Ought to You Contemplate Including US Mid-Cap Shares to Your Portfolio – Telegram Reader Query?

Certainly one of my Telegram group members began out investing in VWRD (Vanguard FTSE All-World UCITS ETF – (USD) Distributing) earlier than shifting to QQQ (Invesco QQQ Belief). He quickly understand that his portfolio can be primarily invested in giant cap shares, or shares which are bigger primarily based on market capitalization.

Quickly , he found about small cap shares, and located it by way of publicity by way of AVUV (Avantis US Small Cap Worth ETF).

Just lately, he quickly found that there’s group of shares that exist between them which is known as the Mid-Cap shares and surprise if you will need to have publicity to them. And if that’s the case ought to he tilt in the direction of the standard, momentum or worth issue.

Here’s what I feel.

At all times Assume In regards to the Huge Forces First.

We will get fairly caught up in contemplating whether or not to go along with index-tracking investments or to go along with a worth, momentum or excessive profitability technique.

However you bought to keep in mind that what is going to transfer the needle tends to be:

- Whether or not you’re investing in equities over pure fastened earnings.

- Which area you spend money on.

These are what I referred to as the “large rocks”.

For those who get caught up with all the opposite stuff, however solely put 20% of your internet wealth into the funding, you’re actually anticipating your equities to do a hell lot of heavy lifting. The one manner you’ll be able to obtain an equal of a 100% fairness portfolio end result is that you simply push that 20% aggressively. Your outcomes can be both superb or very unhealthy.

I feel when you ask me at present what is going to do properly sooner or later, I can’t let you know that mid-cap US shares will do higher than small-caps or large-caps.

Over quick horizon like lower than 10 years, there may be equal likelihood of 1 doing higher than the remaining. Buyers ought to have a time horizon of about 15 years or extra simply to interrupt even with 100% equities. If you need a better chance of harvesting a good return, you want about 20-23 years.

That feels like a very long time however that’s the actuality.

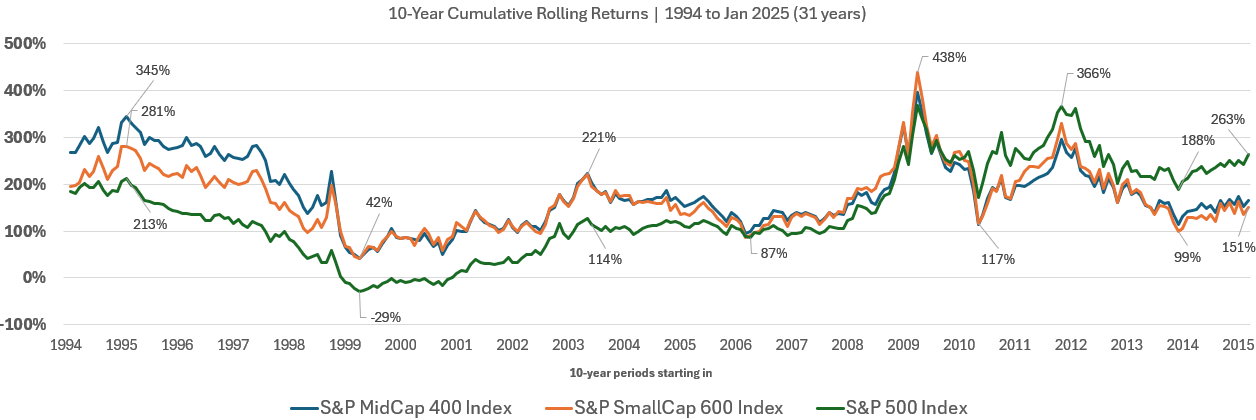

I pulled up some 10-year cumulative returns of US large-cap, mid-cap, small-cap shares through the years within the chart under:

Shares should have sure diploma of liquidity, and be worthwhile for the earlier quarters in addition to the latest quarters.

From 1994 to at present, we’ve about 31 years of knowledge, and if we roll month by month we are able to have many 10-year intervals. Every level on the chart signify a 10-year cumulative returns tarting from the date.

For those who spend money on a ETF that tracks the S&P 600 index within the mid of 2010, you’ll make a complete of 117% within the subsequent 10 years.

For those who perceive this chart, you’ll know that whether or not you spend money on giant, mid or small cap, your returns is just not a repair 96% (7% a yr) however that there are occasions while you earn much less or greater than this. I can’t let you know small caps or mid caps will do higher since you see intervals the place they do significantly better than the massive cap and in addition different sensible.

I hope my reader doesn’t simply concentrate on returns as a result of when you make investments at present, you’ll be able to solely hope which you can get the higher return. If you begin in 2009, whichever you spend money on, you get 438% 10 years later however when you make investments on the peak of the Dot Com bubble, you earn -29% when you spend money on the massive cap however 42% in any other case.

