My Singaporean Reader’s $184,197 Personal Well being Defend Most cancers Declare Expertise.

I’ve a member in my Monetary Independence group who was identified with blood most cancers in 2023.

He has since undergone remedies and we’re blissful that he’s at present in remission. He determine to doc his medical claims expertise in order that extra of us can have an thought about it. So he did up a presentation slide-deck for an inside schooling presentation however graciously share it with me right here in order that extra folks can learn about it.

He was admitted to a authorities hospital beneath an A/B1 class remedy and he has a non-public defend plan with a rider. The entire remedy got here as much as $191k however as a result of he has personal insurance coverage and rider, the overall out-of-pocket ended up $7.1k. This $7.1k may be payable by your CPF Medisave however there are limits to how a lot you’ll be able to pay with it.

This may be one thing that a few of you’re much less conscious of in you can select to alter to a decrease grade of care, even when you go in as a unsubsidized Class A or B1 ward remedy affected person.

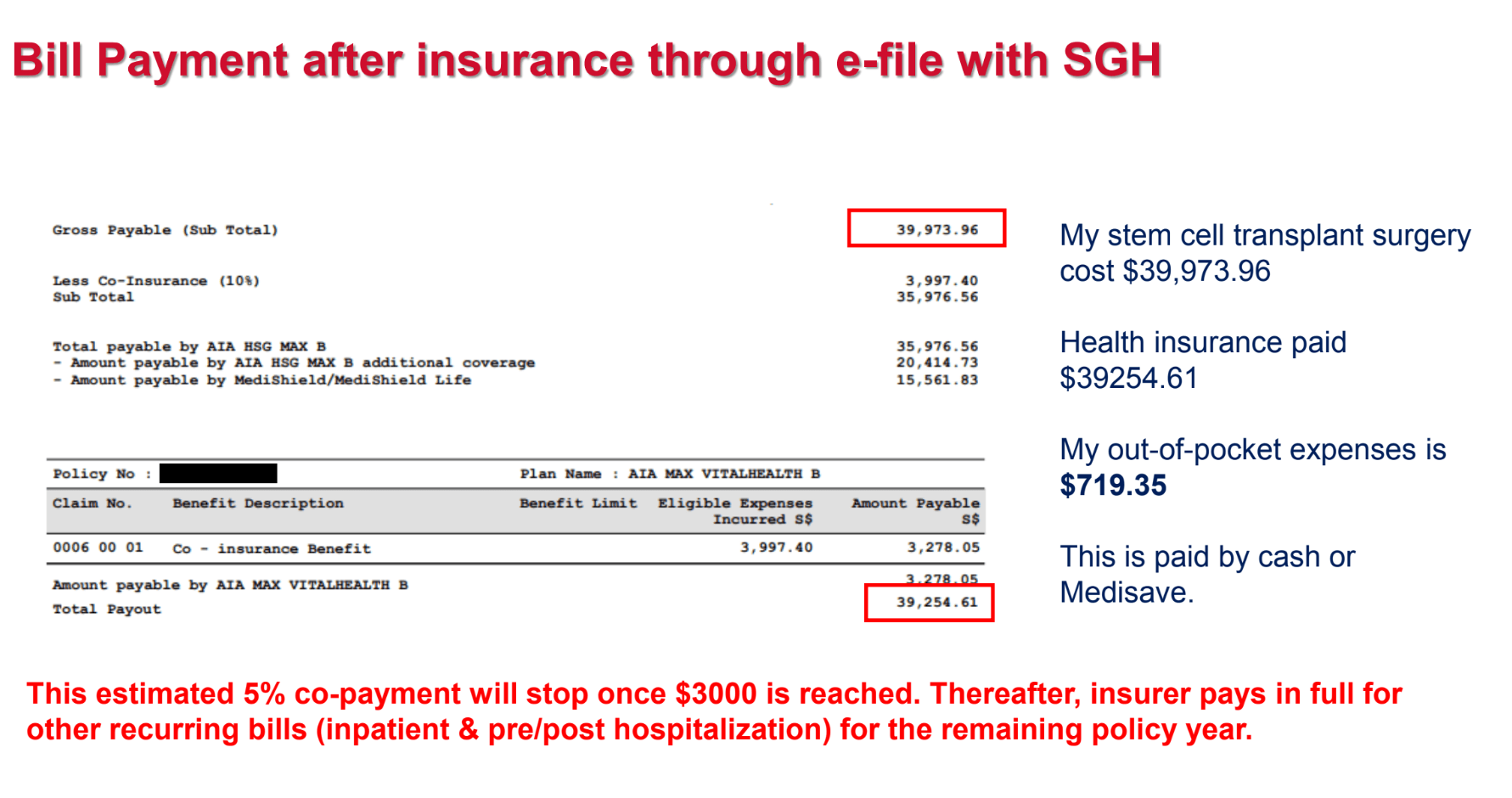

My reader gave a few invoice examples and tries to elucidate easy methods to learn it. This is able to be one of many extra main surgical procedure that comes with a extra hefty invoice earlier than insurance coverage. You don’t see a deductible right here, possible as a result of my reader has already paid for the deductible for this calendar yr (you solely pay the deductible as soon as per calendar yr).

If he doesn’t have a rider that reduces his co-payment, he can be paying out-of-pocket of 10% of that $40k value (about $4k).

I believe the well being defend have labored even when you pay $4k for a serious surgical procedure with out the rider simply that when the invoice provides up it an be larger.

In case your complete medical invoice comes as much as $190k and also you should not have a rider, you would possibly find yourself paying about $24k as an alternative of $7.1k like my reader, with a part of it in Medisave. I wrote about setting apart $50,000 in a medical sinking fund at the moment as a part of my monetary independence plan in order that I can have an inflation adjusted $74k from now (then 44 years outdated) until eternally for my CI wants.

$50,000 Portfolio to Complement Lifetime Vital Sickness Protection.

I used to be provisioning for a $40,000 quantity for a ten% co-insurance in a authorities A ward remedy and this authorities hospital remedy would fall into that.

The times of a medical insurance that covers from the primary greenback is over and we’d want some kind of a medical sinking fund an increasing number of. Not an emergency fund as a result of a medical want will not be an emergency anymore! If you realize that you’re a human, you jolly properly know you’ll break down and if so why is a medical state of affairs such a shock?

