bit:

I simply clarify that there are a few of her bills which are extra work-related and they’re there as a result of they’re the capex for work, and would go away if she decides to not work ultimately. This creates extra flexibility in her 2025 funds but additionally the determine in her thoughts about how a lot long run revenue she wants her portfolio to offer for.

All of us desire to have the ability to spend freely in our retirement, however we are able to spend extra freely if now we have crafted sound constructions and regarded higher.

I believe my pal will do okay.

I think a part of that $2000 to $3000 month-to-month that he wants are about $1000 in mortgage cost and that goes away if we’re contemplating the prospect of setting apart $260,000 simply in case we repay that mortgage. So a spending with out the mortgage is nearer to $1000 to $2000. The very best is likely to be $32,000 a yr.

Conclusion

I believe these are some areas for my pal to consider.

Most of my solutions aren’t easy as a result of most issues aren’t so easy. If my pal has $3 million as an alternative of this, then quite a lot of these issues may go away. However all of us don’t all the time have 3 million.

Having $3 million makes the issue go away on the tier of spending my pal is at however that might nonetheless be an issue for a lot of with extra extravagant spending.

Which is why generally it’s straight ahead generally it isn’t.

Hopefully, that is useful for a few of you with quite comparable drawback as my pal.

If you wish to commerce these shares I discussed, you possibly can open an account with Interactive Brokers. Interactive Brokers is the main low-cost and environment friendly dealer I take advantage of and belief to take a position & commerce my holdings in Singapore, the US, London Inventory Alternate and Hong Kong Inventory Alternate. They can help you commerce shares, ETFs, choices, futures, foreign exchange, bonds and funds worldwide from a single built-in account.

You possibly can learn extra about my ideas about Interactive Brokers in this Interactive Brokers Deep Dive Sequence, beginning with the way to create & fund your Interactive Brokers account simply.