I do suppose that mid cap have fairly shut return to small cap prior to now. There’s a lot much less mentioned in regards to the mid cap shares however you’ll be able to see the returns are usually among the many greatest.

One fascinating truth is that you simply understand the mid cap and small cap DID NOT have a unfavorable 10-year interval whereas we see that for the massive cap.

The truth is, for the reason that reader spend money on AVUV, my information work confirmed me that after Nineteen Thirties, US small cap worth don’t have a unfavorable 10-year interval. Not one thing I can say outright for the S&P 500.

The 1-Yr Dimension Outperformance

I resolve to do an extra return comparability for the totally different indexes:

The primary chart exhibits the 1-year extra return if we take the return of the mid-cap minus the massive. A constructive quantity exhibits that mid-cap earn greater than giant cap over that one yr interval.

There have been 174 constructive and 188 negatives which suggests there have been extra years the place S&P 500 did properly.

Right here is that if we take the small-cap minus the massive cap:

There have been 179 constructive and 183 negatives which suggests there have been extra years the place S&P 500 did properly.

And in addition taking small-cap minus the mid-cap:

There have been 170 constructive and 192 negatives which suggests there have been extra years the place S&P 400 did properly.

I feel my reader would simply go along with the massive cap at this level since there isn’t a lot distinction.

The 5-Yr Dimension Outperformance

The story is totally different if we prolong to 5 years as a substitute of only one yr:

There have been 185 constructive and 129 negatives which suggests there have been extra years the place S&P 400 did properly.

You do see the latest outperformance of huge cap however we are able to see the dimensions outperformance.

Worth, Profitability or Momentum Tilt?

I feel an individual who wish to have equities choice technique must be align to a sure philosophy.

You possibly can simply be slightly honest climate and swap to a different funding that supposedly carry out higher when you don’t have a transparent philosophy. After all, not everyone seems to be fascinated about investing and also you may not have one within the first place. For those who belief somebody, be it an adviser or a guru, you are taking an opportunity that this adviser’s or guru’s philosophy is the appropriate funding philosophy.

Till the investments don’t carry out and also you understand this funding philosophy is shit. You proceed to search out one other one.

These days, buyers are divided into just a few camps:

- The belief the market and it doesn’t matter what occurs, I purchase and maintain an index. They in all probability see the previous 10-12% p.a. returns and the returns make them convicted to simply index.

- You suppose that there are shares that exhibit robust momentum, and when the momentum wanes, you turn from shares with weak momentum to robust momentum.

- You don’t like to purchase shares which are costly, and would observe the standard Buffett manner of shopping for low cost firms. In case you are affected person and when the businesses transfer in the direction of their intrinsic worth (hopefully it’s greater), you’ll promote them off. Rinse and repeat.

- You suppose shares shouldn’t be decide primarily based on value. High quality issues too. And Buffett have proven that when you purchase high quality companies at affordable costs, you’ll do properly.

Completely different philosophies however do they work?

The evidences appear to recommend all of them would assist construct wealth IF you’ve got a very long time horizon (see my first level on this article). The analysis exhibits that there’s a premium to be earn when you do #2-#4 a lot greater than 1.

However you may need not learn that a lot and so you discover #2-#4 to be bull crap. The info prior to now 5 years exhibits that I’m unsuitable or these analysis is unsuitable.

Effectively, that’s your funding philosophy then (for now).

I’m not going to persuade my reader to tilt to what momentum, worth or high quality.

However when you got here from the person inventory investing world and you’ll’t carry your self to personal costly stuff, then you’ve got a funding philosophy in the direction of worth.

So you’ll be able to specific that funding philosophy by purchase giant, mid or small cap worth.

So solely my reader can reply his personal query.

However I actually hope individuals can attempt their greatest to get previous simply “this technique prior to now present greater returns” form of evaluation to infer it is a higher technique and appropriate for you. It’s because US vs worldwide vs rising market, small vs giant, worth versus development, the returns of those comparability is just not constant all through time, and locations.

If somebody don’t search to determine what drives the premiums essentially, they could be deeply dissatisfied in the event that they place their choice solely on returns. Fairly often, we’ll see individuals simply chase funding after funding when their present funding doesn’t work till the individual will get slightly dispirited.

For those who like these things and wanna faucet into my cash mind, do be a part of my Telegram channel.

I share what I come throughout in:

- particular person inventory investing

- wealth-building methods

- portfolio administration

- private finance, monetary independence.

I’d additionally share a number of the ideas of wealth advisory, monetary planning and the trade that I don’t wanna put out on the weblog.

Would in all probability share some life planning case research primarily based on the issues I hear or got here throughout as properly.