There are some stuff that I select to not say as a result of I work in an advisory agency that at present specialise in insurance coverage. However I can inform you that the claims expertise for medical insurance fluctuate among the many insurers.

Differ when it comes to

- While you get the claims cash

- How lengthy the method takes

- How annoyed the method is

- How a lot would be the eventual claims versus your out-of-pocket

You would possibly must pay a few of the payments upfront your self earlier than the claims are settled. The insurer could take time to agree with the hospital on how a lot is claimable, particularly for personal remedy for sure insurers.

Superior-stage crucial sickness insurance coverage helps however they do finish at some stage. You may get a time period until 99 in case you are keen. Or you can begin increase a medical sinking fund like me.

Any financial savings for medial wants is nice.

Particularly in case your medical plan is beneath a well-liked insurer in Singapore that many DIY folks routinely purchase.

My reader put out these two slides to elucidate the bounds of the present evolution in medical insurance and whether or not he thinks it’s satisfactory for us. For a unsubsidized authorities remedy, the bounds must be sufficient for the most cancers drug listing.

However he feels that the quantities for most cancers drug providers will not be enough even if in case you have a fundamental defend plan that 5 occasions the MSHL.

That has at all times been my suspect and we’re beginning to see that play out.

You possibly can overview the entire slidedeck right here.

I need to thank my reader for graciously sharing this with us. I really feel that a few of the nuances of the claims experiences, the quantities, how the invoice appears to be like like are crucial to assist form a few of our monetary selections. Nevertheless it isn’t simple to seek out case research but respect folks’s privateness and I acquired this opportunity as a result of my reader has a large enough coronary heart that need to educate and assist extra folks. Simply to be clear, this isn’t a claims expertise administer by Havend.

These are vital occasions. And so they do alter the way you have a look at your life now, replicate upon how you’ve lived your life, and what it means going ahead. We get to see a few of the stuff my reader missed out on and the enjoyment he felt when he was in a position to get again to it.

If you wish to commerce these shares I discussed, you’ll be able to open an account with Interactive Brokers. Interactive Brokers is the main low-cost and environment friendly dealer I exploit and belief to take a position & commerce my holdings in Singapore, america, London Inventory Alternate and Hong Kong Inventory Alternate. They will let you commerce shares, ETFs, choices, futures, foreign exchange, bonds and funds worldwide from a single built-in account.

You possibly can learn extra about my ideas about Interactive Brokers in this Interactive Brokers Deep Dive Sequence, beginning with easy methods to create & fund your Interactive Brokers account simply.